GBP to USD Rate Not Too Moved by the UK Inflation CPI Today

The exchange rate of GBP to USD has seen upward pressure as GBP/USD remains supported ahead of the FED and BOE meetings

The exchange rate of GBP to USD has seen upward pressure as GBP/USD remains supported. Today we had the CPI inflation report from the UK which showed another cool-off in February, but the GBP is not too moved, as markets await the FOMC meeting later today, while tomorrow we have the Bank of England meeting.

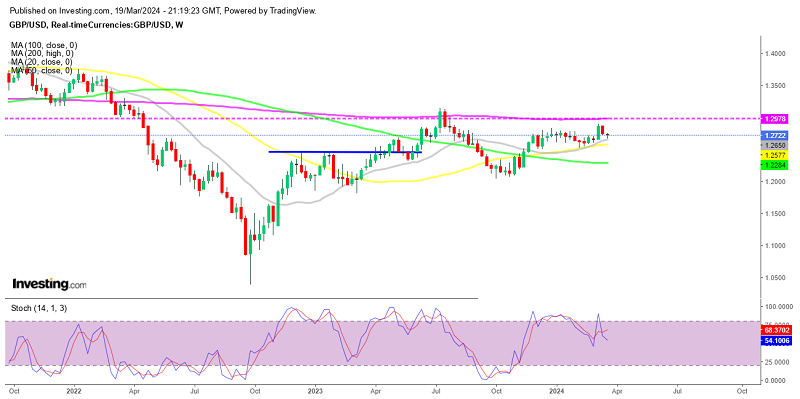

GBP/USD Weekly Chart – MAs Keeping the GBP Supported

GBP/USD has indeed experienced a significant uptick, largely driven by expectations of the Bank of England (BoE) keeping high interest rates for an extended duration. Anticipation of a delayed rate cut by the BoE has played a pivotal role in bolstering the pound against the dollar.

This optimistic sentiment underscores positive perceptions of the UK economy, indicating robust investor confidence and heightening the appeal of the pound. Bank of England Governor Andrew Bailey’s remarks in February, indicating a prolonged period of high interest rates, have further solidified this outlook. Moreover, the prospect of the European Central Bank and the Federal Reserve potentially adjusting their interest rates first has contributed to the GBP’s favorable performance against both the USD and the Euro.

UK February CPI Infation Report

The forecast for UK CPI suggested a slight decrease from the previous reading, with the year-on-year rate expected to be 3.6%, down from 4.0% previously. However, the month-on-month measure is anticipated to rebound to 0.7% from the previous -0.6%. In terms of core CPI, the year-on-year figure is predicted to be 4.6%, down from 5.1% previously.

- February CPI +3.4% vs +3.5% y/y expected

- Prior +4.0%

- Core CPI +4.5% vs +4.6% y/y expected

- Prior +5.1%

The lower numbers reported here should dampen hopes for an August rate decrease. Prior to the data release, traders anticipated a rate cut of approximately 66 basis points this year, with the probability hovering around 97%. It will be interesting to see how things evolve when the rate market opens later.

In terms of specifics, the ONS reports that food costs and expenses at restaurants and cafés contributed the most to the decline in annual inflation. The trend in food prices is certainly promising, and it remains a positive development for the Bank of England as we look ahead to the coming months. However, whether this trend can be sustained remains to be seen.

GBP/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account