CHF to USD Rate Keeps Falling Despite Positive Swiss Retail Sales

The rate of CHF to USD fell almost 1 cent yesterday, heading to 1.10 as USD/CHF keeps moving higher, having established a support at 0.90.

The rate of CHF to USD fell almost 1 cent yesterday, heading to 1.10 as USD/CHF keeps moving higher, having established a support at 0.90. The US ISM manufacturing report showed that this sector turned to expansion after two years of recession, which improved the sentiment for the USD, as the odds of a FED interest rate cut in June keep declining.

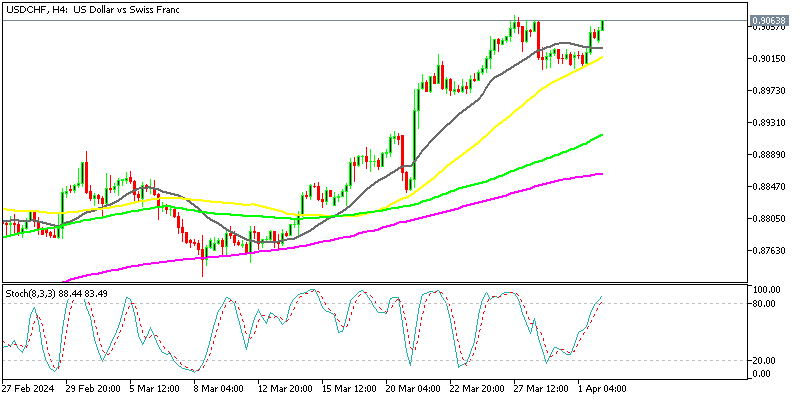

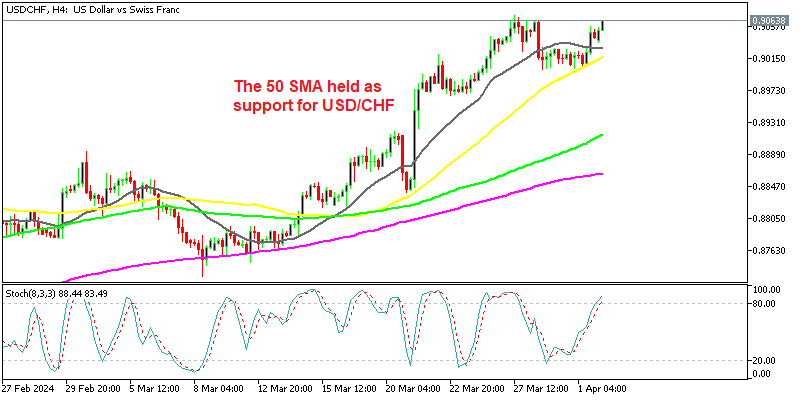

USD/CHF Chart H4 – MAs Holding As Support

The recent upward momentum in USD/CHF slowed after Friday’s retreat, but it has still posted three consecutive weekly gains, and heading into this week, this pair made some strong gains on the first day. Another encouraging aspect for buyers is that the price has formed a support zone around the 0.9000 zone. While not technically significant, it serves as a useful psychological checkpoint and yesterday we saw a bounce off this level, with the 50 SMA (yellow) acting as support.

Among all major pairings, USD/CHF has the potential to be one of the most noteworthy divergence trades right now, as well as EUR/USD . However, the Swiss National Bank (SNB) has already initiated its rate reduction cycle with an unexpected move in March, which has turned the CHF pretty soft.

Strong US Economic Data Keeps the FED in Doubt

Meanwhile, the Federal Reserve (Fed) is perhaps still divided on a move in June and the odds for a cut at that meeting are slipping. If the jobs reports this week remain strong and inflation estimates remain stubborn next week, the current market pricing may come under more pressure. At the moment, over 70% of economists predict a rate cut in June. The discrepancy indicates that traders are not yet convinced it’s a done deal, which means that they will have to be guided by data, as will the Fed, so it can go either way.

However, yesterday’s strong ISM manufacturing report and other data indicate that the US economy is headed in the right direction. This provides one perspective on how USD/CHF might unfold in the coming weeks. If that’s the case, the pair should be prepared to retest its October high of 0.9245.

But, just in case the data is poor and the disinflation trend resumes, the upside for USD/CHF should be limited in the medium term. In the broader picture, traders have already priced in 76 basis points of Fed rate cuts this year. So, unless they are confident that the Fed will cut rates four times, the downside for the dollar is limited in that respect. This is particularly true when compared to the Swiss franc, as the SNB is in a stronger position to cut rates at each of the remaining meetings this year.

USD/CHF Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account