Litecoin ETF Gains Momentum as SEC Opens Public Comment Period

The U.S. Securities and Exchange Commission (SEC) has moved one step closer to approving the first ever Litecoin ETF.

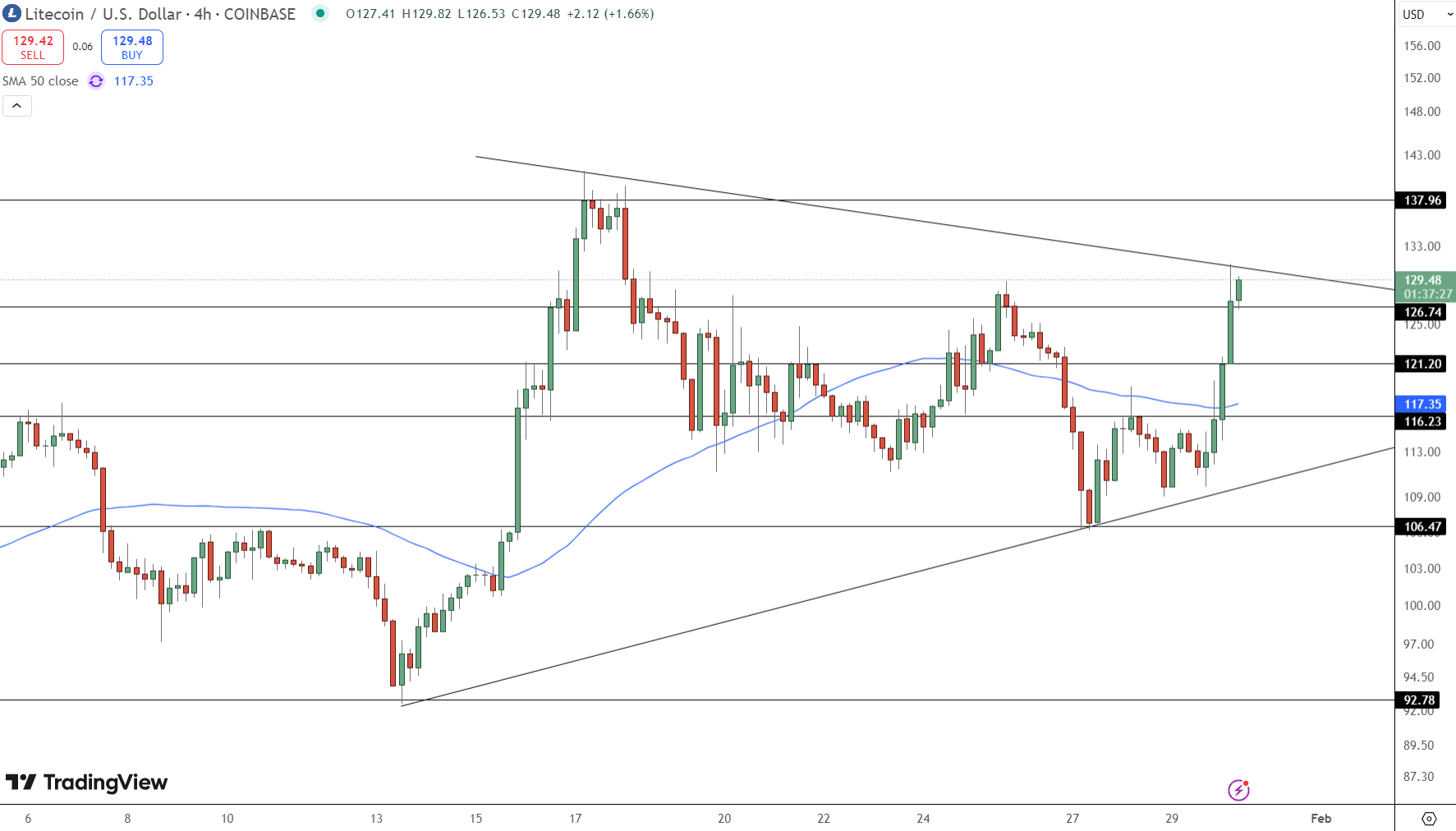

Live LTC/USD Chart

The U.S. Securities and Exchange Commission (SEC) has moved one step closer to approving the first ever Litecoin ETF.

The agency has accepted Nasdaq’s 19b-4 filing for the Canary Litecoin ETF and is now opening up a 21 day comment period. This is a big deal for ETFs and could impact Litecoin’s price.

SEC Acknowledges Canary Litecoin ETF Filing

The SEC’s approval of Nasdaq’s 19b-4 filing is a big deal. This is the first step in getting a Litecoin ETF to market. Now the agency is taking comments for 21 days. Investors, market participants and stakeholders can weigh in.

Bloomberg ETF analyst Eric Balchunas said this is the first altcoin ETF to get this far. “This is the most developed in terms of checking all the boxes,” Balchunas said. The SEC opening up a comment period means they are willing to engage with the crypto community and could lead to future approvals.

Regulatory Process and Market Expectations

The 19b-4 is just the first step in a 2 step process. After the initial review the SEC will look at market structure, investor protection and legal compliance. Analysts are watching to see if the SEC will take the full 240 days or act faster.

Changes in SEC leadership, including Acting Chair Mark Uyeda and Commissioner Hester Peirce being on a crypto task force, means a change in approach. This could be a more favorable environment for crypto ETFs than past administrations.

Growing Interest in Crypto ETFs

Canary is not the only one going after a Litecoin ETF. Grayscale and CoinShares have also filed. Grayscale is converting its existing Litecoin Trust into an ETF and CoinShares has filed an S-1 for a separate offering. This means asset managers are getting more confident the SEC will approve more crypto ETFs.

The Cboe has also filed 19b-4s for Solana ETFs from VanEck, Canary, Bitwise and 21Shares. Bitwise even filed a Dogecoin ETF. This is getting wider and wider.

Litecoin Price Surges Amid ETF Optimism

The news is already moving the market. At the time of this writing Litecoin is at $116.60, up 4.58% in the last 24 hours. Volume and open interest are up too.

Technical analysis says Litecoin is about to break out. It’s breaking out of a falling wedge and the RSI is at 53.52 and rising. The MACD is also bullish.

Key Takeaways:

-

Public Comment Period: SEC opens 21-day window for feedback on Canary Litecoin ETF.

-

Regulatory Shift: Changes in SEC leadership may favor crypto ETF approvals.

-

Market Momentum: Litecoin price surges 4.58% amid ETF optimism.

-

Broader Interest: Grayscale and CoinShares also seek Litecoin ETF approval.

This is big for the crypto space. As the regulatory environment changes the approval of a Litecoin ETF could open up more opportunities for investors and bring digital assets into the mainstream.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account