Forex Signals Brief Dec 20: Brace for Thin Liquidity and Strange Price Action in Holiday Markets

Last week was all about the FOMC meeting led to some heightened volatility, while this week the volatility might come from thin liquidity.

Last week was all about the FOMC meeting led to some heightened volatility, while this week the volatility might come from thin liquidity in financial markets.

Last week started with a batch of economic data from China, which showed that the Chinese consumer is weakening further as retail sales slowed once again. That kept commodity dollars bearish, with the AUD, NZD and CAD falling to new lows for the last two years. The flash services from Europe showed an improvement, jumping above contraction, however, manufacturing activity dived further in recession.

UK CPI consumer inflation jumped which gave the GBP a lift, while the Eurozone inflation ticked lower in November, keeping the ECB rhetoric dovish. The outcome of the FOMC meeting on Wednesday was as expected, with the FED lowering interest rates by 25 basis points to 4.50%, but sending hawkish regarding monetary policy easing in 025, with Powell highlighting sticky inflation. However, the PCE inflation report on Friday was soft, sending the USD 1 cent lower as the odds of FED cut for 2025 increased again.

This Week’s Market Expectations

The Christmas period falls at midweek, so from tomorrow the liquidity will be this, with most markets being closed. We might see some spikes in different assets as a result, so be careful with leverage. Today the main event will be the GDP report from Canada.

Main Forex Events for the Upcoming Week:

Monday:

- UK Final GDP for Q3:

- Provides a comprehensive view of the UK’s economic performance in the third quarter.

- Any revisions could impact GBP movements, particularly amid ongoing discussions around the UK’s economic recovery.

- Canada October GDP (m/m):

- Monthly GDP data will give insights into the strength of Canada’s economy.

- A deviation from expectations could influence CAD sentiment.

- US CB Consumer Confidence:

- A key measure of consumer sentiment in the US.

- Market participants will watch for indications of future consumer spending trends.

Tuesday:

- RBA Monetary Policy Meeting Minutes:

- Offers insights into the Reserve Bank of Australia’s policy stance and deliberations.

- AUD volatility is expected, especially if there are hints about future interest rate moves.

- US Durable Goods Orders (m/m):

- Tracks changes in new orders for long-lasting goods.

- A critical indicator of manufacturing health and broader economic activity in the US.

- US New Home Sales:

- Reflects the state of the US housing market, a key driver of economic growth.

- Any weakness could weigh on USD sentiment.

Wednesday:

- BOJ Governor Ueda Speaks:

- Governor Ueda’s comments could provide clarity on the Bank of Japan’s policy direction.

- Traders will look for insights into potential adjustments to Japan’s ultra-loose monetary policy.

- European and US Markets Closed:

- Markets in Europe and the US will remain closed for Christmas Day, leading to thin trading volumes.

Thursday:

- European and US Markets Closed:

- A second day of closures for Christmas will keep trading subdued.

- US Unemployment Claims:

- A weekly snapshot of the US labor market.

- Continued signs of resilience or weakness could influence expectations for Federal Reserve policy.

- Crude Oil Inventories:

- Provides a view of US crude stockpiles.

- A significant change could impact oil prices and currencies linked to energy markets, such as CAD and NOK.

Friday:

- Tokyo Core CPI (y/y):

- A key inflation measure for Japan.

- Markets will watch for signs of inflationary pressure that could prompt BOJ policy adjustments.

- Japan Retail Sales (y/y):

- Tracks changes in retail spending, a key driver of domestic economic activity.

- A strong reading could support JPY sentiment, while a weak figure might weigh on it.

Last week the volatility was high, with markets being long on the USD in the first half of the week, which the FED confirmed with the hawkish cut. But then reversed lower after the soft US PCE inflation numbers on Friday. We opened 29 trading signals last week, ending it with 21 winning forex signals and 8 losing ones.

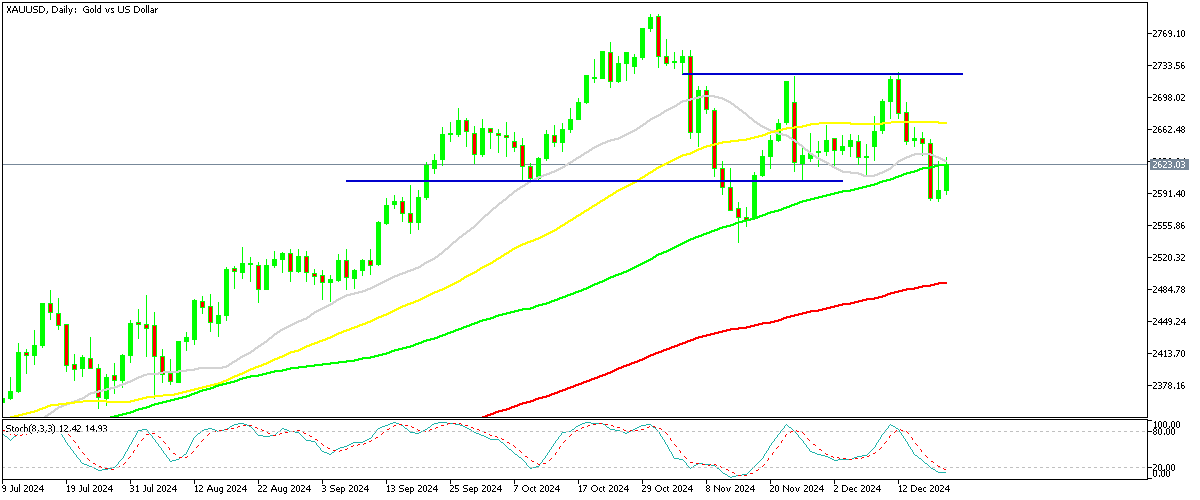

Gold Testing the 100 Daily SMA From Below This Time

Gold and cryptocurrency markets have experienced significant volatility, largely driven by changing monetary policy expectations. Gold prices fell $100 last week after failing to break through the $2,725 resistance level, with strong U.S. services PMI data and anticipated Federal Reserve rate cuts adding to the downward pressure. Prices dropped below the 100 SMA (green), which turned into resistance, and found support near $2,633, close to the 20-day SMA (gray). These movements have confirmed bearish momentum in the gold market.

XAU/USD – Daily Chart

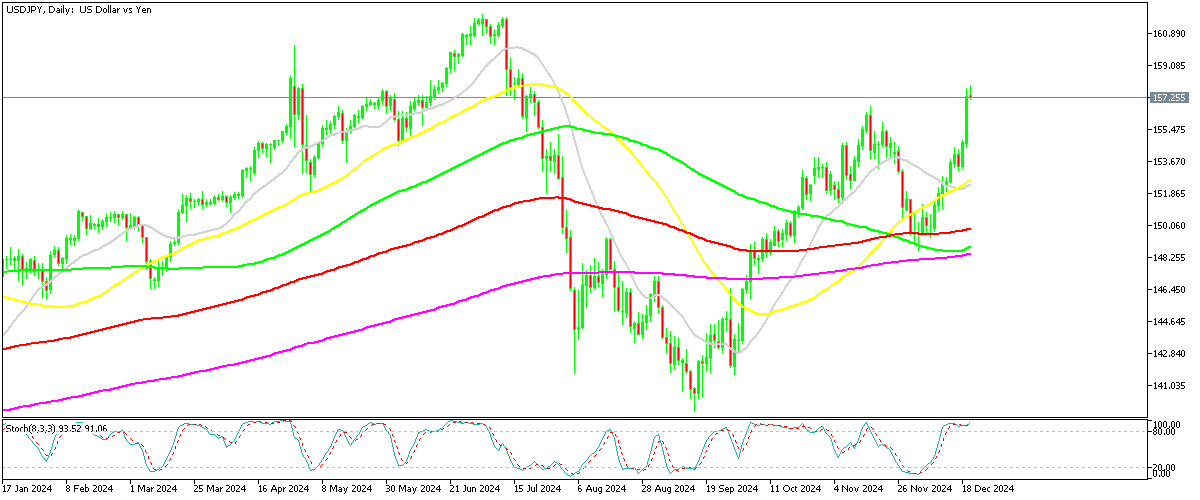

USD/JPY Remains Supported by MAs

The USD/JPY has shown a strong recovery from its bearish phase after a notable summer decline that pushed its value below 140. Buyers have regained control, steadily driving the pair toward the 160 level. However, late November brought another steep setback, with the pair dropping 7 cents and slipping below the critical 150 mark. This decline followed a robust two-month rally where USD/JPY climbed approximately 17 cents. In December, the pair found solid support near key moving averages, allowing buyers to reenter the market. So far, it has regained about 9 cents this month, highlighting renewed bullish momentum. The Federal Reserve’s hawkish 25 basis point rate cut initially caused a brief market pause, as traders looked for signals of a potential rate hike from the Bank of Japan. When no such signals emerged, the bullish trend resumed, propelling USD/JPY to approach the 158 level.

USD/JPY – Daily Chart

Cryptocurrency Update

Bitcoin StaysBelow $100K

In the cryptocurrency space, Bitcoin saw a sharp rise earlier this week, climbing above $108,000 before starting to decline ahead of the FOMC’s decision. Following the Federal Reserve’s aggressive 25 basis-point rate cut, Bitcoin fell dramatically, dropping from $102,500 to $100,000 within hours. A key level to watch remains $98,677, a previous low during the Asian session that briefly prompted a rebound before sellers pushed the price further down to $95,000.

BTC/USD – Daily chart

Ethereum Heads Toward $3,000

Ethereum also faced instability, recovering from a dip below $3,000 to trade near $4,000 earlier in the week. However, after Monday’s rally, Ethereum struggled to maintain gains above $4,000, with the decline accelerating yesterday as prices fell below $3,500. Both gold and cryptocurrency markets reflect persistent volatility and market uncertainty.

ETH/USD – Daily chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account