Higher CPI Inflation Expected for the Eurozone Tomorrow, After Higher German CPI Today

German and Spanish inflation is increasing, suggesting higher Eurozone CPI tomorrow

| (%) | ||

|

MARKETS TREND

The market trend factors in multiple indicators, including Simple Moving Average, Exponential Moving Average, Pivot Point, Bollinger Bands, Relative Strength Index, and Stochastic. |

Inflation dived in spring last year as the global economy fell into a recession due to the coronavirus lockdowns, while US WTI crude Oil fell into negative territory, which sent inflation down. Headline CPI (consumer price index) inflation turned negative in the Eurozone from September until January this year, as a second wave of lockdowns and other restrictions sent the Eurozone economy into a second recession this winter.

CPI inflation turned positive in February this year, as crude Oil prices kept increasing and in the last few months it hes been moving higher as the Eurozone economy reopens. Headline CPI stands at 1.6% for May and this month it is expected to move up to 1.9%.

Core CPI was at 1.4% in January, but has been slashed in half since then. Although we should see a jump tomorrow, after seeing some higher inflation numbers from Germany and Spain today. EUR/USD remains steady around 1.22 waiting for the CPI report tomorrow and will probably jump up is we see a jump in inflation.

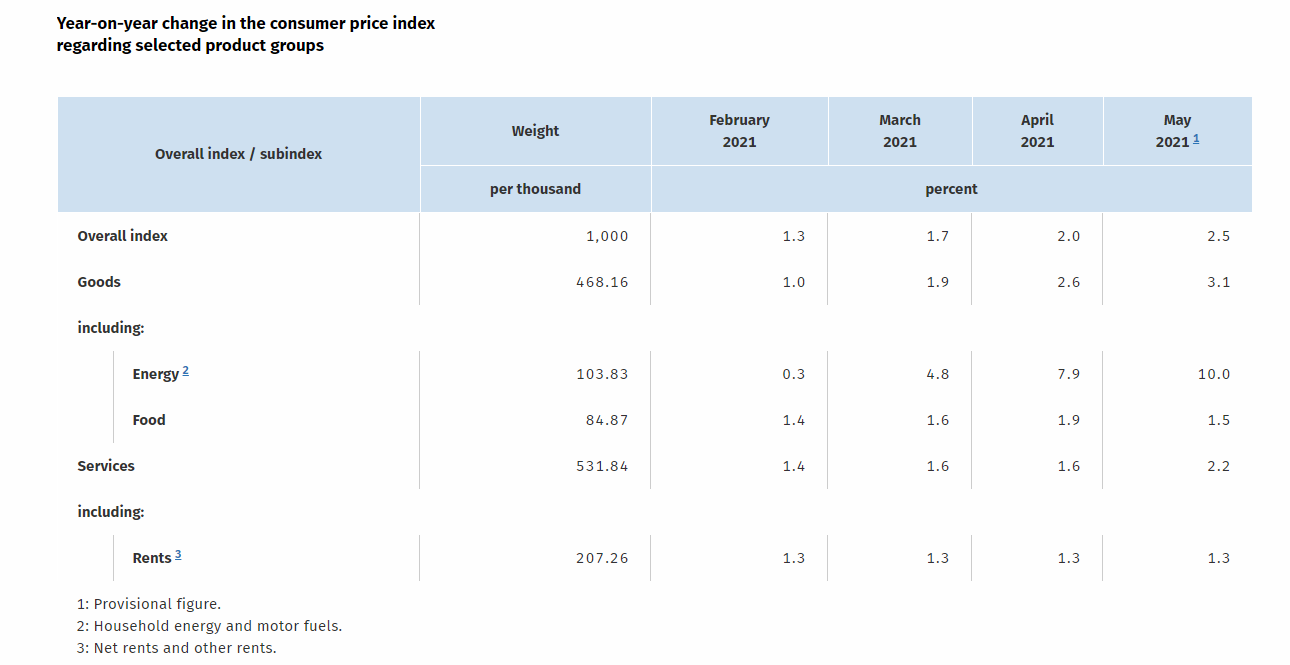

Latest data released by Destatis – 31 May 2021

- May preliminary CPI YoY +2.5% vs +2.3% expected

- April CPI was +2.0%

- CPI MoM +0.5% vs +0.3% expected

- April CPI was +0.7%

- May HICP YoY +2.4% vs +2.3% expected

- March HICP YoY was +2.1%

- HICP MoM +0.3% vs +0.3% expected

- Prior HICP MoM was +0.5%

The beat on the headline reading was to be expected after the state readings earlier as pointed out here. Nonetheless, it marks the highest reading since September 2011. This likely owes to some base effects as well but the higher month-on-month readings also suggest that there are rising price pressures at play too. That will be the thing the ECB may have to be wary about over the next few months.

Latest data released by the National Statistics Institute – 31 May 2021

- May preliminary CPI YoY +2.7% vs +2.4% expected

- April CPI YoY was +2.2%

- CPI MoM +0.4% vs +0.2% expected

- Prior CPI MoM was +1.2%

- May HICP YoY +2.4% vs +2.4% expected

- April HICP YoY was +2.0%

- HICP MoM +0.5% vs +0.5% expected

- Prior HICP MoM was +1.1%

That’s the highest reading since February 2017 as Spanish inflation continues to show strong price pressures in general. The EU-harmonised readings are in-line with estimates but it reaffirms the uptrend amid base effects and higher input cost inflation.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account