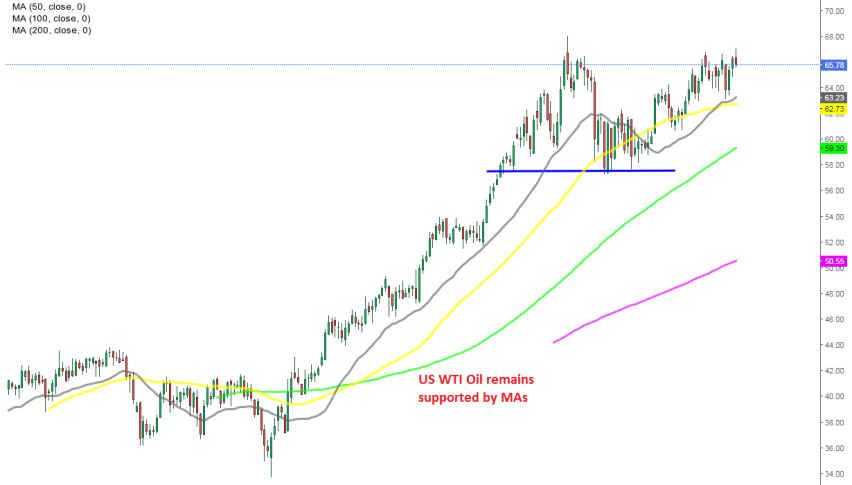

Crude Oil Remain in An Uptrend, But the Pace Has Slowed

There was more good news form IEA today about crude Oil, which remains supported

| (%) | ||

|

MARKETS TREND

The market trend factors in multiple indicators, including Simple Moving Average, Exponential Moving Average, Pivot Point, Bollinger Bands, Relative Strength Index, and Stochastic. |

US Crude Oil has made quite a comeback since it it dived to $-37 last year in March, following the outbreak of the coronavirus. The global economy dived into a recession last year, while going through another weak phase in winter this year, but crude Oil has been marching higher.

The weakness in the USD has played a role in this increase, but also OPEC+ to cut Oil production and the excessive amount of cash that governments and central banks have injected in the economy, keeping the sentiment positive for Oil. We saw a pullback in March, but the uptrend resumed again and crude Oil keeps making new highs.

The pace of the uptrend has slowed, but buyers remain in charge nonetheless. Today we saw a $1.50 pullback, but the price action tells us that the retreat might have ended and the comments from IEA are bullish for Oil.

IEA Comments on Oil and New Fossil Fuel

“The International Energy Agency, which was founded by rich industrial nations after oil shocks in the 1970s to promote secure and affordable energy supplies, says the world needs to stop drilling for oil and gas right now to prevent a climate catastrophe.

This means less supply in the coming years or even months, which is bullish. So, the retrace down seems to be over for crude Oil now on the H1 chart, while on the daily chart US WTI crude seems to be supported by moving averages. So, this might be a good chance to go long on Oil.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account