FTSE: Worse than Expected Retail Sales Send Stocks Lower

UK stocks continue to fall after losing 1.55% in the previous 2 sessions. Retails sales add to the woes of high interest rates for longer.

UK stocks continue to fall after losing 1.55% in the previous 2 sessions. Retails sales add to the woes of high interest rates for longer.

Retail sales data released this morning showed a drop of 2.7% YoY compared to last month’s increase of 0.4%. The market was expecting a decline in consumer activity, but consensus was at -0.2%.

The large surprise in the decline of shoppers’ habits pushed the FTSE lower again in the early trading session. Despite the fact that often weak economic data has often sent stocks higher, since the market perceived greater chances of monetary policing easing.

But today’s figure for retail sales was greatly unexpected and so large a drop, at this point outweighing the positives from interest cuts. Later today we’re expecting Durable Goods Orders from the US.

This data is expected to show a decline of 0.8% MoM, compared to last month’s increase of 2.6%. I would expect that a low number would send stocks higher as it gives way to a more likely monetary easing from the Fed.

Technical View

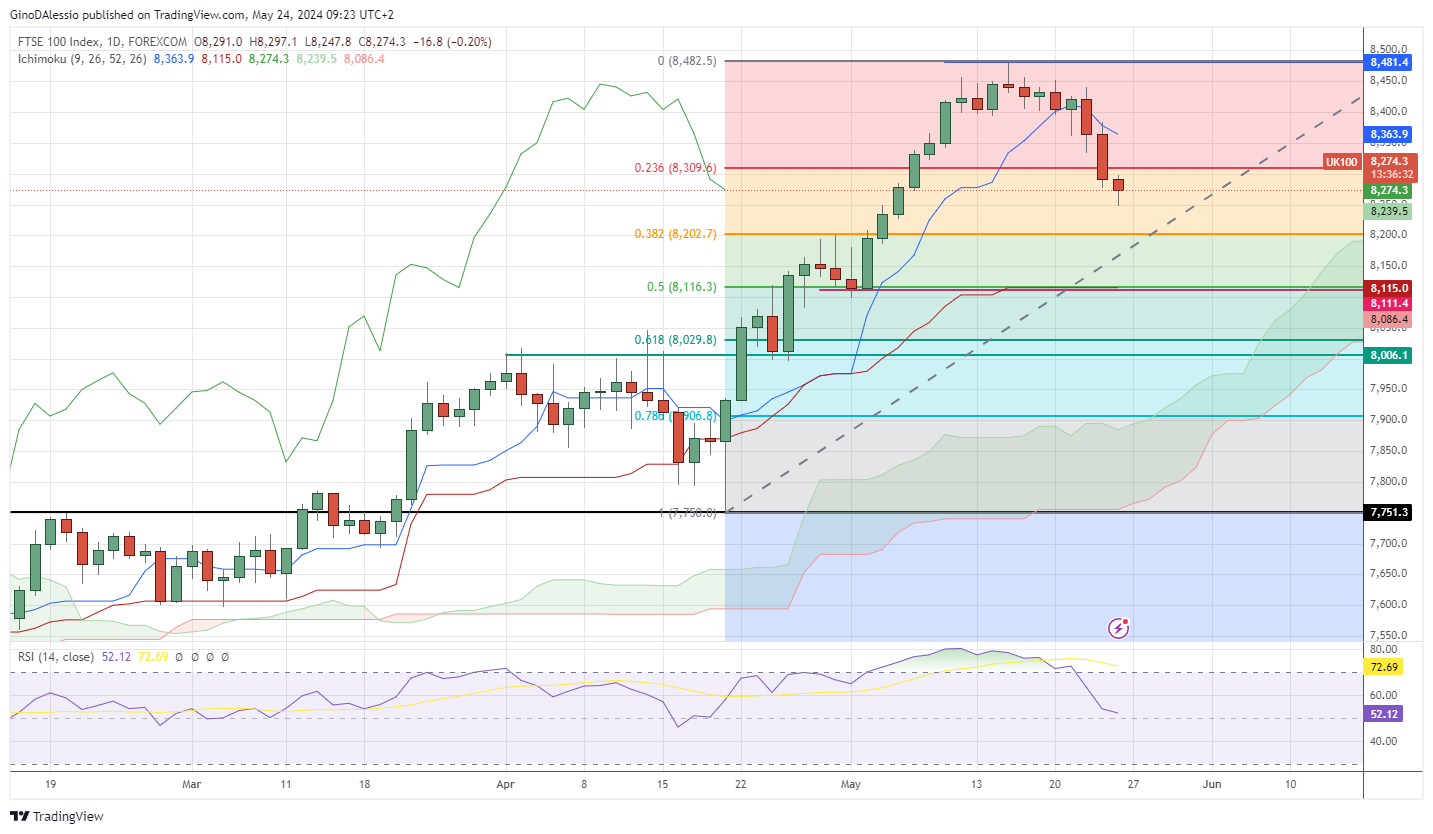

The day chart below for the FTSE shows a correction underway within a major bullish trend. The correction comes after a new all-time high was posted on May 15. The RSI has been well above 70 for an extended period and broke below that level 2 candles back.

The break below signaled a possible correction, and that possibility seems to be playing out. Yesterday’s candle closed below the Fibonacci retracement support of 8309 (red line) and today’s candle should find support at the next Fibonacci support of 8202 (orange line).

The 8202 level also coincides with support from a previous high posted in April, which should make it harder to break. A close below that line should lead to further lows the following support at 8116 or 50% retracement level.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account