Natural Gas Retreats $1 Lower From $10 to $9 as Freeport Capacity Stays Limited

Natural Gas fell from $10 to $9.06 yesterday as news of the Freeport reopening in full capacity were postponed

Natural Gas has been on a bullish trend for more than a year, despite two retreats we saw at the end of last year and in June this year. Yesterday Natural Gas prices touched the $10 level, but we saw a sudden retreat off that major level. One of the reasons is the fact that buyers might have reached their target and closed their positions.

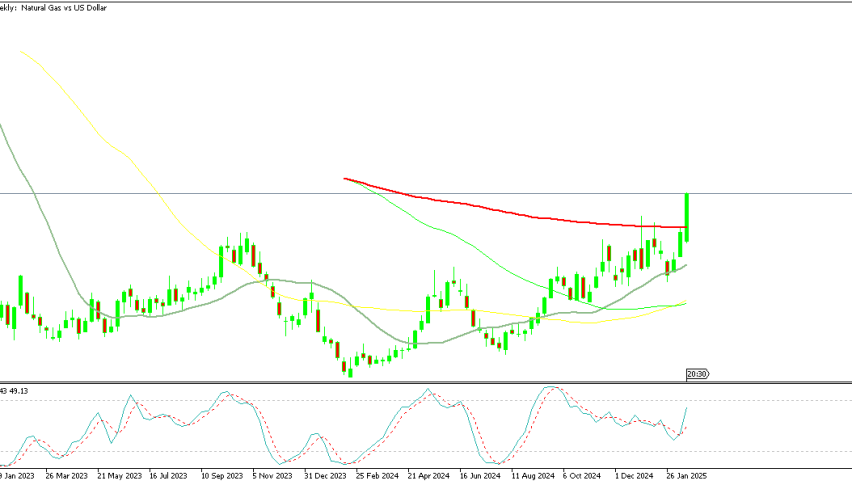

Natural Gas H4 Chart – The 50 SMA Held As Support

Gas is already oversold on the H4 timeframe

Another reason was the postponing of the Freeport LNG terminal’s full capacity reopening, which means fewer exports from the US, therefore more Gas within the country. The expected timeline for a restart of the Freeport LNG terminal in the US was mid-to-late October but that’s been pushed back by an update today. That will mean more gas is stuck in the US and unavailable for export to Europe and the rest of the world. The huge 2 bcf terminal suffered an explosion on June 8 and has been under repair.

The new timeline is for initial production to restart in early-to-mid November and ramp up until the end of the month. Notably, it will continue to operate at only 85% of export capacity until March 2023.

That was a dramatic move in Natural Gas on the headlines. It hit $10 yesterday for the first time since 2008 but fell down to $9.06 where it met the 50 SMA (yellow) on the H4 chart which held the decline. So, this moving average will decide where Gas will be in the near future, above it and it will likely retest the $10 level, below that and we might see a deeper retreat.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account