S&P500 and NASDAQ Price Forecast: Indices to Continue Uptrend Next Week?

The S&P 500 (SPX) is trading at $5303.26, up 0.12%. The 4-hour chart shows the pivot point at $5325, acting as a crucial level. Immediate

•

Last updated: Sunday, May 19, 2024

The S&P 500 (SPX) is trading at $5303.26, up 0.12%, with the pivot point at $5325 acting as a crucial level. The NASDAQ closed at $18,546.23, down 0.06%, with a pivot point at $18,484. Both indices have key resistance and support levels that will determine their near-term direction.

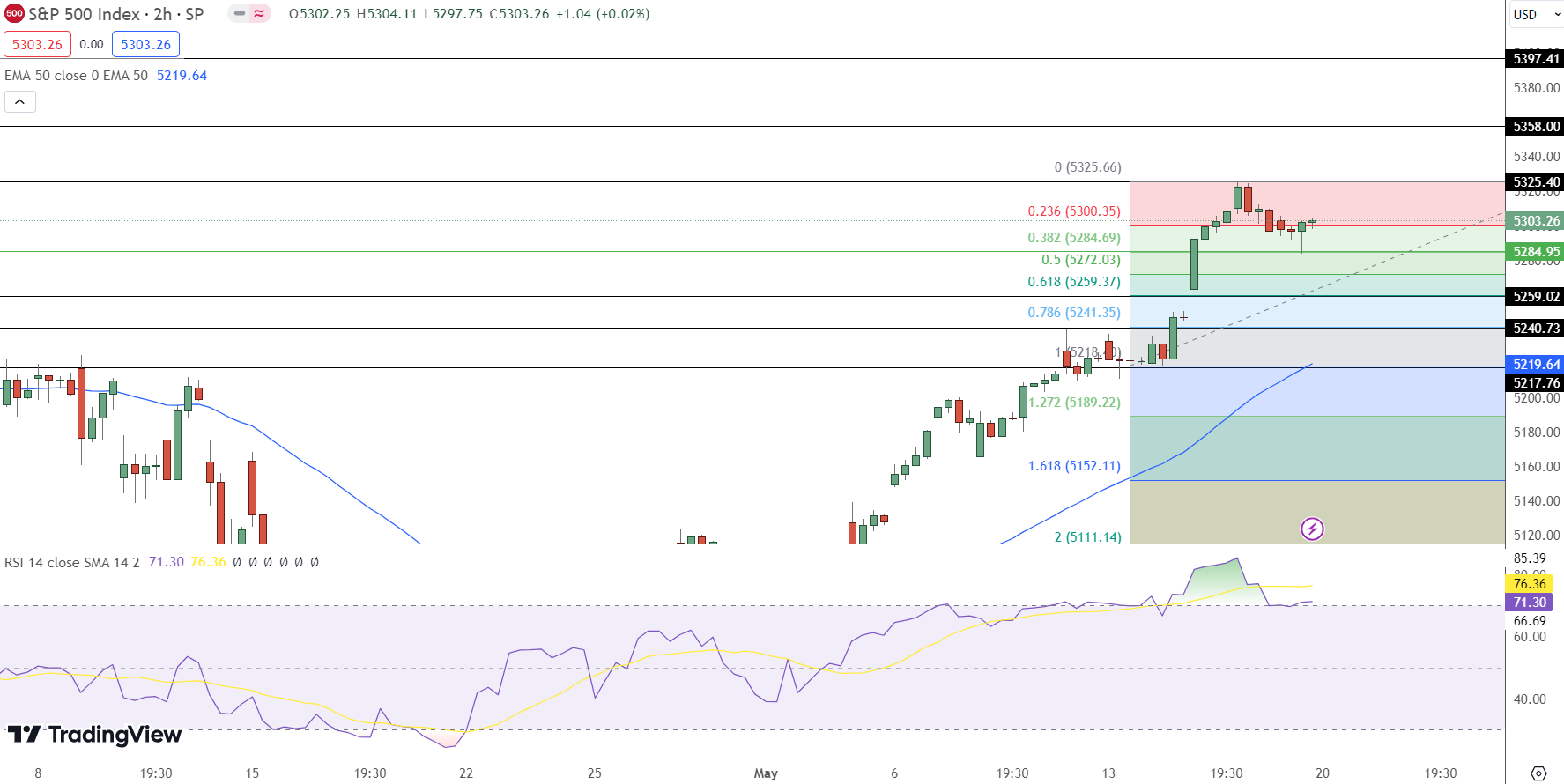

S&P500 (SPX) Price Forecast: Technical Outlook

The S&P 500 (SPX) is trading at $5303.26, up 0.12%. The 4-hour chart shows the pivot point at $5325, acting as a crucial level. Immediate resistance is at $5358, with subsequent levels at $5397 and $5429.

A hold above the pivot point could drive buying momentum, while a break below $5285 might trigger a sharp sell-off. The overall sentiment remains bullish above $5285, but cautious below this level.

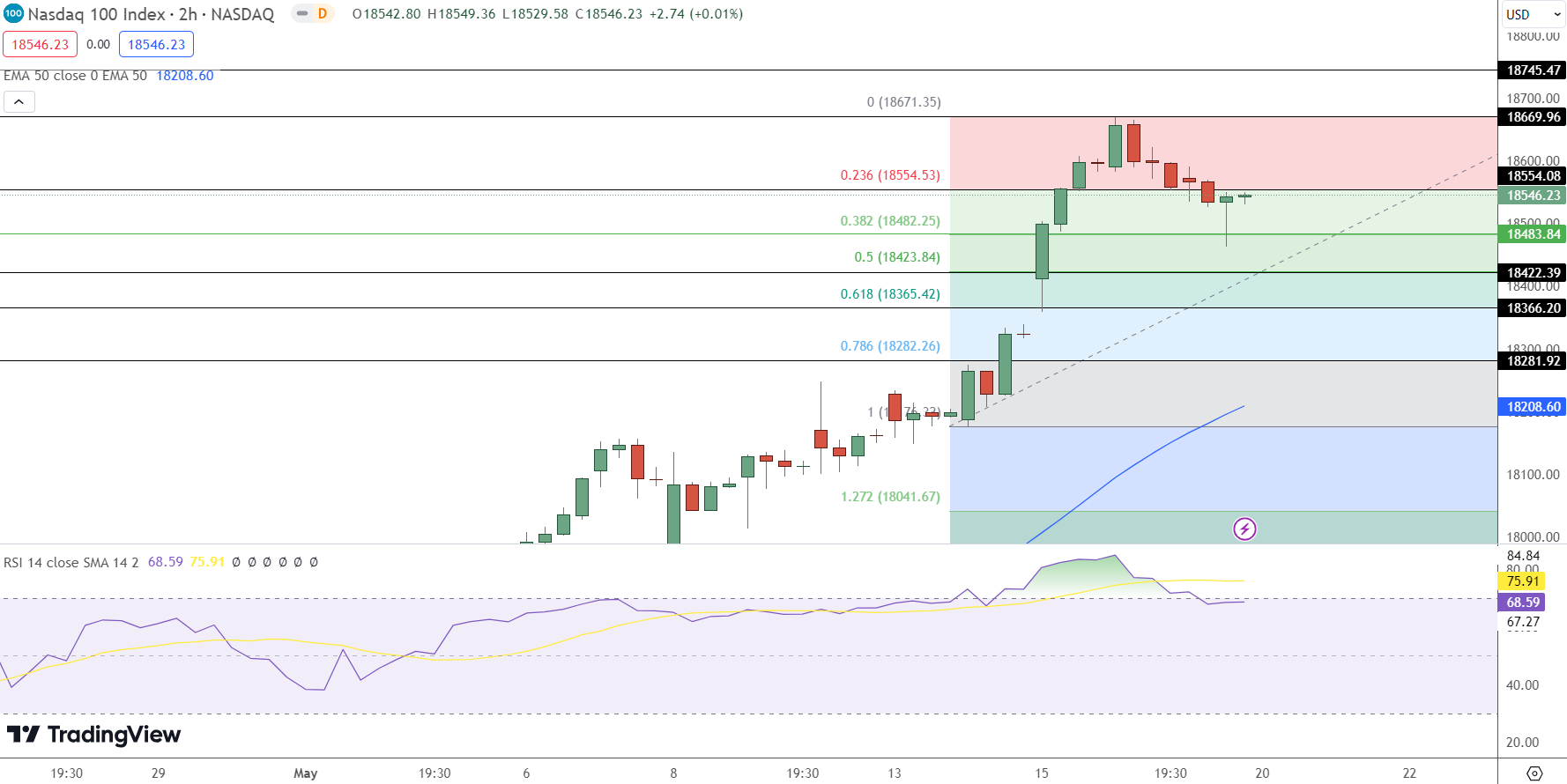

NASDAQ Price Forecast: Technical Outlook

The NASDAQ closed the week at $18,546.23, down 0.06%. The pivot point, marked at $18,484, is critical for the upcoming sessions. Immediate resistance is at $18,554, with further resistance at $18,670 and $18,745.

On the downside, immediate support lies at $18,422, followed by $18,366 and $18,282. The RSI is at 68, indicating the index is approaching overbought territory. The 50-day EMA stands at $18,208.6. The 38.2% Fibonacci retracement at $18,484 underpins a bullish outlook.

Holding above the pivot point could drive a buying trend, while a drop below $18,484 may trigger a sharp sell-off.

The technical outlook remains bullish above $18,484 but turns bearish below this level. The market’s reaction to the pivot point will be crucial in determining the near-term direction.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

ABOUT THE AUTHOR

See More

Arslan Butt

Lead Markets Analyst – Multi-Asset (FX, Commodities, Crypto)

Arslan Butt serves as the Lead Commodities and Indices Analyst, bringing a wealth of expertise to the field. With an MBA in Behavioral Finance and active progress towards a Ph.D., Arslan possesses a deep understanding of market dynamics.

His professional journey includes a significant role as a senior analyst at a leading brokerage firm, complementing his extensive experience as a market analyst and day trader. Adept in educating others, Arslan has a commendable track record as an instructor and public speaker.

His incisive analyses, particularly within the realms of cryptocurrency and forex markets, are showcased across esteemed financial publications such as ForexCrunch, InsideBitcoins, and EconomyWatch, solidifying his reputation in the financial community.