NIKKEI225 Surges to New All-Time High, Fueled by AI Fever & US Stocks

Japanese stocks were propelled higher overnight reaching a new ATH of 41,746 or 2.3%.

Japanese stocks were propelled higher overnight reaching a new ATH of 41,746 or 2.3%.

Most major Asian stock indices got a lift following the new ATH in the US for the NAS100 and SP&500. The AI powered bull run helped chip makers in Japan, together with an increasing perception about accommodating BoJ bond purchases.

The BoJ will meet with bond market makers today, July 9, and tomorrow to get advice on just how much they can reduce their JGB purchasing program. This meeting is seen as possibly an accommodating move.

The BoJ Japan will meet at the end of the month for their monetary policy meeting. At the meeting they’ll also outline with precision their JGN purchases. The market is begging to feel that the reduction in bond purchases may not be as bad as first imagined.

The NIKKEI225 also benefitted from a weak yen, which is trading at 38-year lows against the US dollar below 160. The weak yen is making Japanese stocks much cheaper for investors that have their books in another currency.

Attention turns to Fed Chair Jerom Powell’s testimony to congress at 2pm GMT. Investors and traders are hoping to hear some accommodating language after a series of data showing inflation is cooling.

Technical View

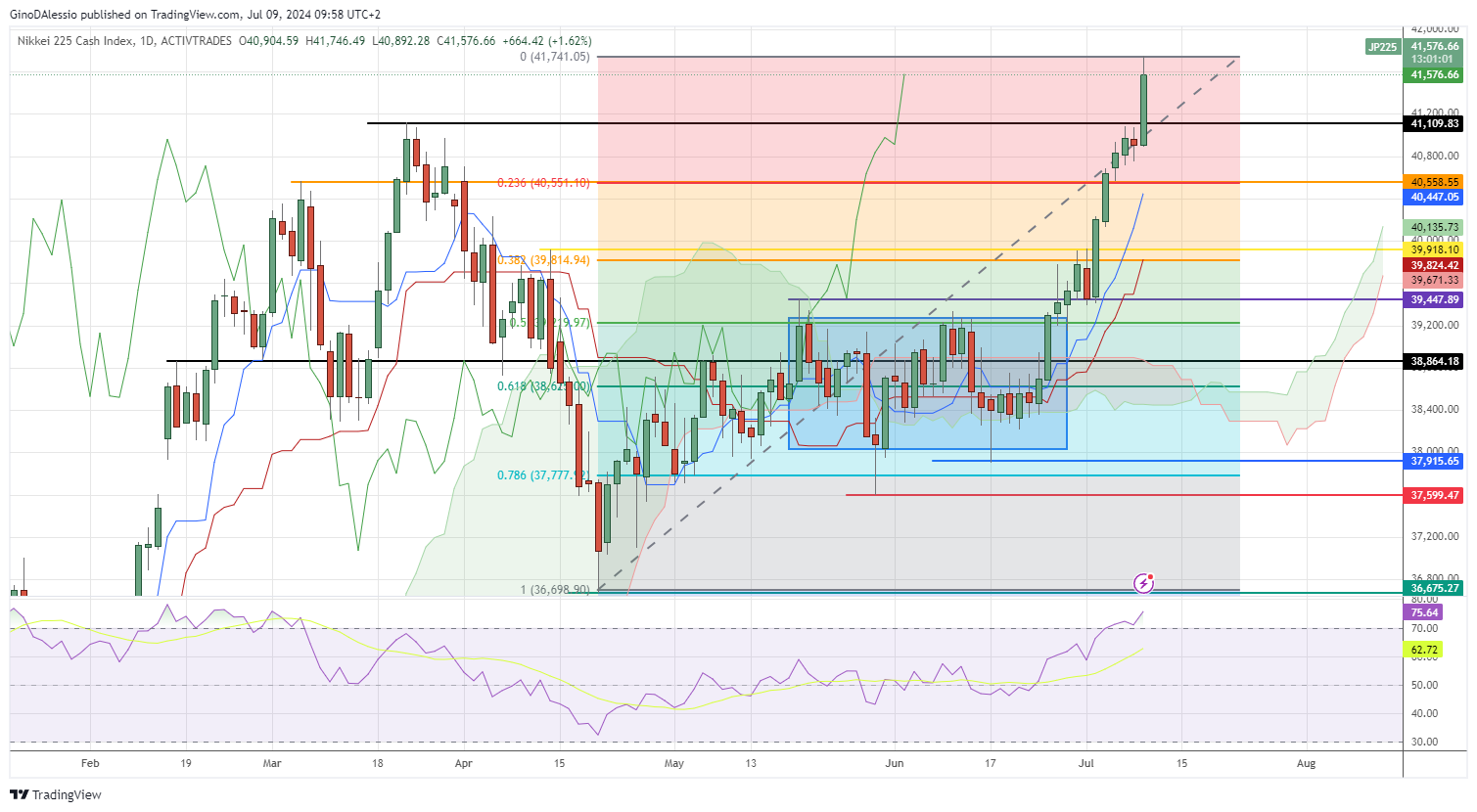

The day chart for the NIKKEI225 below shows a market that is experiencing a bull trend. The trend is in full swing as today’s candle broke through the previous ATH. The RSI is above 70 demonstrating the strength of the move.

As long as the RSI remains above 70 we can expect to see further highs. A dip below 70 would signal a possible correction. If that were to happen the first support would be the previous ATH of 41,109 (black line).

If that breaks, the following support would be at the previous high of 40,558 (orange line). This level of support also coincides with the Fibonacci retracement level of 0.236.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account