USD/JPY Retest Triple Top at 148.80; Hawkish BoJ and Geopolitical Tensions In Play

The USD/JPY currency pair failed to stop its downward trend and remained well-offered around the 148.44 level.

The USD/JPY currency pair failed to stop its downward trend and remained well-offered around the 148.44 level. However, its downward trend can be attributed to the bearish US dollar, which was losing traction despite upbeat US economy data, showing that the US economy is doing well.

Apart from this, the risk-off market sentiment and the BoJ’s hawkish stance have boosted the safe-haven Japanese yen and contributed to the USD/JPY currency pair losses.

Meanwhile, the geopolitical tensions in the Middle East and China’s slowing growth, combined with expectations of fewer Fed rate cuts, dampen investor sentiment, boost the safe-haven JPY, and contribute to the USD/JPY losses.

US Dollar Strength Supported by Positive Economic Data and Hawkish Fed Sentiment

Although it is losing some ground, the broad US dollar is still close to its three-month high thanks to expectations of sustained higher interest rates from the Fed.

In the meantime, the positive US economic data, including the strong NFP report and ISM Services PMI, bolstered these expectations. Hence, the hawkish remarks from Fed officials have lifted US Treasury bond yields, boosting the greenback and potentially limiting the downside for the USD/JPY currency pair.

Geopolitical Tensions Weigh on USD/JPY Amid Safe-Haven Appeal

In contrast, the ongoing worries about Middle East tensions, China’s economic slowdown, and doubts about Fed rate cuts weigh on investor sentiment.

Meanwhile, the Bank of Japan’s hawkish stance further boosts the safe-haven JPY, putting pressure on the USD/JPY currency pair. Market sentiment remains depressed due to ongoing concerns about geopolitical tensions and China’s economic health.

Hence, the geopolitical tensions, bearish USD, and risk-off market sentiment contribute to USD/JPY losses, strengthening the safe-haven

JPY.USD/JPY Forecast: Technical Outlook

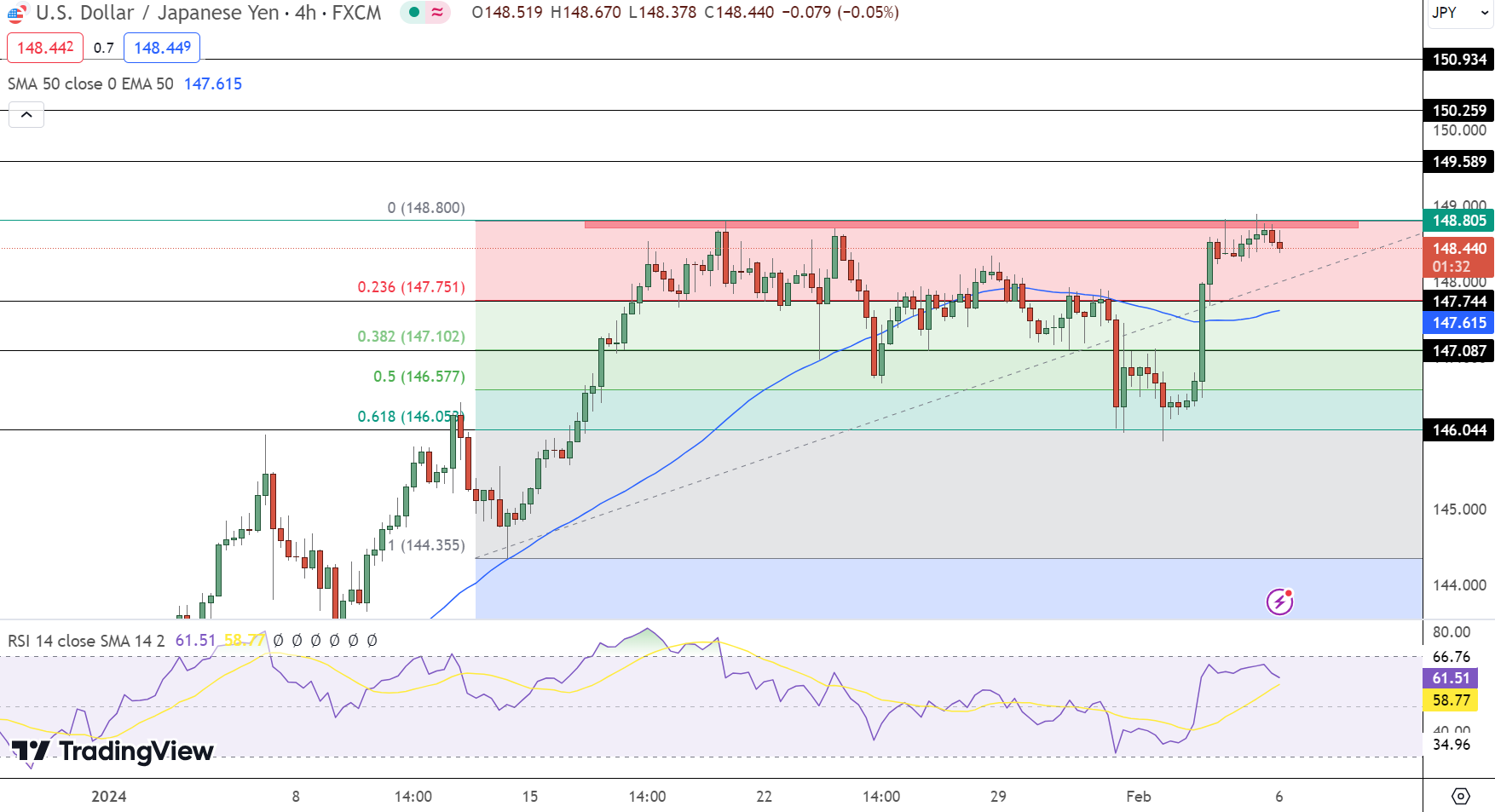

The USD/JPY pair is trading at 148.435, registering a slight decline of 0.16% today. On the 4-hour chart, the pivot point is established at 148.805, serving as a critical juncture for future price movements.

Resistance levels are identified at 149.589, 150.259, and 150.934, which must be breached for further upside momentum. Conversely, support levels are 147.744, 147.087, and 146.044, providing potential floors for any pullbacks.

The Relative Strength Index (RSI) stands at 61, leaning towards overbought conditions but still suggesting room for upward movement. The 50-day Exponential Moving Average (EMA) is at 147.615, supporting the current bullish sentiment.

A notable triple-top chart pattern is observed, with resistance around the pivot point of 148.805. A decisive bullish breakout above this level could dictate the pair’s next direction, potentially opening the door for buying opportunities.

In conclusion, the overall trend for USD/JPY appears bullish above the pivot point of 148.805, with market participants closely monitoring for a breakout to confirm a further upward trajectory.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account