Buying the Pullback in USD/JPY, Despite the Soft US Retail Sales in April

USD/JPY seems about to turn bullish after the US retail sales report

| (%) | ||

|

MARKETS TREND

The market trend factors in multiple indicators, including Simple Moving Average, Exponential Moving Average, Pivot Point, Bollinger Bands, Relative Strength Index, and Stochastic. |

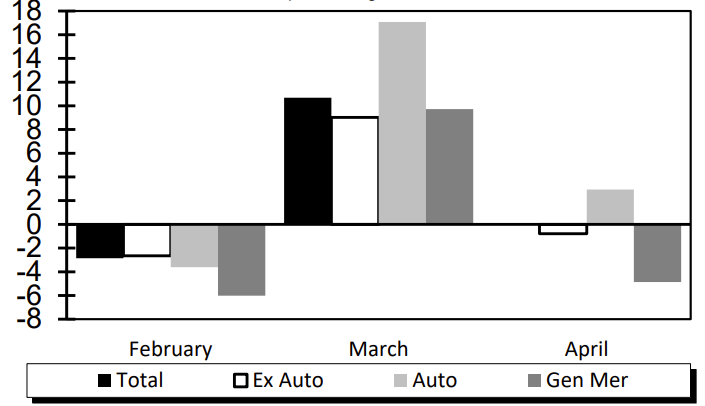

The US economy is expanding rally fast across many sectors and the consumer sentiment has improved considerably as well. But, retail sales have remained volatile, turning from positive to negative every other month.

In the last two months of last year, they were negative, then they turned positive in January, but declined again in February. March was really strong, with a 9.8% jump in headline sales, while core sales increased by 8.4%.

This month sales were expected to increase by 1%, but headline sales fell flat at 0.0%, while core sales came at -0.8%. So, the volatility continues. But, despite the soft numbers for April we decided to go long on USD/JPY above the 200 SMA (purple), since the 20 SMA (gray) is providing support on the H4 chart already.

The Bank of Japan BOJ remains extremely accommodative and dovish, with chairman Kuroda pledging to keep the loose monetary policy, which has turned the JPY quite bearish. Below is the US retail sales report:

US April 2021 retail sales data

- April advance retail sales 0.0% m/m vs +1.0% expected

- March headline sales were +9.7% (revised to +10.7%)

- Core retail sales ex. auto -0.8% vs +0.7% expected

- Retail sales ex. auto and gas -0.8% vs +0.3% expected

- Retail sales control group -1.5% vs -0.4% expected

- Sales +51.2% from the same period a year ago vs +14.3% prior

- Motor vehicle sales and parts +2.9% vs +15.1% m/m prior

- Full report

Prior numbers and revisions

- March retail sales ex auto and gas +8.2% (revised to +8.9%)

- March retail sales control group +6.9% (revised to 7.6%)

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account