ETH/USD Supported Above 38.2% Fibonacci – A Quick Trade Idea

The ETH/USD closed at $3308.41 after placing a high of $3319.27 and a low of $3112.92. ETH/USD surged over the weekend as Delaware-based

- Delaware-based Kryptoin Investment Advisors have filed for an Ethereum exchange-traded fund with the US SEC.

- The ETH/USD pair is trading with a neutral bias at a 38.2% Fibonacci retracement level of 3,250.

- Consider taking a buying trade over 3,249 support level today.

The UK police have become active in seizing cryptocurrencies. Recently, about $22.25 million worth of cryptocurrencies were seized from operators of an international cryptocurrency scam. These digital assets include about $9.5 million worth of Ethereum that was found on a USB stick. On their website, the UK police announced that a sum of $22.25 million, which is equivalent to over 16 million pounds, was seized by special officers after intelligence led to the discovery of a USB stick containing huge amounts of Ethereum. The scam victims were from the UK, the United States, Europe, China, Australia and Hong Kong. This news put pressure on the ETH/USD but failed to reverse its course for the day, and the second-largest cryptocurrency remained green over the weekend.

CEO of Twitter, Jack Dorsey, Supports Ethereum Prices

Furthermore, according to the CEO of Twitter, Jack Dorsey, the platform of the second-largest cryptocurrency, Ethereum, has no potential to shake up the status quo in Big Tech single-handedly. The self-professed Bitcoin maximalist commented on ETH after an online discussion about the usefulness of full-blown integration of NFT into Twitter.

A Twitter user argued that such a move would be more beneficial to Ethereum than to the social media. Dorsey agreed with his argument and said that it would be more useful for the Ethereum ecosystem than for his platform. These comments should have proven negative for the ETH/USD, but the cryptocurrency continued moving upward.

Another reason behind the rising prices of the ETH/USD could be the declining prices of the US dollar. The greenback was weak on Friday, as US consumer sentiment dropped in August, weighing on the currency. That dragged the US Dollar Index below the 93 level, and the US Treasury Yields also fell to 1.28%. The correlation between the US dollar and the second largest cryptocurrency, ETH, is negative, and as a result, the weakness of the US dollar pushed the ETH/USD higher over the weekend.

Ethereum (ETH/USD) Daily Technical Levels

Support Resistance

3,174.47 3,380.82

3,040.52 3,453.22

2,968.12 3,587.17

Pivot Point: 3,246.87

Ethereum (ETH/USD) Daily Technical Forecast

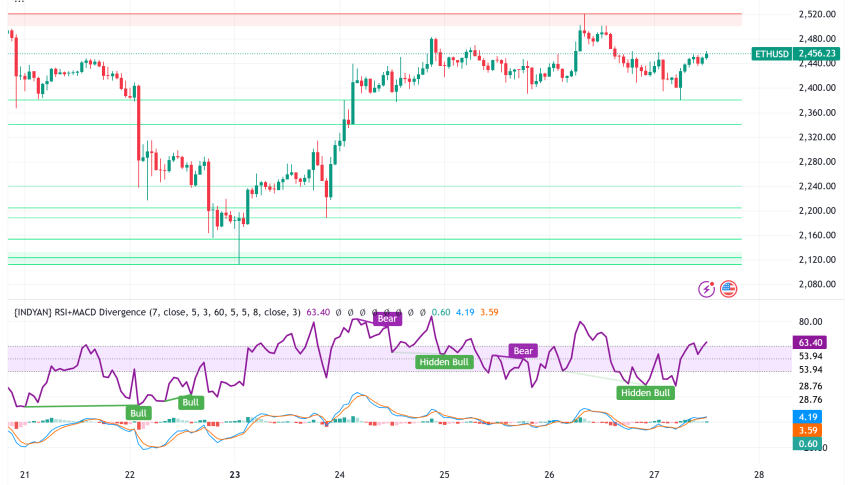

On the technical front, the ETH/USD pair is trading with a neutral bias at a 38.2% Fibonacci retracement level of 3,250. At the same level, the 50-period simple moving average is also providing solid support. However, a bearish breakout below the 3,249 level could extend the selling trend until a 61.8% Fibonacci retracement level of 3,174.

On the hourly timeframe, the leading technical indicator, the RSI, is holding in a buy zone, while the 50 SMA also supports a buying trend. Thus, the chances of bullish trends remain solid on Monday. Let’s consider taking a buying trade over 3,249 support level today. Good luck!

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account