⚡Crypto Alert : Altcoins are up 28% in just last month! Unlock gains and start trading now - Click Here

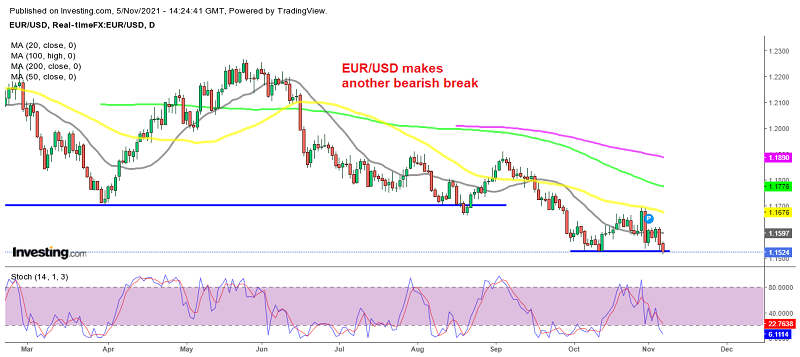

EUR/USD Breaks Below October Lows, After Another Great US Employment Report

EUR/USD has been on a bearish trend since May. The European economy started surging back then, but the US economy was expanding even faster, and inflation was much higher than in Europe. Inflation is still higher in the US, which has forced the FED to announce the beginning of the end of QE. This has weighed on the EUR/USD, and today’s employment report showed further improvement in the US economy, which sent the EUR/USD below October’s low, triggering our take profit target as well.

US non-farm payrolls employment data for October 2021

- September non-farm payrolls +531K vs +425K expected

- Prior was +194K (+312K)

- Two month net revision +235K

- Unemployment rate 4.6% vs 4.7% expected

- Prior unemployment rate 4.7%

- Participation rate 61.6% vs 61.7% expected (was 62.8% pre-pandemic)

- Prior participation rate 61.7%

- Underemployment rate 8.3% vs 8.5% prior

- Average hourly earnings +0.4% m/m vs +0.4% expected

- Average hourly earnings +4.9% y/y vs +4.8% expected

- Average weekly hours 34.7 vs 34.8 expected

- Change in private payrolls +604K vs +317K prior

- Change in manufacturing payrolls +60K vs +26K prior

- Long-term unemployed at 2.3m vs 2.7m prior

- The employment-population ratio, at 58.8% vs 58.7% prior (61% before pandemic)

This is a good report for everyone. There’s some strength here, but not enough to shake the Fed from its ‘transitory’ narrative. The leisure and hospitality sector added 164K jobs, which is a solid sign of recovery from the delta wave.

Comments from KC Fed President George

- The argument for patience has diminished

- A number of indicators point to a tight labor market

- Tightness in labor market could prove temporary

- Now may be a time when the Fed’s goals appear to be in conflict

- Supply disruptions have contributed to higher prices

- Choices for policymakers are complicated by uncertainty on how long inflation and jobs market friction will last

- There’s good reason to believe inflation will eventually moderate but the risk of prolonged high inflation has increased

- We will be watching inflation expectations and wage inflation

- Judging if we’ve achieved max employment will be a question of whether workers on the sidelines will come back over time; that’s likely to happen

- We’re likely to see some moderation in inflation

George will be a voter in 2022.

Check out our free forex signals

Follow the top economic events on FX Leaders economic calendar

Trade better, discover more Forex Trading Strategies

Related Articles

Comments

Subscribe

Login

0 Comments