USD to AUD Rate Sticks Around 0.65 As China Services Slow

AUD/USD lost more than 2 cents in July, but the AUD to USD rate has been consolidating around 0.65 recently.

AUD/USD lost more than 2 cents in July, but the AUD to USD rate has been consolidating around 0.65 recently. After falling below the crucial 0.66 support area, AUD/USD continued its decline to the next significant level at 0.6480 where it bottomed out. after the weaker-than-expected Australian CPI report.

Since mid-July, AUD/USD has been on a downward trajectory, dropping over 300 pips. However, the decline has recently slowed, with the price consolidating around the significant 0.65 level. The Australian Dollar had found some bids in recent months, mainly due to risk-on sentiment, although a recent risk reversal has occurred.

AUD/USD Chart H4 – Moving Averages Still Acting As Resistance

The AUD received a boost from hawkish expectations for the RBA, driven by persistent inflation figures. However, these aggressive hopes were dampened when the Australian Q2 CPI result came in lower than anticipated. Additionally, the downturn in the Chinese economy this year, coupled with recent negative risk sentiment in stock markets, has weighed on the Australian Dollar. On the four-hour chart, moving averages have been acting as resistance, pushing the highs lower, but there is now some consolidation around the 0.65 level.

AUD/USD Risk Management Perspective

From a risk management standpoint, sellers will find a stronger risk-reward setup near the 0.66 resistance, which aligns with the 38.2% Fibonacci retracement level of the entire decline. Conversely, buyers will be looking for the price to break above this resistance to regain control and enhance their bullish positions, aiming for a new cycle high.

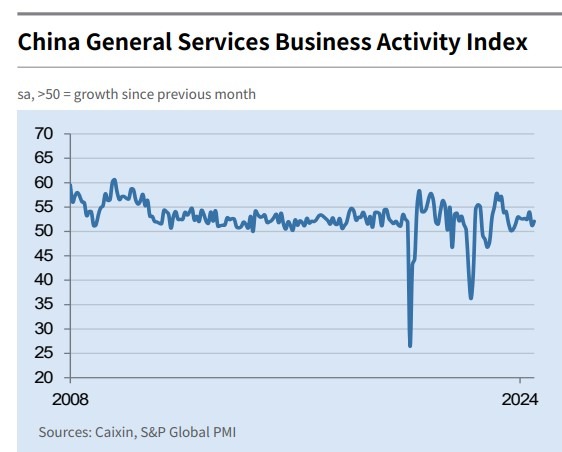

China Caixin Services Report for July

- Services PMI rises to 52.1 in July, surpassing the expected 51.4

- Increased from 51.2 in June

- New business growth accelerates

- Fastest employment growth in nearly a year

- Prices charged remain unchanged despite rising input costs

- Composite PMI dips to 51.2 from 52.8, marking a 9-month low

- Manufacturing sector under more pressure than services

AUD/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account