Gold Price Forecast – Triple Top Pattern in Play, Eyes on a Breakout!

During Monday's Asian trading session, the yellow metal gold succeeded in extending its previous bullish moves. It remained supportive well

| (%) | ||

|

MARKETS TREND

The market trend factors in multiple indicators, including Simple Moving Average, Exponential Moving Average, Pivot Point, Bollinger Bands, Relative Strength Index, and Stochastic. |

During Monday’s Asian trading session, the yellow metal gold succeeded in extending its previous bullish moves. It remained supportive well above $1880 marks, as the bulls remain on track to break the critical $1900 barrier. The upside momentum could be attributed to the long-lasting Sino-American tussles, which can put safe-haven bids in the GOLD prices. Meanwhile, the upticks in the were further bolstered by the fears of coronavirus (COVID-19) Indian strain and airplane hijacking in Belarus. Apart from this, the weekend crash in cryptocurrencies also played its significant role in underpinning the traditional safe-haven asset. Furthermore, the ongoing tussle between Israel and Palestine is also seen as another key factor that boosts the safe-haven yellow-metal prices.

Conversely, the prevalent market upbeat mood, backed by Friday’s released positive activity numbers, as well as faster vaccinations in the West, becomes one of the key factors that kept the lid on any additional gains in the safe-haven metal. Besides, the prevalent buying bias surrounding the U.S. dollar could cap further upside momentum in the dollar-denominated commodity. Gold is trading at 1,885.44 and consolidating in the range between 1,879.89 and 1,887.05. Moving on, the traders seem cautious to place any strong position ahead of several Fed officials’ speeches, including governor Lael Brainard’s speech.

Despite the escalating US-China conflict and the continuation of the Israel-Palestine tussle, the market trading sentiment managed to stop its early-day negative performance and turned bullish ahead of the European session as Friday released upbeat activity numbers, as well as faster vaccinations in the West, helped the sentiment to overshadow the worsening virus reports. As per latest reports, developed countries like the U.S. recently showed readiness to share more vaccines with deserving countries, mainly from Asia and Latin America. However, the prevalent buying bias surrounding the market sentiment was seen as one of the key factors that kept the lid on any additional gains in gold.At the USD front, the broad-based U.S. dollar managed to stop its early-day bearish bias and started to flash green ahead of the European session. The encouraging U.S. manufacturing data raised hopes over the U.S. economic recovery and contributed to the American currency. At the data front, the IHS Markit said its flash U.S. manufacturing PMI grew to 61.5 in the first half of this month which was seen as the best reading since October 2009. Elsewhere, the airplane hijacking in Belarus and the Sino-American tussles, not to forget coronavirus (COVID-19) cases, can put safe-haven bids under the U.S. dollar. Conversely, the gains in the U.S. dollar could be temporary as the prevalent market upbeat mood, backed by the optimism surrounding the coronavirus (COVID-19) vaccine, tend to undermine safe-haven assets like the U.S. dollar. Therefore, the small gains in the U.S. dollar were seen as one of the key factors that kept the gold prices under pressure as it is inversely related to the U.S. dollar.

In contrast, the escalating coronavirus crisis in Asia, especially in India, keeps challenging the market’s risk-on mood, which was seen as one of the key factors that help the gold prices to stay bid. Apart from this, the long-lasting US-China war and the continuation of the Israel-Palestine tussle keep checking the market’s upbeat mood, which may provide extra support to bullion.

Moving on, the market traders will keep their eyes on upcoming speeches from several Fed officials, including governor Lael Brainard. Meanwhile, the many central banks are due to hand down their policy decisions throughout the week, which will also be closely observed. In addition to this, the Chicago Fed National Activity Index for April will be the key to watch.

Gold – Daily Support and Resistance

S3 1841.75

S2 1861.04

S1 1871.17

Pivot Point 1880.33

R1 1890.46

R2 1899.62

R3 1918.91

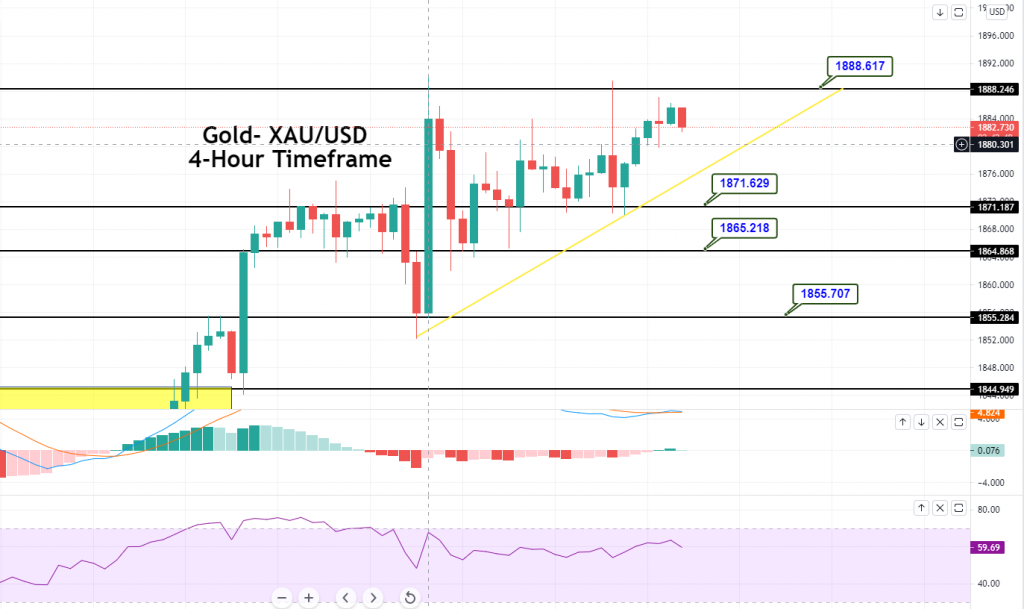

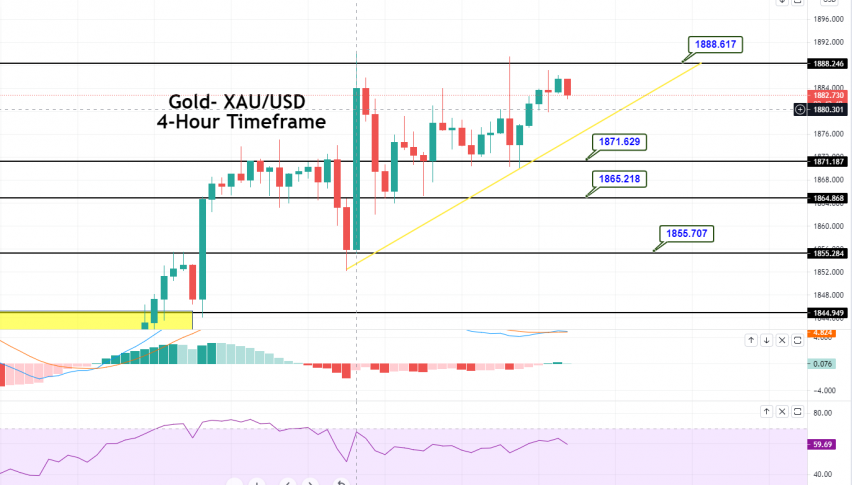

On the technical front, GOLD is trading strongly bullish at 1,883 level. On the higher side, gold is likely to face resistance at 1,888 level and support at 1,871. The 4-hour timeframe has formed an ascending triangle pattern that’s likely to extend resistance at 1,888 level along with a support level of 1,871. The indicators like RSI and MACD support a bullish trend. Therefore, we should consider taking a buying trade over 1,880 level and selling trade below the same. A bullish breakout of 1,888 level can lead the price towards 1,899. Good luck!

| (%) | ||

|

MARKETS TREND

The market trend factors in multiple indicators, including Simple Moving Average, Exponential Moving Average, Pivot Point, Bollinger Bands, Relative Strength Index, and Stochastic. |

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account