US Inflation Jumps in April, While Earnings Decline

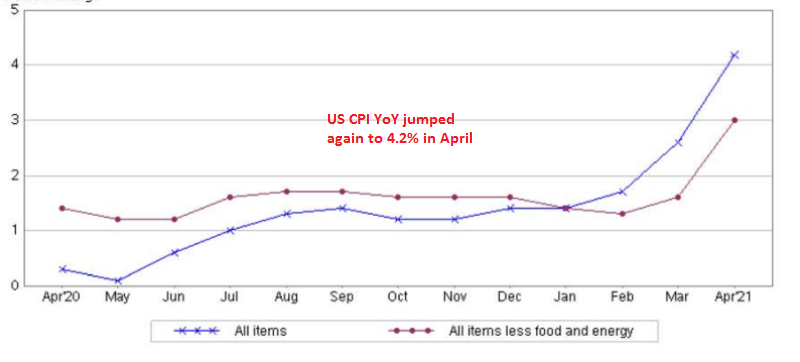

The USD is quite sensitive to inflation right now, because the FED is holding it monetary policy subject to inflation. They played the numbers from March down in their last meeting as transitionary, but today’s report showed another jump, which took the annualized CPI number to 4.2%.

This is a strong sign of sustainable inflation, although there were caveats and the FED will highlight those caveats. The earnings also declined, which turned the USD back down after the initial jump on higher CPI inflation.

US April 2021 consumer price index highlights:

- April headline CPI YoY +4.2% vs +3.6% expected

- March CPI was was +2.6%

- April core CPI YoY ex. food and energy +3.0% vs +2.3% expected

- March core CPI was +1.6%

- April CPI MoM +0.8% vs +0.2% expected

- March CPI MoM was +0.6%

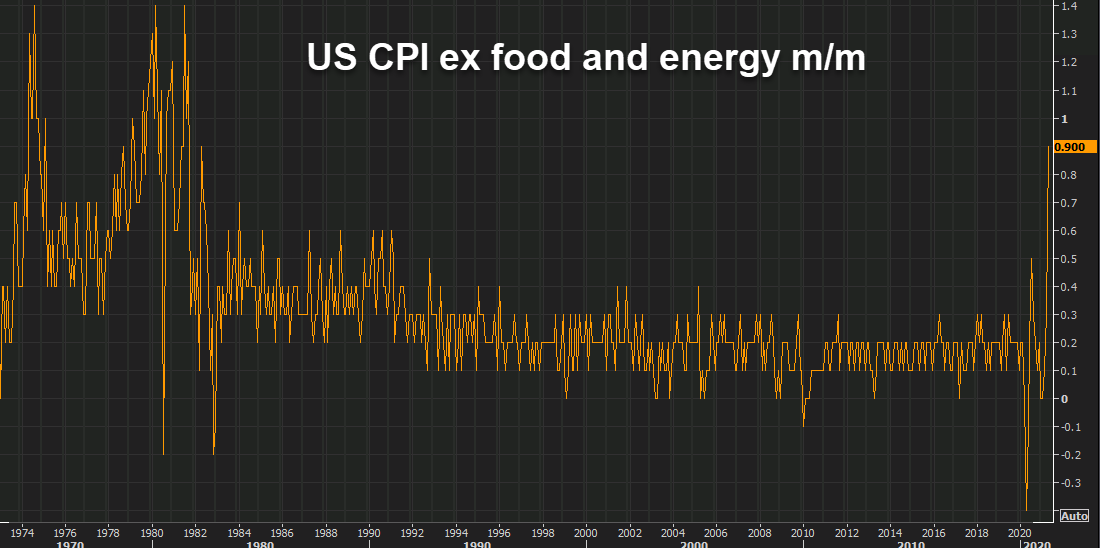

- Coe CPI MoM ex-food and energy +0.9% vs +0.3% expected (highest since 1982)

Wages Figures:

- Real avg hourly earnings -3.7% vs +1.5% y/y prior

- Real avg weekly earnings -1.4% vs +3.9% y/y prior

- Full report

That’s a big miss and the dollar is ripping higher. Everyone was expecting a bump because of base effects but this is truly a surprise and is going to test the FOMC resolve and the market’s resolve to look through bottlenecks or temporary factors.