Silver Climbs 1.4% to $33 as Juanicipio Deal and Tensions Fuel Rally

Silver (XAG/USD) is rallying above $33, gaining more than 1.4% intraday, bolstered by bullish sentiment surrounding corporate consolidation.

Quick overview

- Silver (XAG/USD) is experiencing a rally above $33, driven by positive sentiment from corporate consolidation and geopolitical tensions.

- Pan American Silver's acquisition of MAG Silver's stake in the Juanicipio mine enhances its production portfolio with a high-grade silver asset.

- Despite the gains, silver's upward momentum may be limited by a stronger US dollar and easing global anxiety following progress in US-China trade talks.

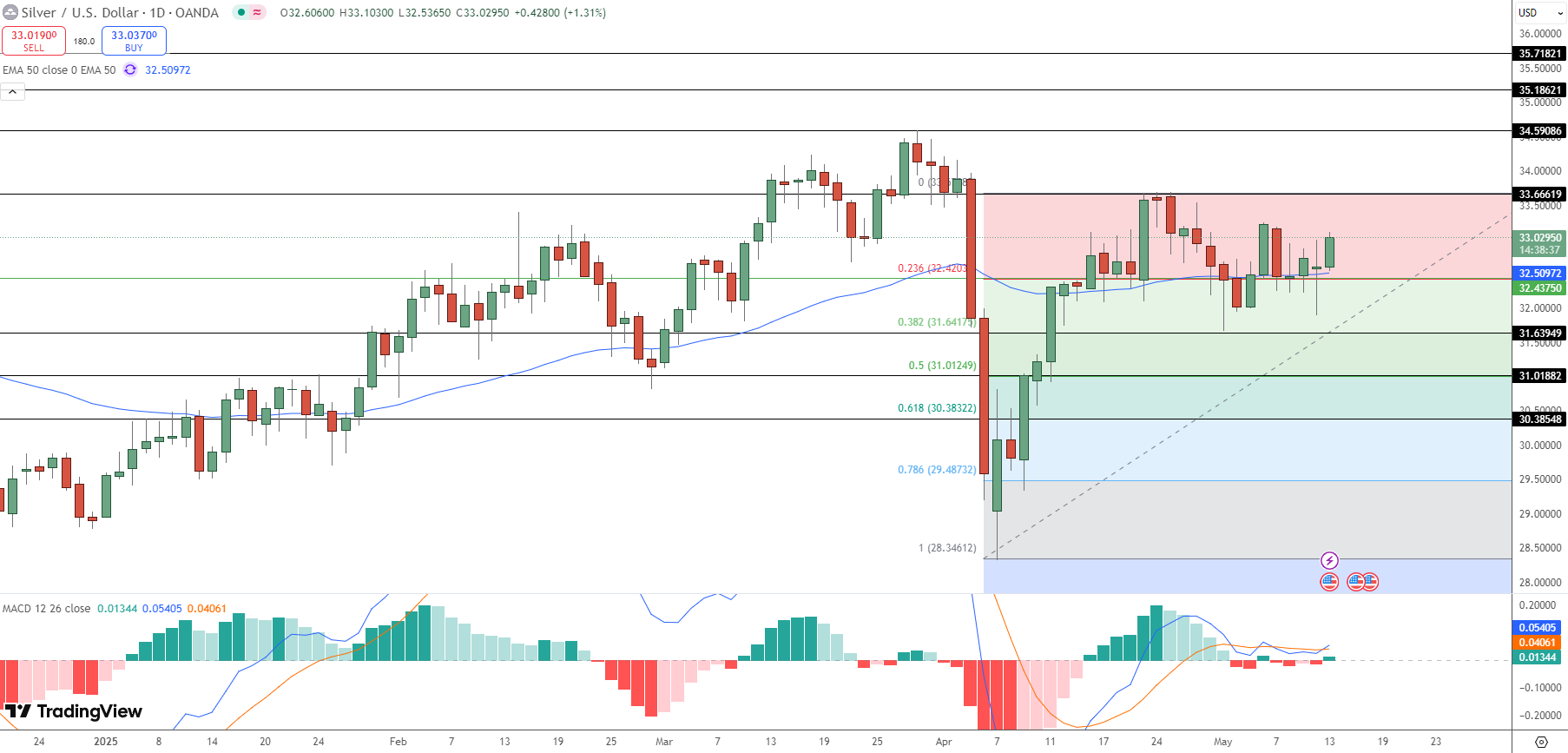

- Technical indicators suggest that silver bulls are targeting resistance levels at $33.66 and $34.59, while maintaining support above the 50-day EMA.

Silver (XAG/USD) is rallying above $33, gaining more than 1.4% intraday, bolstered by bullish sentiment surrounding corporate consolidation and rising geopolitical tensions.

Silver (XAG/USD) is up 1.4% today above $33, driven by positive sentiment around corporate consolidation and rising geopolitical tensions.

Pan American Silver has agreed to buy MAG Silver’s 44% stake in the Juanicipio silver mine in Mexico, co-owned with Fresnillo (56%). This strategic acquisition adds to Pan American’s production portfolio by giving them access to one of the highest grade silver mines in the region. The deal was approved unanimously by both companies and is expected to close in 2H 2025.

Meanwhile, tensions between India and Pakistan over ceasefire and Russia-Ukraine standoff have added to safe-haven demand for precious metals. Ukraine’s proposed ceasefire was rejected by Moscow, who instead demanded unconditional negotiations, adding to the uncertainty and silver’s safe-haven status.

Trade Optimism and Fed Comments Cap Silver’s Gains

Despite the move up, silver’s gains could be capped by easing global anxiety and a stronger US dollar. Progress in US-China trade talks over the weekend has reduced some of the risk aversion. Beijing has agreed to formal trade talks and Washington said “significant progress” was made.

Also, Fed Chair Jerome Powell’s comments last week that the Fed is cautious on inflation and labor market has tempered the appeal of non-yielding assets like silver in the short term. Powell ruled out cutting rates to offset economic impact of tariffs. The Fed’s hawkish tone could slow down silver in the near term.

Silver Technical Setup: Bulls Target $33.66 and $34.59

Silver is trying to break above short term resistance, supported by a bounce from the 50 day EMA at $32.50 – a level that’s also the 23.6% Fib. The MACD histogram is printing green bars again.

Trade Setup:

-

Buy Entry: $32.60-$32.80 (near EMA + Fib support)

-

Target 1: $33.66 (key resistance zone)

-

Target 2: $34.59 (next breakout level)

-

Stop Loss: Below $32.40Above $33.10 today. If above $33.66, bullish. Below $32.50, silver down to $31.63.

Bullish as long as price holds 50 day EMA. But be careful.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account