FTSE Tests New All-Time High but Fails to Hold Newly Acquired Territory

The FTSE set a new all-time high in the early hours of today’s trading session, and then retreated from the high.

The FTSE set a new all-time high in the early hours of today’s trading session, and then retreated from the high.

The FTSE index has been riding the wave of optimism regarding BoE’s next move to cut interest rates. The perception was boosted further after last week’s additional vote in favour of cutting rates.

US inflation data will be released later today, so the market may be taking profits in anticipation of an unexpected number. The forecast for today’s US inflation expects a decline from 3.5% to 3.4% YoY.

An unexpected rise in inflation or even a level that matches last month’s data could send a shockwave through the stock market. And the FTSE would certainly be affected by it, especially having just reached new highs on lower inflation expectations.

Technical View

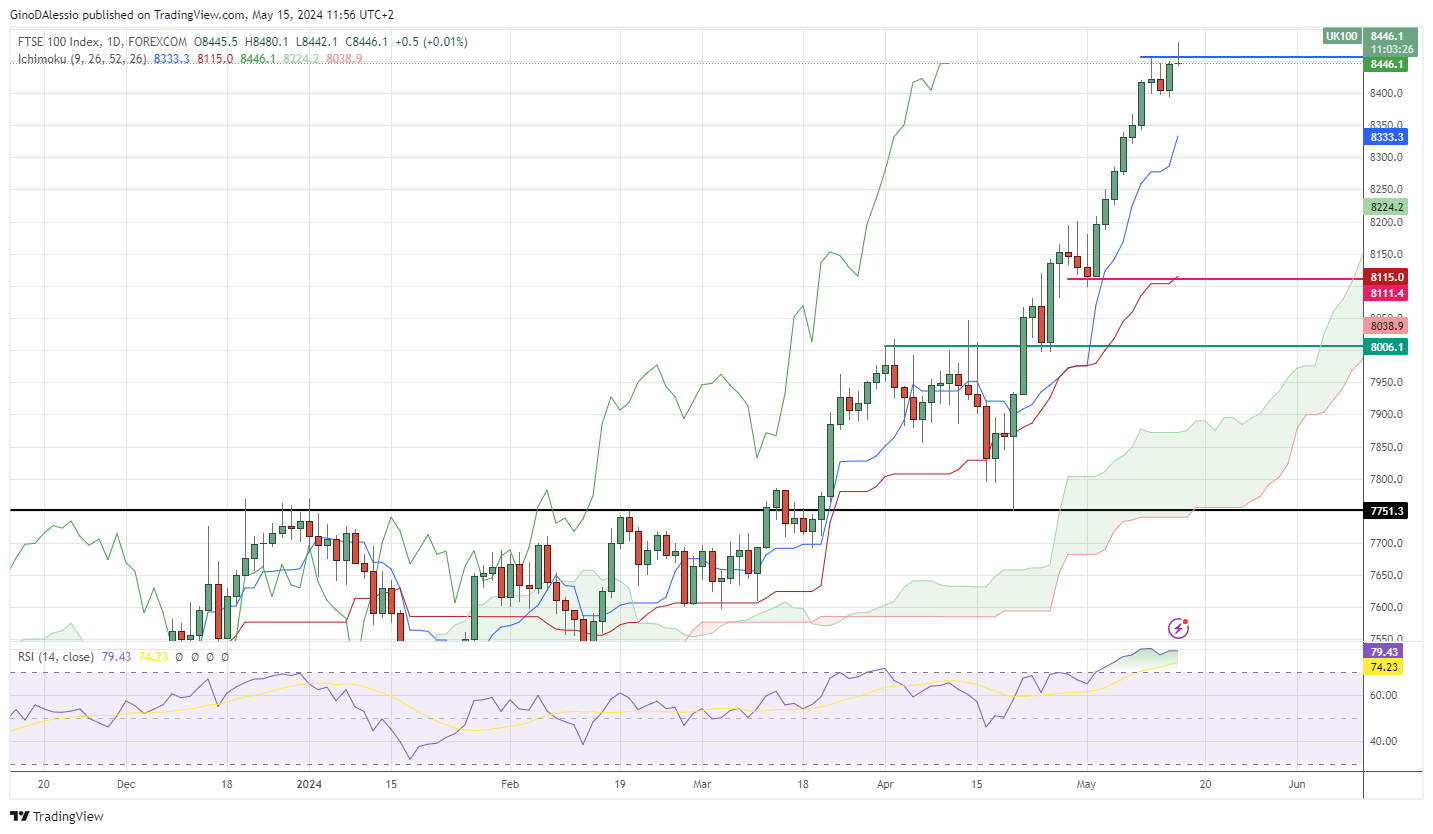

From the day chart below for the FTSE we can see a strong bullish trend, with the current leg reaching a new all-time high today of 8480. The RSI has accompanied price action above the 70 level. Levels of 70 plus for the RSI indicate a strong bullish momentum.

However, today’s market tested a new ATH and subsequently retraced from that level. We can see that with the current price level the RSI is still above 70, indicating the momentum is still ongoing.

In the case the market falls lower, and the RSI breaks below 70, we could get a larger correction. The first support would come from the Fibonacci retracement level pf 0.236, which would be at 8309.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account