Gold Price Forecast: Could Geopolitical Tensions Drive Prices Above $2,800?

Gold fell but is up for the week as investors seek the safe-haven metal amid rising geopolitical tensions. Palladium is up for its best week

Gold fell but is up for the week as investors seek the safe-haven metal amid rising geopolitical tensions.

Palladium is up for its best week in over a month as supply disruptions loom. Here’s a closer look at what’s driving gold and palladium prices this week and the technicals for gold.

Geopolitical Tensions Boost Gold Demand

The geopolitical situation is getting more tense and investors are flocking to gold as a safe-haven. In Gaza, an Israeli airstrike, escalating the situation in the region. US and Israeli negotiators will meet in Doha to talk ceasefire agreements, adding to the uncertainty.

Commodity Market Update

Key price movements:

1. Gold: Up on strong US labor market data.

2. Silver: Steady amid geopolitical tensions, maintaining demand.

3. Crude Oil: Down due to oversupply concerns and China's weak consumption.

4. Natural Gas: Up on forecasts of cooler…— A Rahul Kumar (@RahulKumar_A) October 25, 2024

Meanwhile, the US presidential race is getting closer as the November 5th election approaches. Political volatility makes investors run to gold which is seen as a hedge against uncertainty.

“Gold loves uncertainty and this election is as unpredictable as it gets,” said Julia Khandoshko, CEO at European broker Mind Money. Khandoshko also said gold could reach $2,800 in the next 3 months and $3,000 in the long term as the markets remain unstable.

Palladium fell 0.4% to $1,152.50 but up 7% for the week, its best week in over a month. The metal is up as the US is asking its Group of Seven allies to consider sanctions on Russian palladium and titanium exports. Russia’s Nornickel is the world’s largest producer of palladium and any disruption in Russia’s output will add to the price.

Events Driving Market Sentiment

Several economic events have influenced market movements this week, including:

-

U.S. Unemployment Claims: Released at 227K, slightly lower than the 243K forecast.

-

Flash Manufacturing PMI: Posted at 47.8, beating expectations of 47.5.

-

Flash Services PMI: Came in at 55.3, surpassing the 55.0 estimate.

-

New Home Sales: Surged to 738K, significantly above the 719K forecast.

Today investors will be watching Core Durable Goods Orders (-0.1%) and Durable Goods Orders (-1.1%) and the University of Michigan’s Revised Consumer Sentiment 69.2 vs 68.9 previous.

Gold surged above $2,730 on October 24th, 2024, as safe-haven demand grows amid geopolitical tensions and economic uncertainty. #Gold #Markets #October24th2024 pic.twitter.com/KQICG7FCBb

— Russell Calkins (@RUSSELLCALKINS) October 24, 2024

Palladium Set to Rise Further

Palladium’s strong week is all about geopolitics and the possibility of sanctions on Russian exports. Daniel Hynes, senior commodity strategist at ANZ, said “Disruption to Russian supply comes at a time when the rest of the market is struggling to produce. This will add to palladium prices.”

Analysts think if sanctions are extended it will cause severe supply constraints in the palladium market and prices will go even higher in the coming months. As global automakers use more and more palladium in catalytic converters in vehicles, the supply crunch will impact the entire automotive sector.

Gold Price Forecast: Technical Outlook

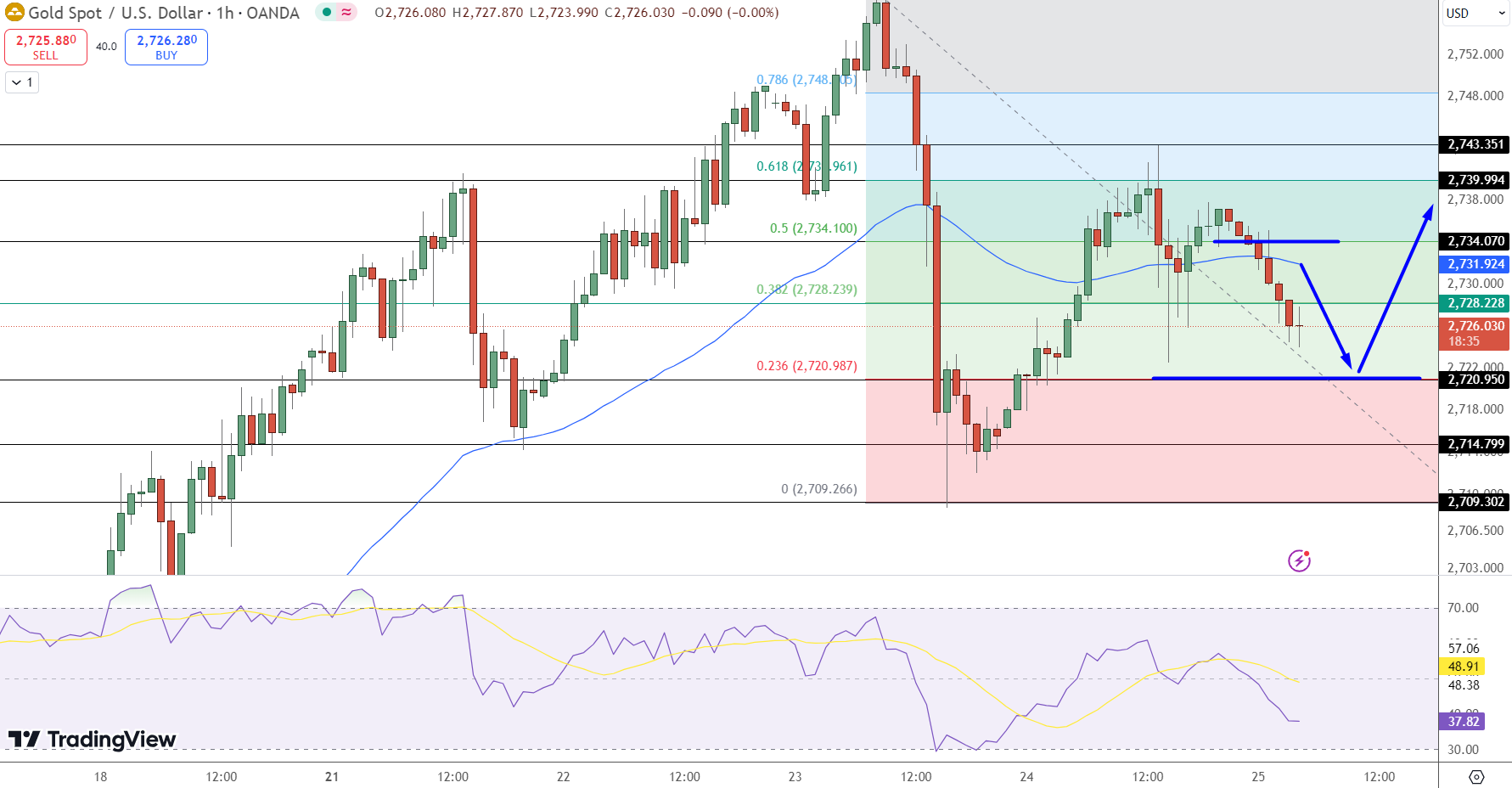

As of Friday gold (XAU/USD) is at $2,726 below the key 38.2% Fibonacci level of $2,728. This level was support before but a break below it could mean more downside. If selling intensifies gold could drop to the immediate support at $2,720 then $2,715 and $2,710.

On the upside the 50-day Exponential Moving Average (EMA) at $2,731.92 is acting as short term resistance which is also the 50% Fibonacci level at $2,734. A break above these levels could see a bounce with resistance at $2,739 and $2,743. But the bearish momentum is strong with the RSI at 37.82 which means more downside.

In summary, gold will be influenced by the current geopolitics and upcoming data in the short term. Watch the levels and global events as gold is a safe haven in this messy world.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account