⚡Crypto Alert : Altcoins are up 28% in just last month! Unlock gains and start trading now - Click Here

EUR/USD Turns Lower, After the Impressive US Durable Goods Report

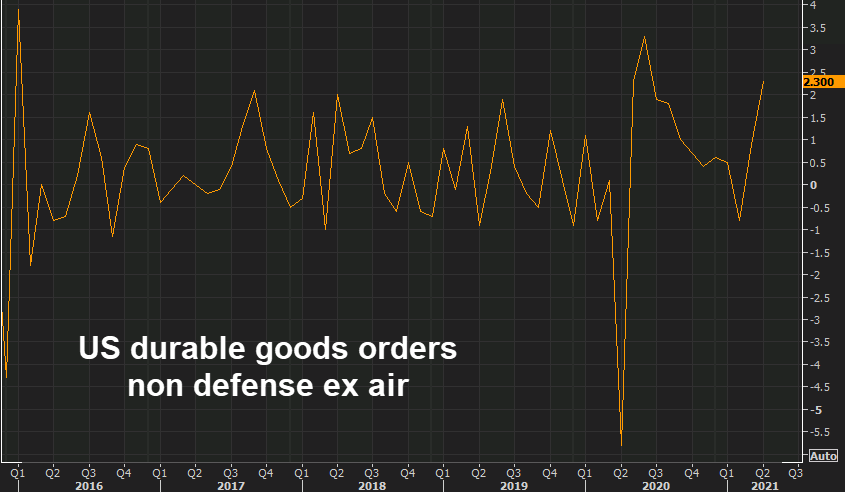

OK, the headline is negative, showing a decline last month, but the core orders and the capital orders which remove Air and Defence spending/purchases was positive. EUR/USD was trying to turn bullish a while ago, attempting to break the 50 SMA (yellow) on the H4 chart.

But, the jump in core orders and the decline in the unemployment claims, while the GDP kept steady at 6.5% in Q1 helped the USD, turning this apir bearish. So, the 50 SMA has turned into resistance now, which is a bearish sign.

April Prelim US Durable Goods Orders Report

- April prelim durable goods orders -1.3% vs +0.8% expected

- March durable goods orders were +1.0%

- Core orders excluding transportation +1.0% vs +0.7% expected

- Prior ex transportation +2.3%

- Capital goods orders non-defense ex-air +2.3% vs +1.0% expected

- Prior capital goods orders non-defense ex-air +1.0% (revised to +1.6%)

- Capital goods shipments non-defense ex-air +0.9vs +0.8% expected

- Prior capital goods shipments non-defense ex-air +1.3%

EUR/USD

Ignore the headline, core orders were strong and capital orders even stronger. The USD has been trading the FED rhetoric, but with the data improving the FED will be forced to accept reality, which will be the time the USD will start a bullish phase.

Check out our free forex signals

Follow the top economic events on FX Leaders economic calendar

Trade better, discover more Forex Trading Strategies

Related Articles

Comments

Subscribe

Login

0 Comments