USDCAD to Resume Uptrend As BOC Rate Cut Odds Rise

USDCAD has been retreating since it made a bullish break above the triangle 2 weeks ago, but it found support at MAs and buyers are comin...

USDCAD has been retreating since it made a bullish break above the triangle 2 weeks ago, but it found support at MAs and it seems like buyers will come back next week after the strong PMI numbers from the US on Friday and softer Canadian advance retail sales for May.

USD/CAD broke out of a two-month triangular pattern following the latest Non-Farm Payroll (NFP) report, and the former resistance has now transformed into support. The pair pulled back to 1.3674, where it found support at the previously descending resistance trendline. This trendline has now reversed its role, acting as a support level, bolstered by moving averages that reinforce the support zone.

USD/CAD Chart Daily – The 50 SMA Continues to Hold As Support

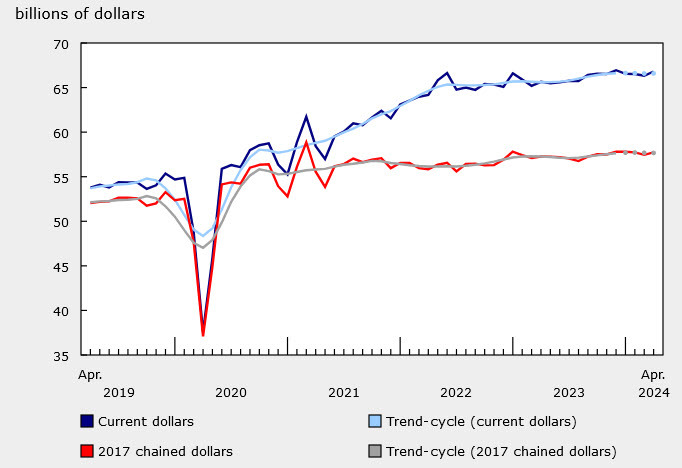

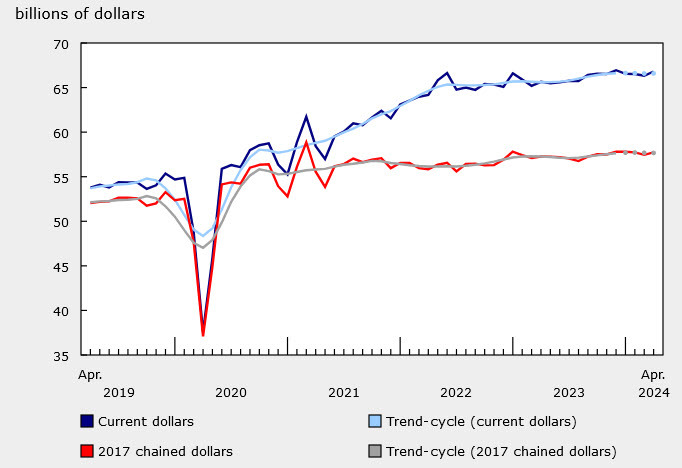

Following Friday’s disappointing retail sales and Producer Price Index (PPI) figures from Canada, the Bank of Canada’s July decision is increasingly expected to lean towards a rate cut. The market now anticipates a 73% chance of consecutive rate reductions. Retail sales met the +0.7% forecast for April, but the preliminary report for May suggests a 0.6% decline, and the March figure was revised down to -0.3% from -0.2%.

These figures indicate a weakening consumer sector, corroborated by RBC’s Canadian credit card data. Inflation appears to be easing, as today’s PPI figure came in at 0.0%, falling short of the expected 0.5% increase. Additionally, raw materials prices dropped by 1.0% this month, following a 5.3% rise the previous month. Interestingly, the Canadian dollar has not weakened despite the increased likelihood of a BOC rate cut.

Canada April Retail Sales

-

Overall Retail Sales:

- Actual: +0.7%

- Expected: +0.7%

- Prior: -0.2%

-

Sales Excluding Autos:

- Actual: +1.8%

- Expected: +0.7%

-

Excluding Autos and Gasoline: +1.4%

- Sector Breakdown:

- Motor Vehicle and Parts Dealers: -2.2%

- Food and Beverage Retailers: +1.9%, led by grocery stores

- Regional Performance:

- Alberta: +3.1%

- Ontario: -1.0%, with Toronto sales down by -2.5% (Toronto currently has the weakest housing market)

-

Preliminary May Data: -0.6% month-over-month

This resilience might be attributed to FX market volatility and higher oil prices. However, it seems the BOC may be lagging in its response, and the market could eventually welcome the effects of rate cuts, providing Governor Macklem with an opportunity to avert a severe economic downturn.

USD/CAD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account