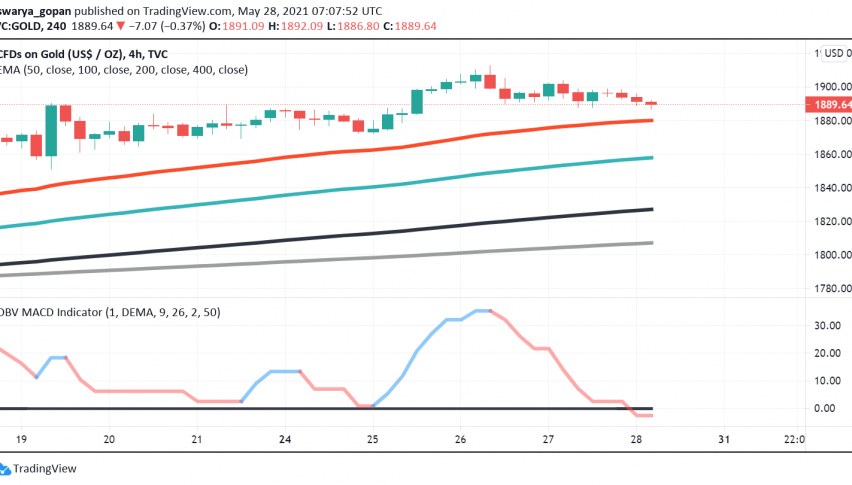

Gold Steady Ahead of Release of US Core PCE Figures

Gold is holding mostly steady into Friday after strong economic data from the US boosted the Treasury yields and the dollar, even as markets

| (%) | ||

|

MARKETS TREND

The market trend factors in multiple indicators, including Simple Moving Average, Exponential Moving Average, Pivot Point, Bollinger Bands, Relative Strength Index, and Stochastic. |

Gold is holding mostly steady into Friday after strong economic data from the US boosted the Treasury yields and the dollar, even as markets cautiously await the release of core PCE figures from the world’s largest economy due later in the day. At the time of writing, GOLD is trading at a little above $1,889.

Boosted by the reopening of the American economy and the widespread distribution of the COVID-19 vaccines through the nation, the number of layoffs by businesses eased, sending the number of unemployment claims filed to the lowest levels seen since mid-March 2020. Meanwhile, the US Commerce Department confirmed that the US economy posted a 6.4% growth through Q1 2021.

The optimistic data releases bolstered investor confidence in the US economy, offering some much needed support to the greenback that had been trading weak over the past several sessions, which in turn drove gold lower as the yellow metal shares a negative correlation with the US dollar. In addition, the news also resulted in an uptick in US Treasury yields, which also drove weakness in gold as higher bond yields increase the opportunity cost of holding non-yielding bullion.

Gains in gold, however, remain limited as traders adopt a wait and watch approach prior to the release of personal consumption figures from the US, as they are key gauge to assess the effect of inflation on the economy. A stronger than forecast figure will once again raise fears of inflation heating up, which could not only pressure the US dollar and Treasury yields but also support the safe haven appeal of the precious metal.

| (%) | ||

|

MARKETS TREND

The market trend factors in multiple indicators, including Simple Moving Average, Exponential Moving Average, Pivot Point, Bollinger Bands, Relative Strength Index, and Stochastic. |

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account