Stock Market Retreats Tesla Stock Jumps to $200

Stock markets today retreated after the surge on Nvidia last week, but the Tesla stock made a strong move today, as TSLA jumped $10 higher

Stock markets have been on a strong rally and last week we saw an even stronger rally after some great profit results from Nvidia, which pulled the Tech stocks higher. The Tesla stock didn’t benefit from that, but it is making a strong move today, as it jumps $10 higher, pushing above $200 briefly.

The volatility today was low as traders grappled with uncertainties following events from last week. Bond yields saw some demand once again, leading to an 8-point jump in 10-year Treasury rates to 4.30%, after rebounding from around 4.22%. US equities, on the other hand, retreated ower, giving back some of their gains from the previous week but not Tesla shares, which surged higher.

In terms of currencies, the euro was the most notable mover during the session. The EUR/USD pair edged higher from 1.0820 to 1.0855, indicating some upward momentum. However, aside from this, activity in most other major currencies against the dollar was lackluster, with minimal changes observed. The absence of significant data releases contributed to the overall subdued mood in the forex and the stock markets, both of which saw minor price action.

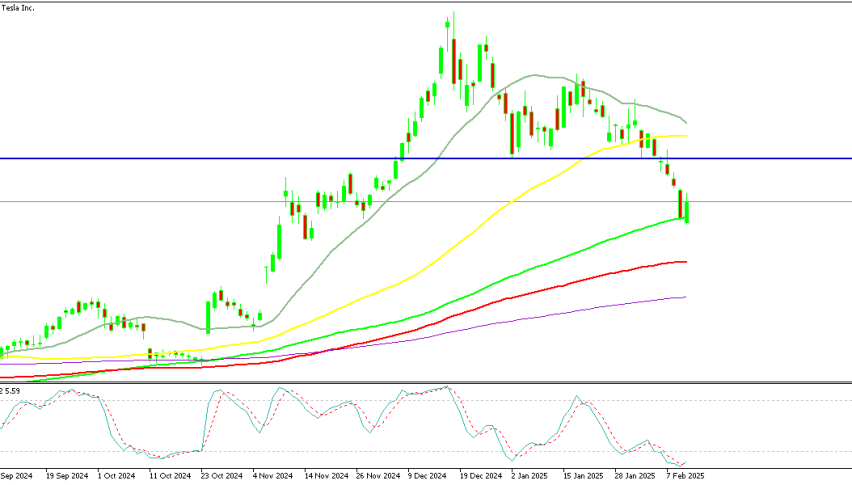

Tesla Stock Bounces Off the 20 SMA

However, it’s important to keep in mind the potential impact of month-end flows in the coming sessions when analyzing market movements throughout the week. TSLA retreated lower last week in fact, but the 20 SMA (gray) held as support around the $190 level and today the price bounced off that moving average.

There were headlines today all over the news, highlighting that the Chinese automaker BYD has an apparent competitive edge over Tesla in the electric vehicle (EV) market. However, an executive from BYD referred to Tesla as a “partner” in electrifying the transportation industry. This acknowledgment underscores Tesla’s significant role in popularizing and educating the public about electric cars. Despite being competitors in the EV market, BYD recognizes Tesla’s contributions to advancing electric vehicle technology and promoting widespread adoption of electric cars. This might have helped pop the Tesla stock higher.

Overall, the session reflected a cautious approach among traders, with limited conviction and subdued activity across various asset classes. As the week progresses, market participants will likely continue to monitor developments closely, including any shifts in sentiment and potential influences from month-end flows.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account