UK Services Helping GBPUSD Recover but Mfg. Falls Further in Contraction

GBP/USD failed to hold gains above 1.28 and reversed lower, falling 2 cents and resuming the downtrend after the decline in the UK GDP.

GBP/USD failed to hold gains above 1.28 last week and reversed lower, falling 2 cents and resuming the downtrend after the decline in the UK GDP report for October, confirming the difficulty in the UK economy.

The UK GDP report for October 2024, released by the ONS, reveals weaker-than-expected economic performance across key sectors. Monthly GDP contracted by -0.1%, missing the forecasted growth of +0.1% and matching the previous month’s decline. Services output stagnated at 0.0%, falling short of the modest growth anticipated. Industrial production and manufacturing output both declined significantly by -0.6%, underperforming market expectations of +0.3% and +0.2%, respectively.

Construction output also fell by -0.4%, reversing the previous month’s slight gain and missing the projected +0.3% growth. This disappointing data indicates ongoing challenges in the UK economy, with sluggish activity in major sectors potentially signaling a broader economic slowdown. These conditions increase the pressure on BOE policymakers to continue cutting interest rates as they assess the outlook for monetary adjustments, however the Bank of England is not expected to cut rates this week.

GBP/USD Chart Daily – The 200 SMA Rejected Buyers

The GBP/USD faced resistance near the 1.28 level, where the 200-day moving average acted as a barrier. This pause in buying momentum led to the formation of doji candlesticks on the daily chart, signaling potential indecision. Sellers capitalized on this setup last week, driving the pair down by 2 cents, as the bearish reversal took hold. The decline was further fueled by stronger-than-expected US CPI and PPI inflation data, which supported the dollar.

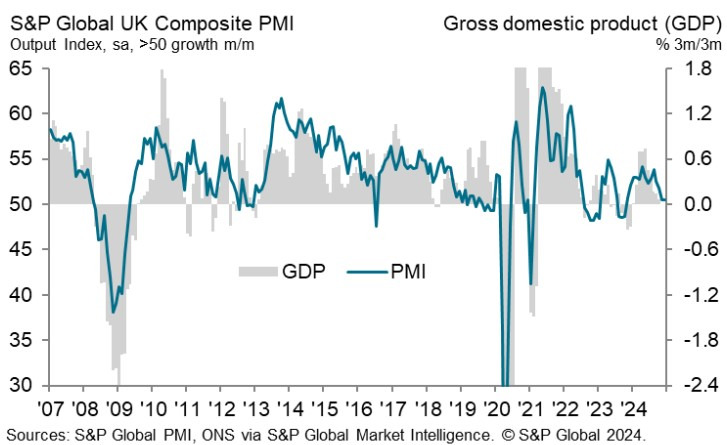

UK Services and Manufacturing PMI for December![UK Composite PMI]()

- Services PMI:

- Actual: 51.4 points (2-month high)

- Expected: 51.0 points

- Previous: 50.8 points

- Manufacturing PMI:

- Actual: 47.3 points (11-month low)

- Expected: 48.2 points

- Previous: 48.0 points

- Composite PMI:

- Actual: 50.5 points (unchanged from November)

- Expected: 50.7 points

Key Insights:

- Services: Business activity improved to a 2-month high, suggesting modest resilience in the sector.

- Manufacturing: Output dropped to 45.7 points, marking an 11-month low, reflecting continued struggles in the sector.

- Overall Economy: The Composite PMI indicates flat growth, highlighting a divergence between modest service sector gains and manufacturing weakness.

GBP/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account