USD/CAD Edges Closer to 1.39 as Canadian GDP Remains Flat

USD/CAD has climbed higher today and we expect further upside momentum as Canadian economy remains weak

The USD/CAD reached above the high of a swing area on Friday to trade at the topside trendline on the daily chart near 1.3861 area. The high price reached 1.3880 before stalling. Yesterday the price fell back below the broken trendline moving toward support near 1.3800, but today buyers are in control again, pushing the price toward 1.39.

USD/CAD turned bullish in July as the USD gained momentum, but we saw a reversal lower in the second week of September, from below 1.37, a resistance zone, and the top of the wedge, which also stopped the bullish move, as commodity dollars found some support, despite the US dollar’s resiliency, which was bolstered by strong economic data.

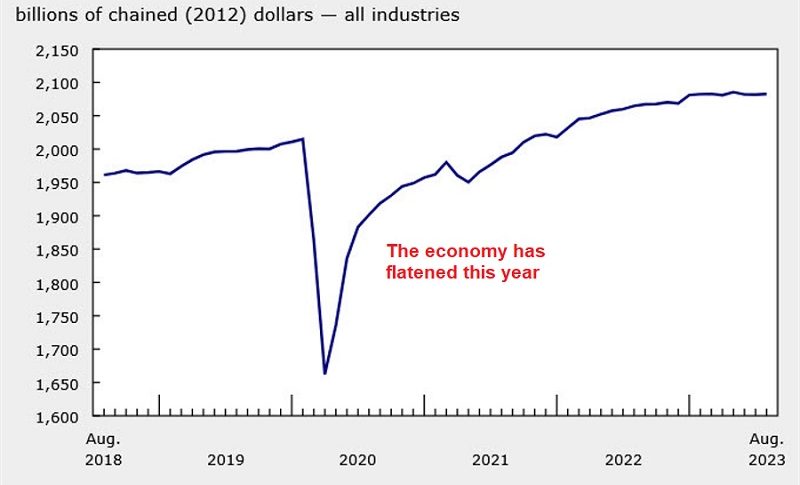

So GDP in July, August, and September is all zero percent. This makes calculating Q3 GDP quite simple. In terms of the broader picture, a flat number for Q3 GDP may swiftly morph into a negative reading for Q4, and the Bank of Canada will be reducing rates soon. I believe the landing would be especially difficult if the BOC maintains its hawkish position until April, when the spring real estate season begins.

Canadian August 2023 GDP and the advanced report for September

- August GDP 0.0% vs +0.1% expected

- July advanced reading was 0.0%

- Prior was 0.0%

- September advance GDP 0.0%

- Services +0.1%

- Goods -0.2%

- Wholesale trade +2.3%

- The mining, quarrying, and oil and gas extraction sector rose 1.2%

- Manufacturing -0.6%

- Accommodation and food services declined 1.8%

- The transportation and warehousing sector increased 0.8%

- Retail trade contracted 0.7%

Following a modest contraction in Q2, today’s advanced GDP data showed a flat result for Q3. This is much lower than the Bank of Canada’s prediction of +0.8% GDP growth. Goods-producing industries have been down for five months in a row, with agriculture particularly affected by dry weather in Western Canada, and CIBC worries that this may understate the economy’s health.

USD/CAD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account