USD/BRL: Real Suffers Bullish US Data & Weak Employment from Brazil

The real continued in a bearish market today as strong economic data from the US favored the greenback.

The real continued in a bearish market today as strong economic data from the US favored the greenback.

The USD/BRL rose again today after testing a low at 4.9779, the market found bullish momentum after the US data was digested. From the US we had the following releases:

- PCE QoQ (Q4) – Expected 1.8%, actual 1.8%, previous 1.8%

- GDP Annualized Q4 – Expected 3.2%, actual 3.4%, previous 3.2%

- Michigan Consumer Sentiment – Expected 76.5, actual 79.4, previous 76.5

- Initial Jobless Claims – Expected 215k, actual 210k, previous 212k

The initial market reaction after today’s flurry of data releases was to send USD/BRL lower for the first 30 minutes. Due to the stable PCE number showing that statistic for inflation seemingly under control.

For Core PCE the number was even slightly better at 2% after a previous reading of 2.1%. However, the market also had to digest the significance of the economic data for GDP, unemployment, and consumer sentiment, all of which came in stronger than expected.

The market rallied 0.23% or 280 pips after the first reaction as the market took into account the strength of the US economy. This strength in GDP and low unemployment may leave room for the Federal Reserve to wait longer before implementing interest rate cuts.

Brazilian unemployment data was also released today. Although the number was as expected at 7.8%, it showed an increase from last month at 7.6%. The weakness of the Brazilian economy could create more pressure for the BCB to act sooner on interest rates.

Technical View

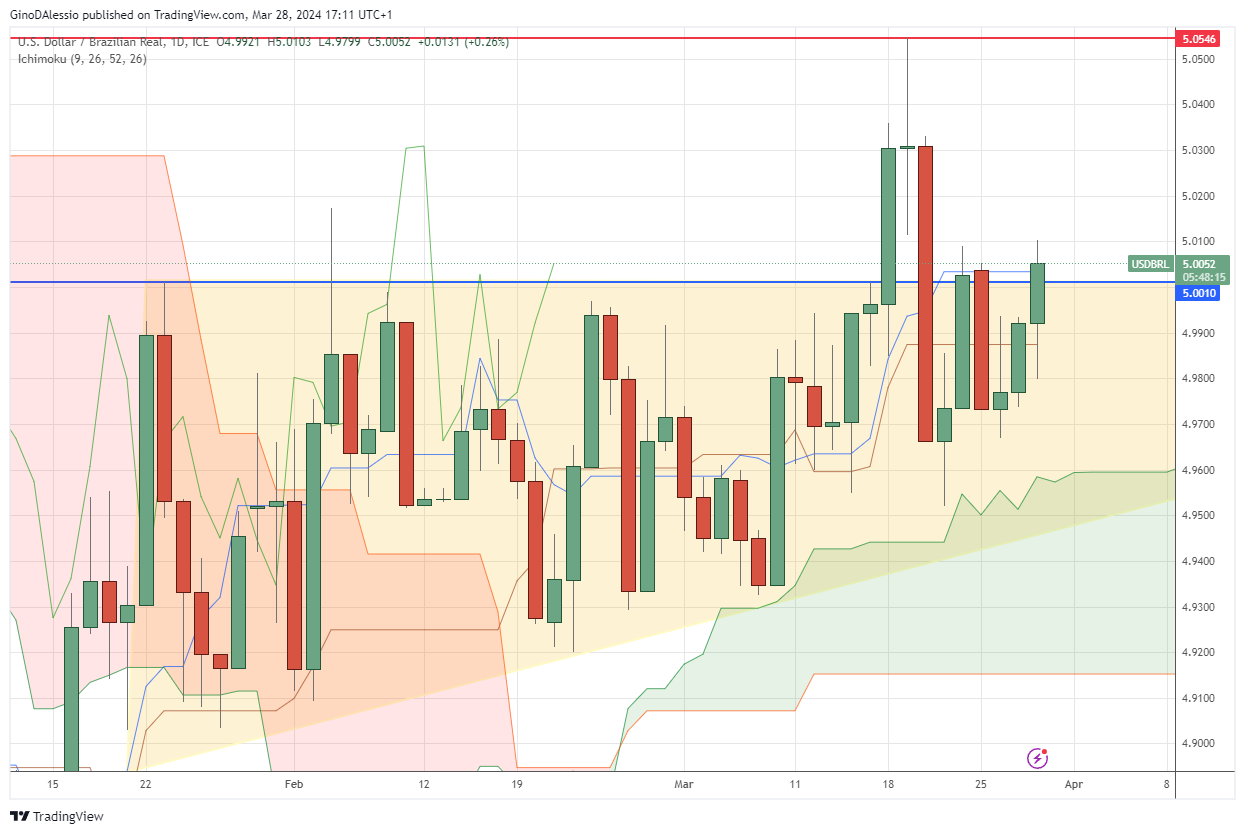

The day chart below for USD/BRL shows an attempt of bullish sentiment to take over. The market is about to produce 3 green candles in a row, if today’s close is around these levels, as would be expected.

The volume in the market is lighter than usual given the festive session, but it looks like today’s candle could close above the resistance line at 5.0010 (blue line). The level is an important level as it has the psychological barrier of a handle followed by straight zeros.

Should the market close above this resistance area, we should see the USD/BRL rally higher. The next resistance level would be the recent high at 5.0546 (red line). On the other hand, failure to break above the blue line could lead to a correction.

In this scenario the next support level would be the lower side of the yellow triangle. That area also coincides with the topside of the Ichimoku cloud, creating an area of strong support, at around 4.9600.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account