USD/CAD Supported by MAs As Markets Expect Dovish BOC After Lower Inflation

USD/CAD has been bouncing in a wedge with support by moving averages, and yesterday we saw a bounce after the decline in the CPI

Last week I posted an update about USD/CAD and how this pair was bouncing in a wedge, with highs getting lower and lows getting higher. This pair turned bullish in July as the USD gained momentum, but we saw a reversal lower followed in the second week of September, from below 1.37, which is a resistance zone, and the top of the wedge, which also stopped the bullish move, as commodity dollars found some support, despite the US dollar’s resiliency, which was supported by strong economic data.

The Canadian currency was benefiting from a surge in Oil prices, with WTI hitting $95 before reversing direction and falling to $80 lows in the days that followed. Although the 50 SMA (yellow) has been holding for USD/CAD . The price bounced off this moving average last week and after returning back down we saw another bounce yesterday, following the soft inflation report from Canada. Now analysts expect the Bank of Canada to turn dovish eventually, so we expect this pair to break above the wedge soon.

Canada September CPI Inflation Report

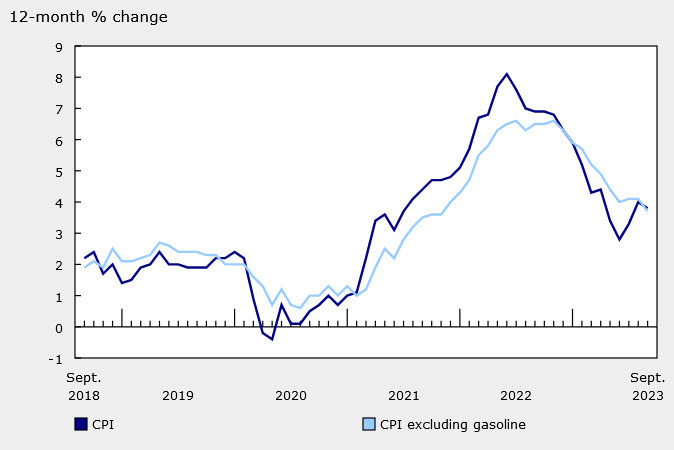

- September CPI YoY 3.8% versus 4.0% expected

- August CPI YoY was 4.0%

- CPI MoM -0.1% versus 0.1% expected

- August CPI MoM was 0.4%

Core measures:

- BOC core YoY 2.8% versus 3.3% last month

- BOC core MoM -0.1% versus 0.1% last month

- CPI median 3.8% versus 4.1% last month

- CPI trim 3.7% versus 3.9% last month

- CPI common 4.4% versus 4.8% last month

The year-over-year deceleration was broad-based, Statistics Canada said, stemming from lower prices for some travel-related services, durable goods and groceries. The improvements come despite a 7.5% y/y rise in gasoline prices and +0.8% m/m. That rise has unwound in October so there’s some good news in the pipeline.

Groceries remain a problem point with prices up 5.8% y/y but that has decelerated from +6.9% y/y as base year effects lower meat and dairy inflation.

A big YoY decline was in airfares, which fell 21.1% in September as flight capacities have improved.

USD/CAD jumped on this report, in part because it’s a dovish reading that should lead the BOC to cool its recent hawkish rhetoric at next week’s meeting. The pair rose about 50 pips on the headline. The other side of the jump is because the US reported a very strong retail sales report, leading to broad USD strength. Pricing for a hike next week is down to 22% and the March meeting now prices in 18 bps of hikes from 24 bps last week.

USD/CAD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account