Gold (XAU/USD) Forecast: Slips to $2,157 Pre-Fed Decision; Week Ahead

The gold (XAU/USD) price forecast took a downturn as it pulled back from the vicinity of $2,180 on Friday, marking a continuation

•

Last updated: Saturday, March 16, 2024

The gold (XAU/USD) price forecast took a downturn as it pulled back from the vicinity of $2,180 on Friday, marking a continuation of its downward trajectory amidst growing anticipation of the US Federal Reserve’s monetary easing.

However, this prospect has been pushed further due to robust US economic indicators. The stronger-than-anticipated inflation data lend weight to Fed Chair Jerome Powell’s stance on maintaining the current monetary policy until significant disinflationary trends emerge. Currently, XAU/USD is trading at $2,157.66, showing a decrease of 0.20%.

Market Sentiments and Treasury Yields Influence the Gold Price

As Wall Street braces for a downturn at the week’s close, reflecting a risk-averse sentiment, gold prices typically benefit from such market dynamics.

Nonetheless, a surge in US Treasury yields following the release of Thursday’s Producer Price Index (PPI) data exerted downward pressure on XAU/USD prices throughout the European session and into the day’s end.

Despite lacklustre US economic data releases failing to significantly impact market movements, gold remained subdued.

Upcoming Economic Events and Gold Price Anticipation

Looking ahead, the upcoming week is packed with pivotal US economic data releases, poised to influence gold (XAU/USD) price dynamics significantly:

- Building Permits and the Federal Reserve’s Rate Decisions: Scheduled for Tuesday and Wednesday, respectively, these events could stir volatility in the gold markets, especially if the Federal Funds Rate remains unchanged at 5.50%. The FOMC’s economic projections and statements will be closely watched for any shifts in its monetary policy outlook.

- Unemployment and Manufacturing Indices: Thursday’s data on unemployment claims and the Philly Fed Manufacturing Index will provide further insight into the US economic landscape, potentially impacting gold prices as investors gauge the health of the labour market and manufacturing sector.

- Fed Chair Jerome Powell’s Speech: Friday’s address by Fed Chair Powell is highly anticipated, with the potential to sway gold price forecasts depending on the tone and content of his speech.

As these events unfold, Gold (XAU/USD) investors and traders will be keenly observing for any indications of economic strength or weakness, which could signal buying opportunities or suggest a tightening grip on current price levels.

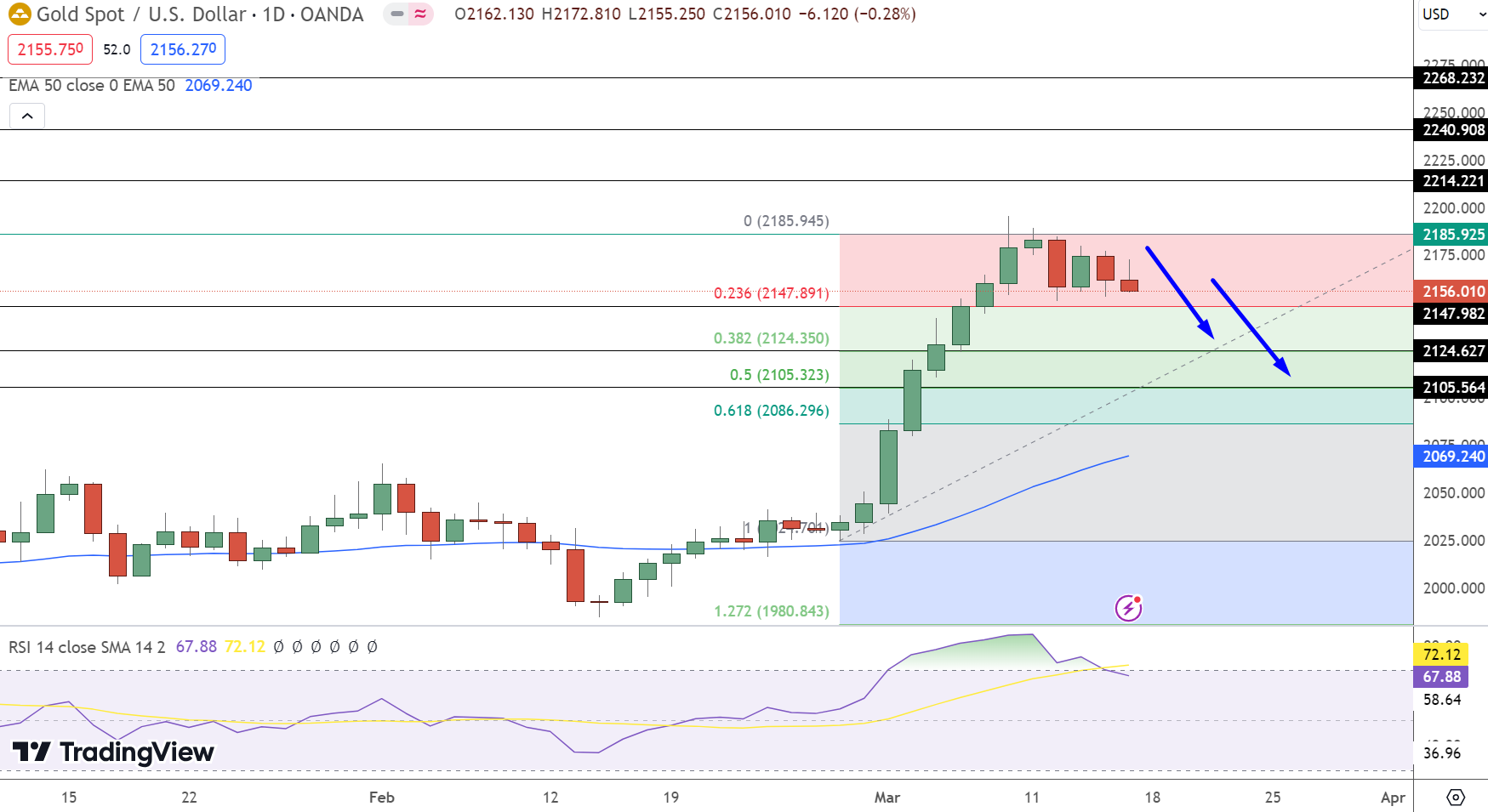

Gold Price Forecast: Weekly Outlook

Gold’s market position remains delicate as it hovers around a pivot point of $2185.93. The asset faces immediate resistance at $2214.22, with further barriers at $2240.91 and $2268.23. Support levels are critical to watch, starting at $2147.98, followed by $2124.63 and $2105.56, delineating potential fallbacks.

The Relative Strength Index (RSI) sits at 67, indicating a leaning towards overbought conditions, which could limit upside potential in the near term. The 50-day Exponential Moving Average (EMA) of $2069.24 underlines a bullish undertone, yet the asset’s current position calls for caution.

Gold’s immediate future hinges on its ability to maintain levels above the pivot point. A downturn below $2170 signals a bearish trend, potentially driving prices towards the 23.6% Fibonacci retracement at $2147. A breach here could prompt a descent to the 38.2% Fibonacci level around $2124.

Conversely, a breakthrough above $2170 may ignite a stronger bullish sentiment, underscoring the asset’s volatility and investor anticipation for directional cues.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

ABOUT THE AUTHOR

See More

Arslan Butt

Lead Markets Analyst – Multi-Asset (FX, Commodities, Crypto)

Arslan Butt serves as the Lead Commodities and Indices Analyst, bringing a wealth of expertise to the field. With an MBA in Behavioral Finance and active progress towards a Ph.D., Arslan possesses a deep understanding of market dynamics.

His professional journey includes a significant role as a senior analyst at a leading brokerage firm, complementing his extensive experience as a market analyst and day trader. Adept in educating others, Arslan has a commendable track record as an instructor and public speaker.

His incisive analyses, particularly within the realms of cryptocurrency and forex markets, are showcased across esteemed financial publications such as ForexCrunch, InsideBitcoins, and EconomyWatch, solidifying his reputation in the financial community.