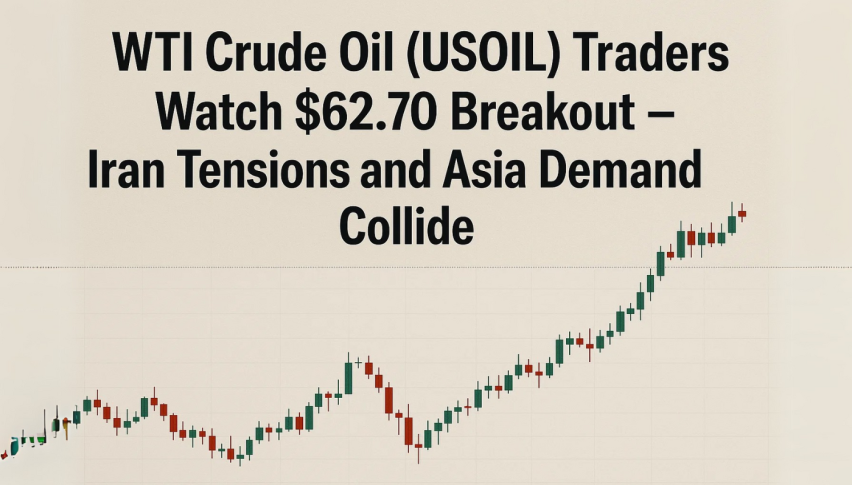

WTI Crude Oil (USOIL) Traders Watch $62.70 Breakout – Iran Tensions and Asia Demand Collide

Oil prices were flat on Tuesday with WTI crude holding at $61.84 as geopolitical and macro forces pulled in opposite directions.

Quick overview

- Oil prices remained stable at $61.84 amid conflicting geopolitical and macroeconomic factors.

- Stalled US-Iran nuclear talks have raised concerns about oil supply, with potential exports of 300,000 to 400,000 bpd at stake.

- Physical demand in Asia is supporting prices, driven by strong refining margins as maintenance season ends.

- China's economic slowdown and the recent downgrade of the US sovereign rating are creating bearish sentiment in the oil market.

Oil prices were flat on Tuesday with WTI crude holding at $61.84 as geopolitical and macro forces pulled in opposite directions. The latest impasse in US-Iran nuclear talks has cast doubt on any near term relief in oil supply. Iranian Deputy Foreign Minister Majid Takht-Ravanchi said talks would stall if the US demanded a full halt to uranium enrichment – a condition Washington reiterated over the weekend.

A deal could have unlocked 300,000 to 400,000 bpd of Iranian oil exports according to StoneX analyst Alex Hodes. Without a deal supply is tight and geopolitical risk is back on the radar. But market reaction has been muted with traders now wary of headline driven volatility and waiting for clearer signals.

Asia’s Physical Demand Lifts Floor on Prices

Iranian output is capped but physical demand in Asia is providing some support. Strong refining margins are driving near term buying especially as maintenance season winds down.

Key regional indicators:

-

Singapore complex refining margins averaged over $6/bbl in May

-

Up from $4.4/bbl in April, per LSEG data

-

Asia buying is picking up pace despite slow start

Neil Crosby, analyst at Sparta Commodities, said the rebound in margins and refinery operations should underpin spot demand for now even if broader risk sentiment remains cautious.

China’s Slowing Growth and US Debt Weigh on Sentiment

Not all demand signals are bullish. China – the world’s largest oil importer – showed signs of macroeconomic slowdown with retail sales and industrial output missing expectations. Analysts at BMI forecast oil consumption in China could decline by 0.3% in 2025 as demand weakens across all fuel categories.

On top of that is Moody’s recent downgrade of the US sovereign rating to “Aa1” reflecting fiscal concerns over the $36 trillion national debt. The downgrade is casting a shadow over global risk appetite and questions over long term energy demand in the world’s largest economy.

WTI Crude Oil Technical View: Price Coils in Symmetrical Triangle

From a technical perspective WTI crude (XTI/USD) is about to breakout from a symmetrical triangle. Price is boxed between ascending support and descending resistance with the 50-EMA ($61.81) as the pivot. MACD is neutral but any move above $62.70 could see $63.81 and $64.66. Below $60.96 could see $60.09 and $59.20.

Quick Setup:

-

Resistance: $62.70

-

Support: $60.96

-

Breakout targets: $63.81 / $64.66

-

Breakdown targets: $60.09 / $59.20

Be on high alert – when price breaks out of this coil the move will be fast and directional.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account