USDJPY Keeps Grinding Higher as Japan Economy Slows

The JPY to USD rate has exhibited considerable volatility since late April, characterized by significant declines followed by robust buying.

•

Last updated: Monday, May 20, 2024

The JPY to USD rate has exhibited considerable volatility since late April, characterized by significant declines followed by robust buying activity. However, buyers remain in control and the main trend remains bullish, with the price heading for 160 again as economic indicators from Japan show a weakening economy. Yesterday the Tertiary Industry Activity showed a -2.4% contraction during last month, while tomorrow we have the Core Machinery Orders and Trade Balance.

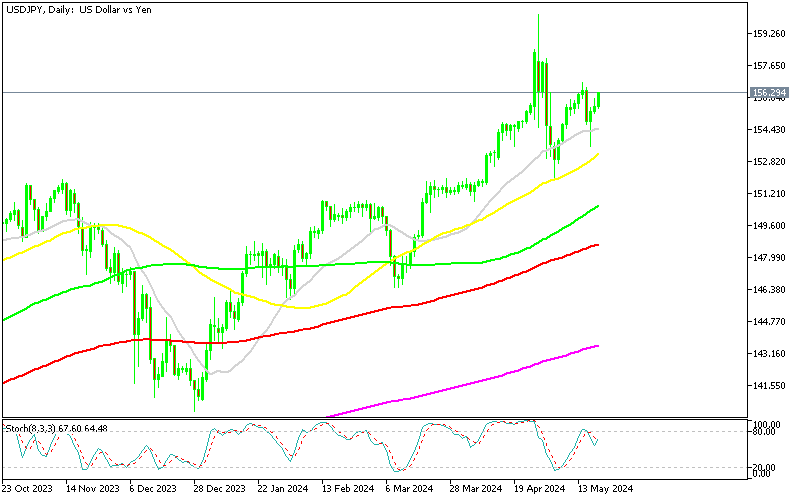

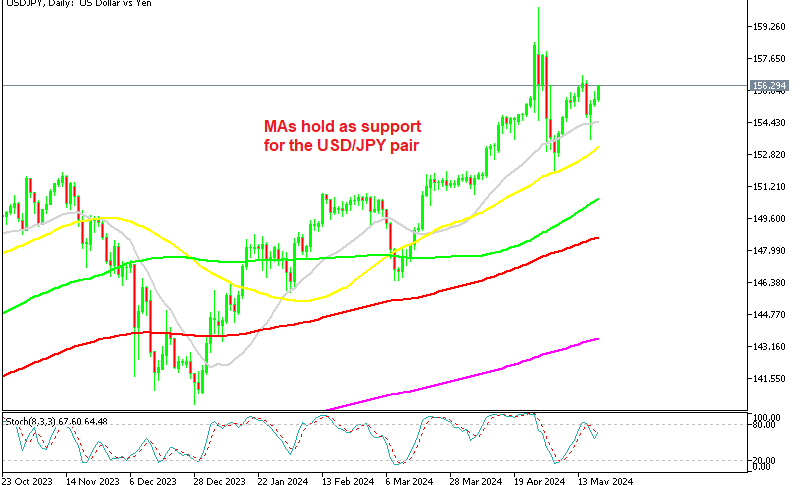

USD/JPY Chart Daily – MAs Have Turned into Support

Key Factors Influencing the Price Action in USD/JPY

-

Bank of Japan (BOJ) Intervention:

- The BOJ’s intervention in early May provided significant upward momentum for USD/JPY , pushing the pair to a high of 156.80. This intervention reflects the BOJ’s efforts to manage the yen’s value, which often leads to sharp market movements.

-

US Economic Data:

- Recent US economic indicators, particularly the Non-Farm Payrolls (NFP) report and Consumer Price Index (CPI) inflation figures, have played a pivotal role. The lower-than-expected CPI inflation report led to a temporary retreat of the USD, causing USD/JPY to slip below 154.

- Despite this, the NFP employment data, which suggested a cooling in job growth, influenced market expectations about the Federal Reserve’s policy trajectory, adding to the pair’s volatility.

-

Overall Market Sentiment:

- The overall trend for USD/JPY remains bullish, with buyers maintaining control despite short-term retracements. The market’s optimistic outlook is bolstered by the expectation that the US dollar will continue to perform well against the yen, driven by divergent monetary policies between the Federal Reserve and the BOJ.

USD/JPY Technical Analysis

- Support Levels: The recent dips found support below the 154 level, indicating a strong buying interest at lower levels.

- Resistance Levels: The previous high of 156.80 serves as a notable resistance level, and a break above this could see the pair aiming for the 160 mark.

- Moving Averages: The pair’s movements relative to key moving averages (e.g., 50-day and 20-day SMAs) can provide further insights into potential support and resistance areas.

Future Outlook:

- Monetary Policy Divergence: As long as the BOJ maintains the low policy rate at/near the zero level, while the FOMC interest rate stands above 5%, the pressure will be on the top side for this forex pair. Even in the case of the FED hinting at a rate cut, which would send the USD lower as we have seen against most major currencies, USD/JPY has continued to hold the gaind and remain bullish.

USD/JPY Live Chart

USD/JPY

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

ABOUT THE AUTHOR

See More

Skerdian Meta

Lead Analyst

Skerdian Meta Lead Analyst.

Skerdian is a professional Forex trader and a market analyst. He has been actively engaged in market analysis for the past 11 years. Before becoming our head analyst, Skerdian served as a trader and market analyst in Saxo Bank's local branch, Aksioner. Skerdian specialized in experimenting with developing models and hands-on trading. Skerdian has a masters degree in finance and investment.