USD/CAD Retreats to 1.3150 Following Fed’s Less-Hawkish Guidance

The USD/CAD pair has exhibited impressive resilience, swiftly finding intermediate support near the 1.3160 level during the London session. Notably, the Loonie asset, represented by the Canadian dollar, has emerged as a prominent player with a steady downward trajectory.

The spotlight is currently on the US Dollar Index (DXY), as it faces mounting pressure following the Federal Reserve’s (Fed) recent delivery of less-hawkish interest rate guidance on Wednesday. This development has left the USD struggling to maintain its position.

While the currency market drama unfolds, investors and traders are closely monitoring the Loonie’s performance, as it appears poised to sustain its downward movement. Meanwhile, the USD’s outlook remains uncertain due to the prevailing pressure on the DXY.

During European trading hours, S&P500 futures have recorded notable gains, reflecting a rise in market participants’ risk appetite. However, the US equities market experienced a choppy session on Wednesday, following the Federal Reserve’s decision to increase interest rates by 25 basis points to a range of 5.25-5.50%. It’s worth noting that the market had already anticipated a 25 bps interest rate hike, making it a widely expected move.

Investors and traders are closely observing the market dynamics, reacting to the interest rate adjustment and gauging its potential impact on various sectors and asset classes. The prevailing uncertainty in the US equities market adds to the importance of analyzing and adopting prudent investment strategies during this period of monetary policy changes.

In September’s monetary policy meeting, Federal Reserve policymakers opted to maintain a data-dependent approach. This decision indicates that their future policy actions will be influenced by the incoming economic data and indicators.

The market sentiment brightened considerably when Federal Reserve Chair Jerome Powell reassured investors that policymakers do not anticipate a recession despite the challenges posed by a tight labour market. This positive outlook from the Fed Chair uplifted the overall market mood, instilling confidence among investors and traders.

With the Fed’s commitment to closely monitor economic data before making any significant policy changes, market participants are now eagerly observing key indicators to gauge the trajectory of the economy and potential future policy shifts. Powell’s statements have provided a sense of reassurance and stability, contributing to the upbeat sentiment in the financial markets.

Anticipation is building in the US Dollar Index as market participants eagerly await the release of two crucial economic indicators: the second-quarter Gross Domestic Product (GDP) numbers and June’s Durable Goods Orders data. The outcome of these reports is likely to influence the direction of the US Dollar. According to the preliminary report, the GDP expanded at a rate of 1.8% during the second quarter, reflecting the growth and performance of the economy during that period. Additionally, June’s Durable Goods Orders rose by 1.0%, indicating an increase in demand.

The Canadian Dollar is displaying strength against the US Dollar, largely driven by the positive performance of oil prices. West Texas Intermediate (WTI) oil futures are gaining momentum, aiming to break above the significant resistance level of $80.00. Investors are optimistic that the interest rate hike implemented by the Federal Reserve in July will be the final one, further contributing to the positive sentiment surrounding oil prices.

The situation is noteworthy as Canada stands as the primary exporter of oil to the United States. With oil prices on the rise, the Canadian Dollar is receiving support, buoyed by the country’s oil exports.

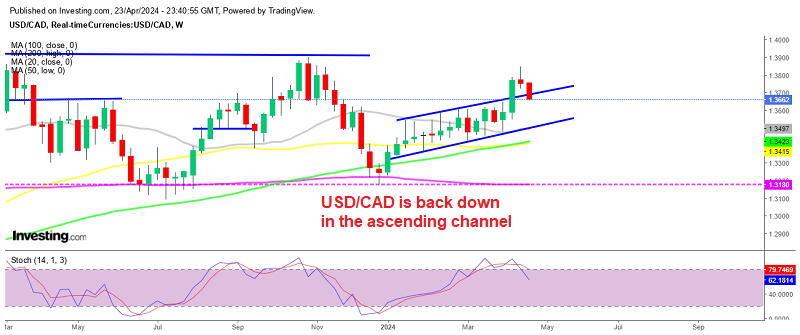

USD/CAD technical analysis chart