Walmart Eyes Vizio Buyout: A $2 Billion Bet on Smart TVs and Streaming Supremacy

Walmart sent shockwaves through the tech and entertainment industries with news of its potential $2 billion acquisition of Vizio, smart TV

•

Last updated: Wednesday, February 14, 2024

Retail giant Walmart sent shockwaves through the tech and entertainment industries with news of its potential $2 billion acquisition of smart TV maker Vizio, as reported by the Wall Street Journal. This bold move comes at a crucial juncture, with streaming wars raging and consumer electronics evolving rapidly. Let’s dissect the potential implications for financial markets and investors:

Market Repercussions of Walmart-Vizio Deal

- Retail Consolidation: The deal, if finalized, signifies Walmart’s commitment to consolidating its electronics dominance. By integrating Vizio’s manufacturing strength and smart TV platform, Walmart could offer competitive prices and potentially even exclusive content deals, further squeezing rivals like Amazon and Best Buy.

- Streaming Wars Intensify: Owning Vizio’s platform grants Walmart direct access to millions of eyeballs, potentially making it a strategic player in the streaming wars. Integrating its own streaming service, Vudu, with Vizio TVs could attract new subscribers and challenge established giants like Netflix and Disney+.

- Investor Jitters: Though Walmart stock initially dipped on the news, it’s crucial to assess potential long-term gains. Investors might remain cautious until the deal’s impact on profitability and competition becomes clearer.

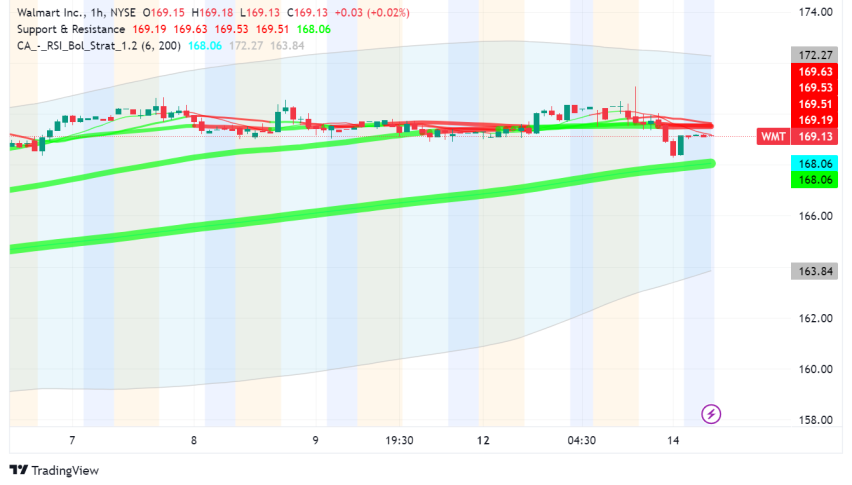

Technical Analysis: WMT Stock in Focus

- Recent Performance: After an initial dip, WMT has rebounded slightly, suggesting investor uncertainty. A breakout above $170 could signal long-term bullishness, while a drop below $150 might indicate profit-taking.

- Key Indicators: Watch for changes in Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) to gauge momentum and potential trend reversals.

- Trading Caution: With the deal still pending regulatory approval and market dynamics fluid, short-term trading based solely on this news carries high risks.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

ABOUT THE AUTHOR

See More

Arslan Butt

Lead Markets Analyst – Multi-Asset (FX, Commodities, Crypto)

Arslan Butt serves as the Lead Commodities and Indices Analyst, bringing a wealth of expertise to the field. With an MBA in Behavioral Finance and active progress towards a Ph.D., Arslan possesses a deep understanding of market dynamics.

His professional journey includes a significant role as a senior analyst at a leading brokerage firm, complementing his extensive experience as a market analyst and day trader. Adept in educating others, Arslan has a commendable track record as an instructor and public speaker.

His incisive analyses, particularly within the realms of cryptocurrency and forex markets, are showcased across esteemed financial publications such as ForexCrunch, InsideBitcoins, and EconomyWatch, solidifying his reputation in the financial community.