Feds Minutes Send the Dollar Lower

| (%) | ||

|

MARKETS TREND

The market trend factors in multiple indicators, including Simple Moving Average, Exponential Moving Average, Pivot Point, Bollinger Bands, Relative Strength Index, and Stochastic. |

The dollar (USD) dropped on Wednesday and then again on Thursday following the FOMC (Federal Open Market Committee) minutes. The dollar index fell under 90.0 around 10:00 last night to 89.90.

The dollar index had gone up and down crossing the 90 mark and falling back down over the few hours preceding 10:00 PM but has stayed under that mark since then.

The Feds discussed fears of risk taking in the market, as many people are investing their stimulus checks and limited income in hopes to strike it big. Recent news reports of people making huge returns on their investment in GameStop stocks, Bitcoin, and Dogecoin among others have driven a speculator boom in investment markets.

The dollar has not fallen as far as its recent three-month low, though, managing to retain some of its strength.

Takeaways from recent USD activity:

- The U.S. economy continues to recover at an appreciable rate

- After Fed minutes, the dollar rose higher and short dollar positions we’re off-loaded

- The dollar struggled in much of Europe, as initial gains were quickly lost

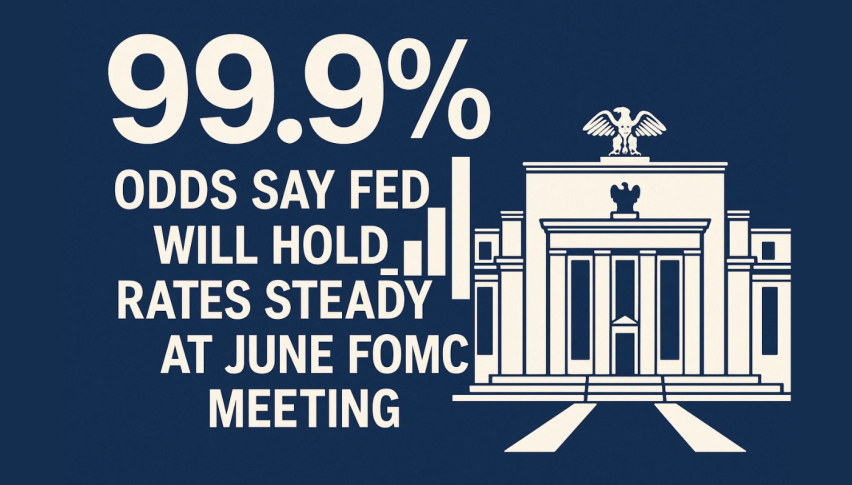

- Rate changes expected near the end of 2022

Strategists from Commerzbank are expecting to see the dollar strengthen soon, but still anticipate a continuing downward trend for the currency for now. Their daily note remarked that it “is still too early for a trend reversal”.

The Fed notes included remarks an economic recovery, stating that major progress in economic recovery could be some time away. The Fed minutes noted that asset tapering was not necessary at this time.

| (%) | ||

|

MARKETS TREND

The market trend factors in multiple indicators, including Simple Moving Average, Exponential Moving Average, Pivot Point, Bollinger Bands, Relative Strength Index, and Stochastic. |

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account