NZDUSD Returns to 0.60 As RBNZ Gov Orr Sounds Dovish

NZD/USD remains volatile, with the pair dropping by over one cent yesterday after the RBNZ unexpectedly cut rates by 25 basis points.

The NZD/USD exchange rate remains volatile, with the pair dropping by over one cent yesterday after the RBNZ unexpectedly cut rates by 25 basis points. On the daily chart, this decline formed a bearish engulfing candlestick pattern, bringing the price down to 0.60 by the close of the day.

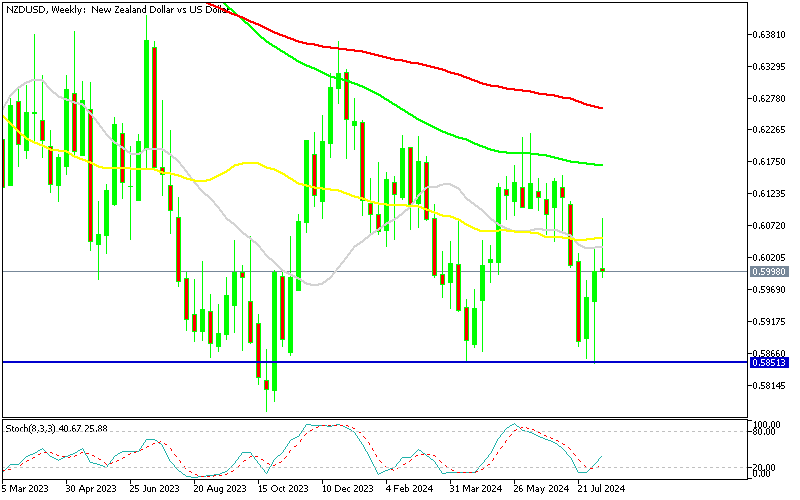

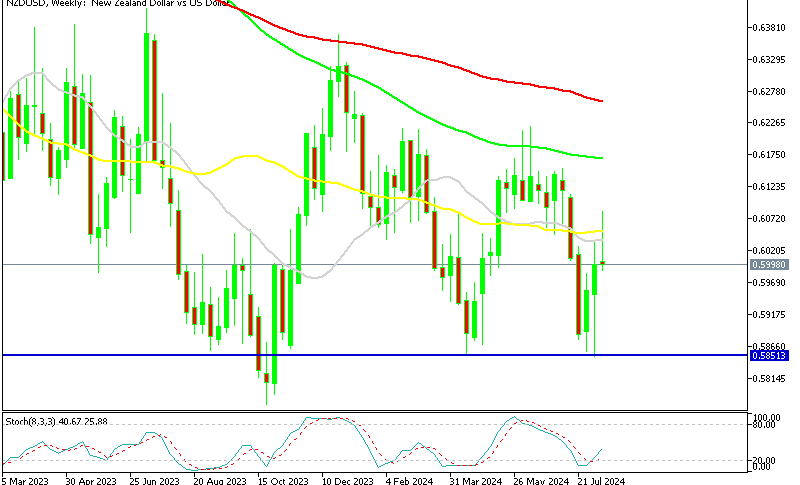

NZD/USD Chart Weekly – The Support at 0.8550 Held Again

On the weekly chart, the pair has been developing a triangle pattern, with the 0.5850 level acting as a support zone since September last year. However, the peaks have been gradually descending as moving averages continue to serve as resistance. This week, the 50-week SMA (yellow) further pushed the price down, signaling a strong bearish trend even as the USD weakens overall. RBNZ Governor Orr’s comments overnight did not offer much optimism for the Kiwi, though the impact on the currency was minimal.

Reserve Bank of New Zealand Governor Orr’s Remarks:

- Trimming monetary policy restraint is appropriate now, with caution advised in adjusting interest rates.

- Price behavior aligns with low inflation, making it suitable to remove monetary policy restraint temporarily.

- Inflation is moving in the right direction, though the current economic environment is weaker than anticipated six months ago.

- The Reserve Bank has strong control over inflation, and there’s no discussion on the committee about raising rates again.

- While the battle with inflation isn’t over, progress is evident.

- If inflation expectations remain well-anchored, some fluctuations can be overlooked.

New Zealand July Retail and Food Price Data:

- Retail sales MoM: -0.1% (improved from -0.7% previously)

- Retail sales YoY: -4.9% (unchanged from the previous -4.9%)

- Food Price Index for July: 0.4% (down from 1.0% previously)

Card spending data covers around 68% of core retail sales in New Zealand.

NZD/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account