Polkadot (DOT) Rejects Daily 38% Fibby, Plunges 8%

Capitulation is a term used to describe investors selling other assets and moving into cash. That’s what we are seeing today, as stocks, commodities, and cryptos are all in the red. For the leading altcoins Polkadot (-7.5%), Dogecoin (-8.75%), and Tezos (-5.9%), the damage has been significant.

Of course, true capitulation is what we saw last March amid the COVID-19 market panic. Investors flooded into the USD from all other assets as they perceived the sky to be falling. However, today has been a mixed bag for the Greenback as indicated by a lagging USD Index (-0.25%).

For now, it looks today’s steep losses on Wall Street are indicative of shifting Fed sentiment and progression of the Delta COVID-19 variant. In this morning’s COVID-19 task force briefing, it was disclosed that the Delta variant is now the dominant form of new infections in the U.S. This may be at least a peripheral factor in today’s risk asset selloff, including the downtick in cryptocurrencies.

In a Live market update from yesterday, I outlined a shorting opportunity for Polkadot. The trade turned out to be a breakaway winner, producing a fast $1.70 (9.7%) profit. If you got in on the play with your crypto CFD broker, well done.

Polkadot Fails At Daily 38% Fibby

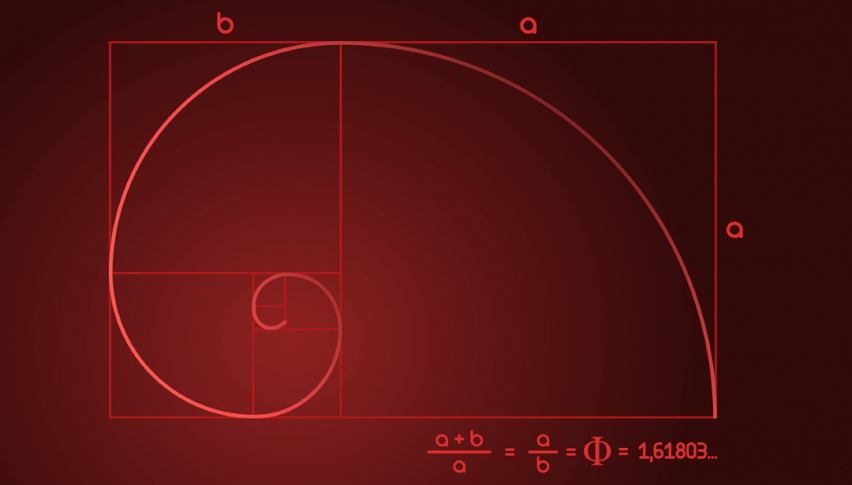

The 38% Fibonacci retracement of any asset is an inherently important level. For Polkadot, it turned out to be a major area of resistance and signals that the bearish trend is intact.

Overview: As we head toward mid-July trade, the intermediate-term downtrend for Polkadot is alive and well. Until we see prices become established above the daily 38% Fibonacci retracement ($17.98), a bearish bias is warranted. Should the DOT/USD take out natural support at $15.00, a swift test of the daily swing low at $13.00 is highly likely.