EUR/USD Forms a Bearish Reversing Pattern, Despite the Jump in Investor Confidence

The investor confidence is picking up in Europe, but EUR/USD remains stagnant today

•

Last updated: Monday, June 7, 2021

| (%) | ||

|

MARKETS TREND

The market trend factors in multiple indicators, including Simple Moving Average, Exponential Moving Average, Pivot Point, Bollinger Bands, Relative Strength Index, and Stochastic. |

The EUR/USD has been really bullish in the last two months, with the USD decline returning again in April, despite the economy picking up pace after a strong period in Q1. But it hasn’t been able to make new highs and push above the highs of early January.

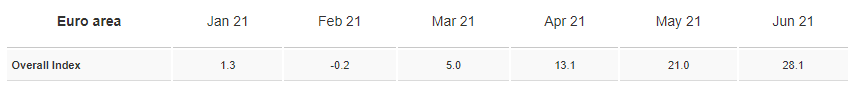

That is a bearish signal, and since late May, this pair has actually been trying to turn bearish again. Today, the Eurozone investor confidence report was stronger than expected, but the EUR/USD hasn’t been able to push above the moving averages, after failing to do so late last week. Other major USD pairs have been increasing further today, but not this pair, which points down once the USD decline stops. Below is the investor confidence data for this month:

Latest data released by Sentix – June 7, 2021

- June Sentix investor confidence 28.1 points vs 25.4 expected

- May investor confidence was 21.0 points

That’s a decent beat and reaffirms the more optimistic sentiment towards the euro area economy as of late. This isn’t going to move the needle in the euro for now, but it does reflect better prospects going into the summer, though it still remains to be seen what the ECB has to offer later this week.

EUR/USD Live Chart

EUR/USD

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

ABOUT THE AUTHOR

See More

Skerdian Meta

Lead Analyst

Skerdian Meta Lead Analyst.

Skerdian is a professional Forex trader and a market analyst. He has been actively engaged in market analysis for the past 11 years. Before becoming our head analyst, Skerdian served as a trader and market analyst in Saxo Bank's local branch, Aksioner. Skerdian specialized in experimenting with developing models and hands-on trading. Skerdian has a masters degree in finance and investment.