U.S. Deficit Fears Cause Stock Market to Dip

The U.S budget bill has been approved by the House of Representatives but still faces a battle at the Senate.

Quick overview

- Budget bill negotiations in the U.S. are raising concerns about a potential $2.3 trillion increase in the deficit over the next decade.

- The stock market has reacted negatively, with major indices like the Dow Jones, Nasdaq, and S&P 500 all experiencing declines.

- The House passed the budget bill narrowly, and it now moves to the Senate, where its fate remains uncertain.

- Investors should brace for continued market volatility as fears of rising Treasury yields and inflation persist.

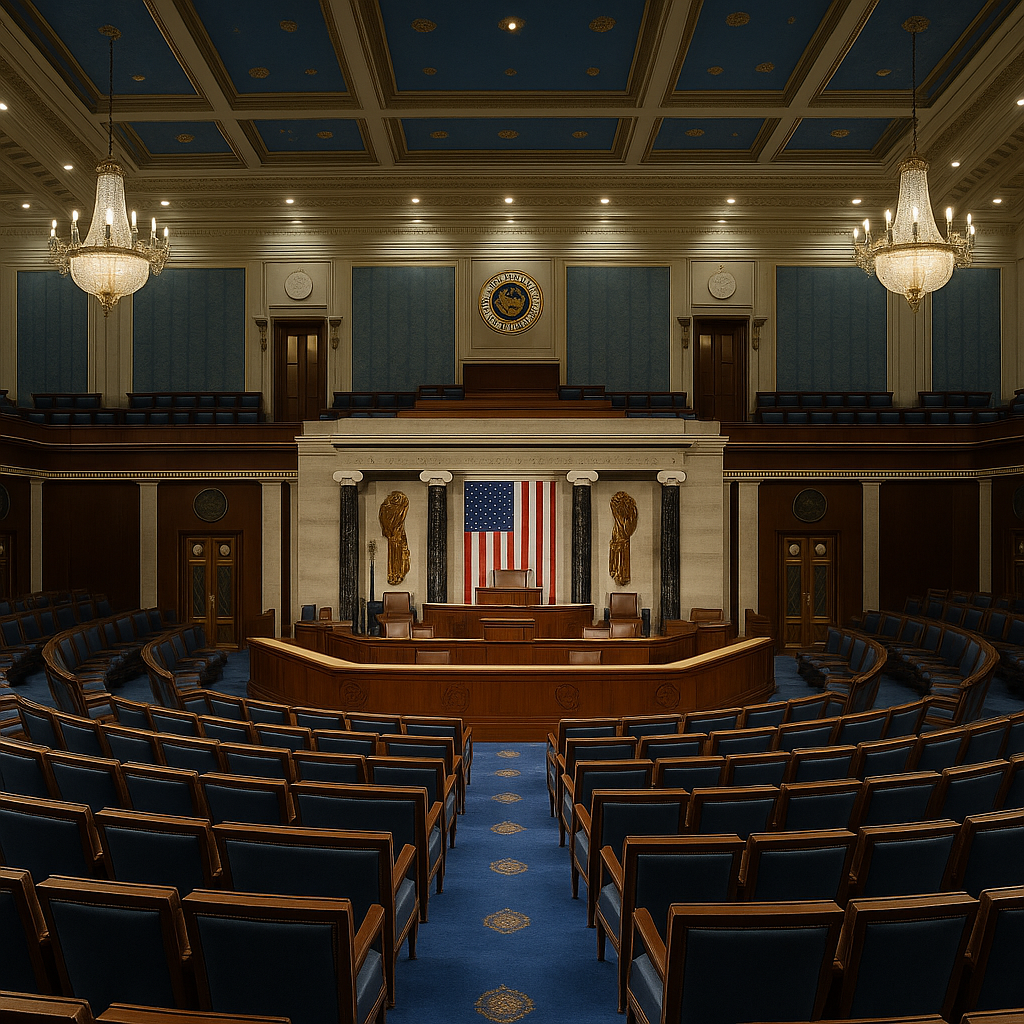

Budget bill negotiations on Capitol Hill are causing widespread fear about the United States’ deficit, leading to stock market decline across all three major indices.

The U.S government is debating about a far-reaching budget bill that the Congressional Budget Office says would add about $2.3 trillion to the already high U.S. deficit within 10 years. As a result, the stock market is dropping, with the Dow Jones losing 1.91%, and the Nasdaq Composite down 1.41%. The S&P 500 fell by 1.61% on Wednesday too, quickly eliminating this week’s gains.

Stocks felt the pressure from rising Treasury yields, with the 10-year Treasury note at 4.59% and the 30-year Treasury bond yield at 5.09%.

The Budget Bill Goes to the Senate

This is just the start of the budget bill’s path to going into effect or being tabled. The stock market is sure to feel the pressure as the bill progresses.

The House of Representatives agreed to pass the bill, but only by a small margin- 215 for and 214 against. The bill now has to go through the Senate, which can take a while. The bill has an extensive reach, including tax cuts, SALT deduction cap increases, and new Medicaid work requirements.

How the Stock Market Is Likely to Respond

We have already seen some significant movement from the stock market in response to the budget bill overcoming its first hurdle. The decline is likely to continue as deficit fears persist.

The stock indices are high, though, so some backtracking is not going to crash the market, but investors need to be prepared for a rough week with plenty of losses. If the deficit is going to become more of a problem than it already is, then that could mean the devaluing of the U.S. dollar, higher Treasury yields, and increased inflation. As a result, the Federal Reserve may not issue the expected interest rate cuts.

Throughout the day Thursday, we expect the stock market to decline further, while at the same time, the cryptocurrency market is climbing. However, there could be some pullback there, because even though new regulations could open up the stablecoin part of that market, the deficit problem caused by the budget bill could rein investors in.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account