USD/INR Ticks Higher After India’s Services Sector Contracts in May

The Indian rupee has weakened to above the 73 level against the US dollar following the release of a disappointing PMI report which reveals

| (%) | ||

|

MARKETS TREND

The market trend factors in multiple indicators, including Simple Moving Average, Exponential Moving Average, Pivot Point, Bollinger Bands, Relative Strength Index, and Stochastic. |

Early on Thursday, the Indian rupee has weakened to above the 73 level against the US dollar following the release of a disappointing PMI report which reveals a contraction in the services sector activity during May amid the second wave of the pandemic. India’s services sector PMI slumped from 54 in April to 46.4 in May, falling below the 50-threshold indicating contraction for the first time since eight months.

Even though the situation has improved and India is reporting a decline in the caseload, the numbers still remain quite high – over 100,000 infections and over 3,000 cases on a daily basis. While the Modi government has resisted imposing a nationwide lockdown, several states have announced distribution lockdowns, restrictions and curfews that have significantly hurt the services sector.

The decline in the headline PMI reading was driven by a sharp drop in demand, which fell at the fastest pace since August 2020, especially overseas demand which contracted at the fastest rate seen since November 2020. In addition, companies in the services industry laid off workers, driving the fastest pace of contraction in employment seen since last October.

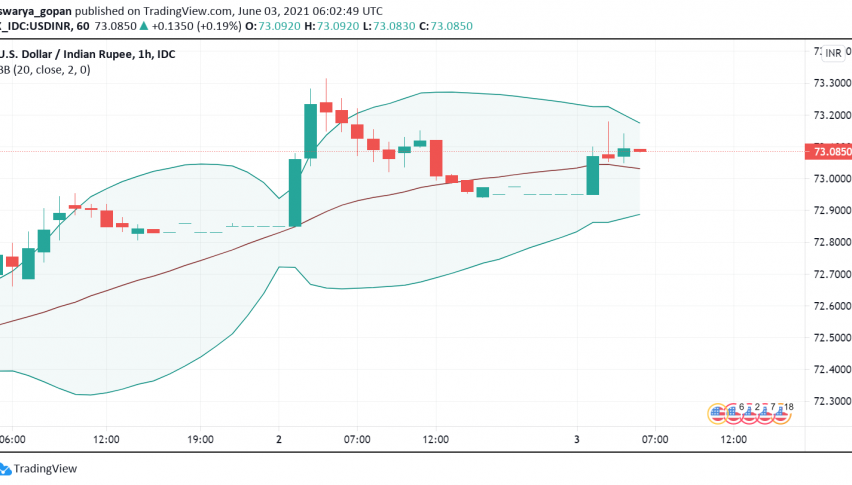

Despite the US dollar trading somewhat steady ahead of the all-important jobs data, USD/INR has climbed back above the key 73 level amid the worsening economic outlook for one of the largest emerging markets in the world. At the time of writing, USD/INR is trading at around 73.o8 and could see further upside in the near-term unless India reigns in the pandemic’s latest wave quickly and rescues its fragile economy.

| (%) | ||

|

MARKETS TREND

The market trend factors in multiple indicators, including Simple Moving Average, Exponential Moving Average, Pivot Point, Bollinger Bands, Relative Strength Index, and Stochastic. |

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account