XAUUSD Analysis – Eyes Turn to FOMC Meeting!

The upward momentum in gold prices diminished on March 12th, but there isn’t a clear shift in direction yet. Analysis of both the 2-hour and 4-hour charts reveals a descending triangle pattern emerging, while on longer timeframes, it appears to be a mere retracement. This suggests that the market is still abiding by the established price range observed last week, signaling a sideways movement according to technical analysis. However, tonight’s FOMC Statement and Powell’s Press Conference could alter this trajectory.

With consumer inflation consistently surpassing expectations for three consecutive months and the PPI doubling within 30 days, there’s now increased uncertainty surrounding monetary policy. Investors are eagerly awaiting clarification, anticipating potential volatility. If the Federal Reserve hints at delaying or reducing rate cuts, gold may lose its appeal, potentially breaking below the $2,147 support level.

Economists largely anticipate the Fed to proceed with its planned cut in June, albeit with less frequency thereafter, aiming to navigate a soft landing while addressing inflationary pressures. The current prediction by the CME FedWatch Tool suggests a rate cut in June 2024. Any decline in inflation, akin to what occurred today in the UK, could drive up demand for gold. With US interest rates expected to remain at 5.50%, market focus predominantly lies on forward guidance.

A serious concern for economists and bankers is the rise in the price of Oil. The American Petroleum Institute (API) reserves report published yesterday recorded a decrease of 1.519M barrels instead of the expected increase of 0.077M barrels. This applies further upward pressure, but investors are glad to see prices retracing.

The latest report from the US Commodities Futures Trading Commission (CFTC) indicates a continued rise in contracts, with buy contracts increasing by 25,734 and sellers decreasing by 2,766. This underscores the prevailing belief among many traders and institutions that gold prices will either rise or hold steady.

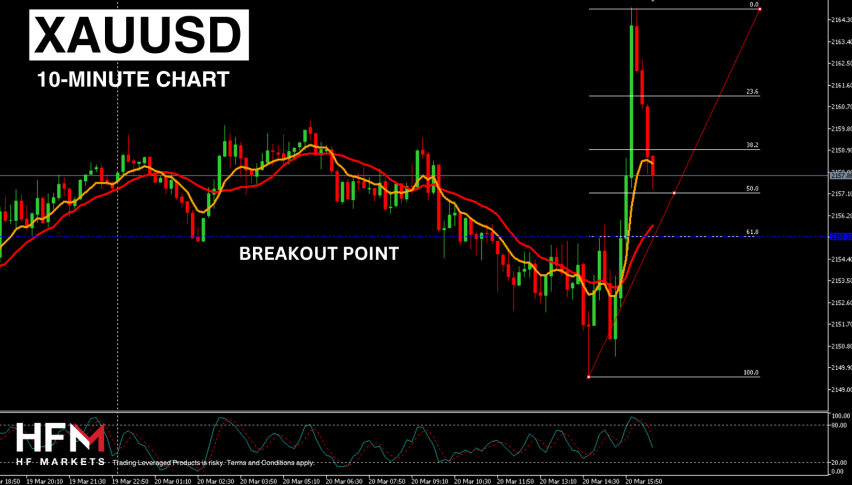

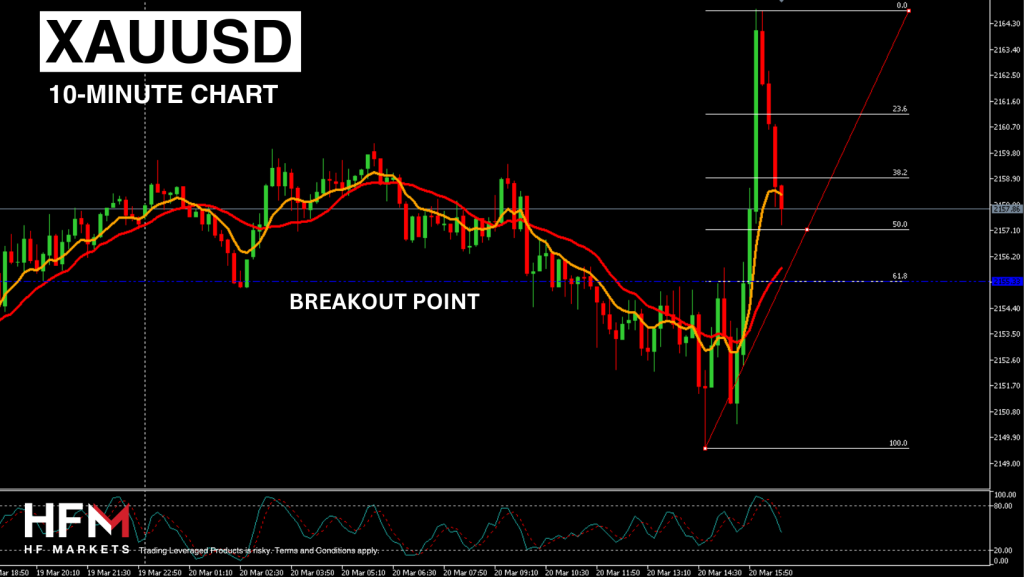

Although technical analysis presently indicates downward momentum and an intraday downward trend, Fibonacci levels suggest the price is finding support within the current range. Consequently, short-term traders may await a bearish breakout below $2,155.32 (61.8% Fibonacci level) for clearer signals, with momentum likely to pick up following the opening of the US trading session.

Tomorrow’s release of March data on business activity in the US and eurozone, particularly the anticipated slowdown in the US Services PMI from 52.3 points to 52.0 points and a potential decrease in Manufacturing PMI from 52.3 points to 51.8 points, is expected to introduce volatility in tomorrow’s trading sessions.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account