Markets Looking For A Reason to Sell the USD, As the FED Looks For Any Reason to Stay Loose

US April NFP was quite good but missed expectations, which was enough to send the USD down

| (%) | ||

|

MARKETS TREND

The market trend factors in multiple indicators, including Simple Moving Average, Exponential Moving Average, Pivot Point, Bollinger Bands, Relative Strength Index, and Stochastic. |

The US Dollar turned bearish in March last year, after the coronavirus broke out in the West and it still remains bearish. We saw a decent attempt to reverse the situation in the first three months of this year, but in April the decline resumed again.

In the first week of May we saw another attempt at turning the USD bullish, but on Friday it all went to waste as EUR/USD jumped off 1.20 and ended the day and the week at the highs, more than 150 pip higher.

The US economy is running pretty hot across most sectors, with manufacturing surging since Q4 of last year, while services have also been surging for several months now. Unemployment claims have fallen below 500K, while the consumer and investor sentiment are have improved as well.

The US is in a much better place than all other major economies, which leaves the FED in a good position But, they are trying to avoid any clear comment on tightening the monetary policy, delaying it as much as possible. Markets are trading the FED so the USD is following that sentiment. Yesterday’s Non Farm Payrolls (NFP) report wasn’t sop bad after all, as shown below.

April 2021 non-farm payrolls report:

- April non-farm payrolls +266K vs +990K expected

- March was 916K (revised to +770K)

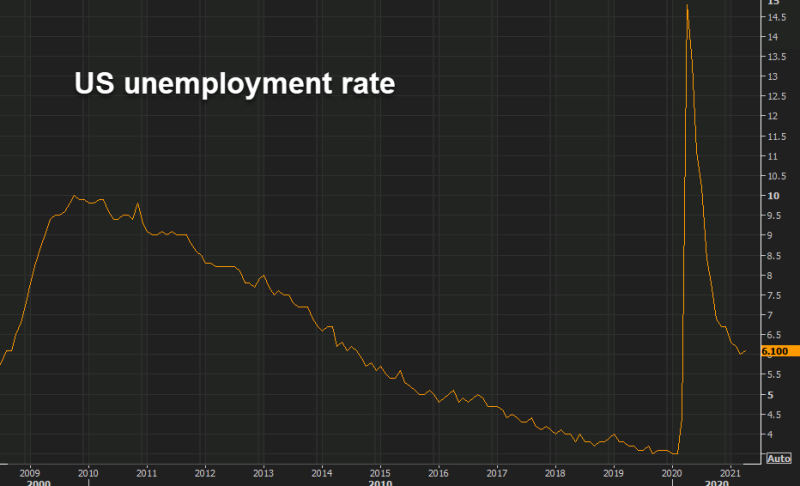

- Unemployment rate 6.1% vs 5.8% expected

- March unemployment rate 6.0%

- Participation rate 61.7% vs 61.6% expected (was 62.8% pre-pandemic)

- March participation rate 61.5%

- Underemployment rate 10.4% vs 10.7% prior

- Average hourly earnings +0.7% m/m vs 0.0% expected

- Average hourly earnings +0.3% y/y vs +4.2% expected

- Average weekly hours 35.0 vs 34.9 expected

- Two month net revision -78K

- Change in private payrolls +218K vs +933K expected

- Change in manufacturing payrolls -18K vs +54K expected

- Long-term unemployed at 4.2m vs 4.2m prior

- The employment-population ratio, at 57.9% vs 57.8% prior (61% before pandemic)

- Full report

The revisions lower for March also played a part in the USD decline on Friday. April’s expectations were much higher, but the actual number is not bad either. Comments said that “In April, notable job gains in leisure and hospitality, other services, and local government education were partially offset by losses in temporary help services and in couriers and messengers,” the report said.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account