EUR/USD Eyes $1.1488 as ECB Rate Cut and US Jobs Miss Shape Sentiment

EUR/USD is holding steady around $1.1415 in the early European session, recovering from minor intraday losses. Support was found at $1.1403.

Quick overview

- EUR/USD is stable around $1.1415, recovering from minor losses as it awaits the ECB rate decision.

- Markets anticipate a 25bps cut to 2.00%, marking the eighth consecutive cut, with focus on Lagarde's guidance post-decision.

- The US Dollar is weakening due to disappointing jobs and services data, raising concerns about a slowdown in the US economy.

- Technically, EUR/USD is bullish, with a potential breakout above $1.1455 targeting higher levels.

EUR/USD is holding steady around $1.1415 in the early European session, recovering from minor intraday losses. Support was found at $1.1403, but overall direction is still tied to the ECB rate decision later today. Markets expect a 25bps cut to 2.00%, the 8th consecutive cut.

Attention will turn to Lagarde’s press conference after the decision, where traders will be looking for guidance on future easing. She’ll likely be neutral and reiterate the meeting-by-meeting approach. But disinflationary trends in the Eurozone support further easing. Producer prices fell 2.2% in April, accelerating from 1.7% in March and GDP growth is sluggish.

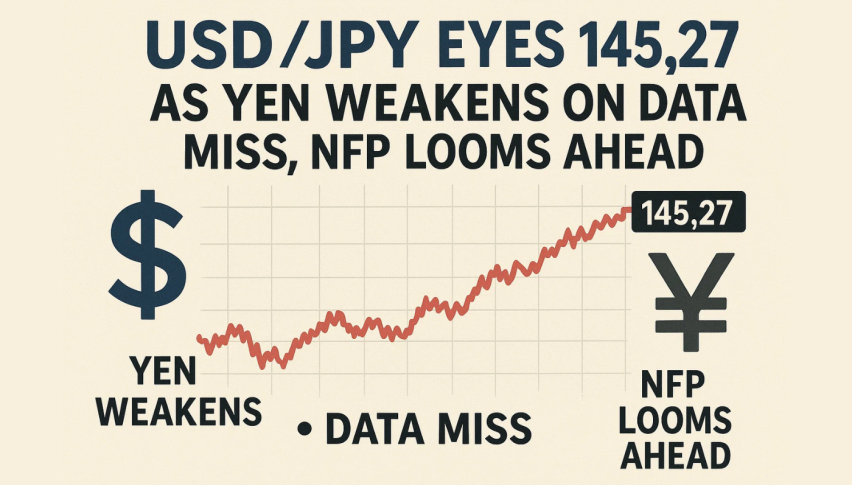

US Dollar Weakens on Bad Jobs and Services Data

The US Dollar is under pressure after a string of poor data. The ISM Services PMI for May fell to 49.9, the first contraction in nearly a year and below expectations. And the ADP Employment Change report showed only 37,000 private-sector jobs added in May, well below the 115,000 forecast.

This has reignited fears of a slowdown in the US economy and weakened the greenback, pushing the US Dollar Index (DXY) lower. And trade tensions are still a headwind. Trump’s comments on the difficulty of getting a deal with China and doubling tariffs on metals have added to the uncertainty.

Technical Outlook: Bulls Target Break Above $1.1455

EUR/USD is bullish on the 2-hour chart, holding trendline support and reclaiming the $1.1403 pivot. The 50-period EMA at $1.1393 is sloping up, adding support to the bullish setup. Higher lows since late May and momentum building.

- MACD histogram is green

- A 2-hour close above $1.1455 could trigger $1.1488 and $1.1520

- Key support at $1.1393; below $1.1365 exposes $1.1324Above $1.1455 and short term up.

- Below $1.1403-$1.1393 and looking for bullish reversal.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account