U.S.-China Trade Talks Calm Crude Oil Market

WTI has risen 4% while Brent surged by 2.1% this week

Quick overview

- Oil prices fell on Friday but are set for their first weekly increase in three weeks due to resumed trade talks between China and the US.

- Brent crude futures dropped to $65.15 a barrel, while West Texas Intermediate fell to $63.17, despite both benchmarks expected to settle higher for the week.

- Trade negotiations between Canada and the US are ongoing, with concerns about tariffs and their impact on the global economy affecting oil market fluctuations.

- Saudi Arabia reduced its July crude prices for Asia, which was less than expected following OPEC+'s agreement to increase output.

Oil prices dropped on Friday but remained on track for their first weekly increase in three weeks after Chinese leader Xi Jinping and President Donald Trump resumed trade talks, bolstered growth prospects, and rising demand in the world’s two largest economies.

Brent crude futures fell 19 cents to $65.15 a barrel, while U.S. West Texas Intermediate dropped 20 cents, or 0.3%, to $63.17 after gaining around 50 cents on Thursday.

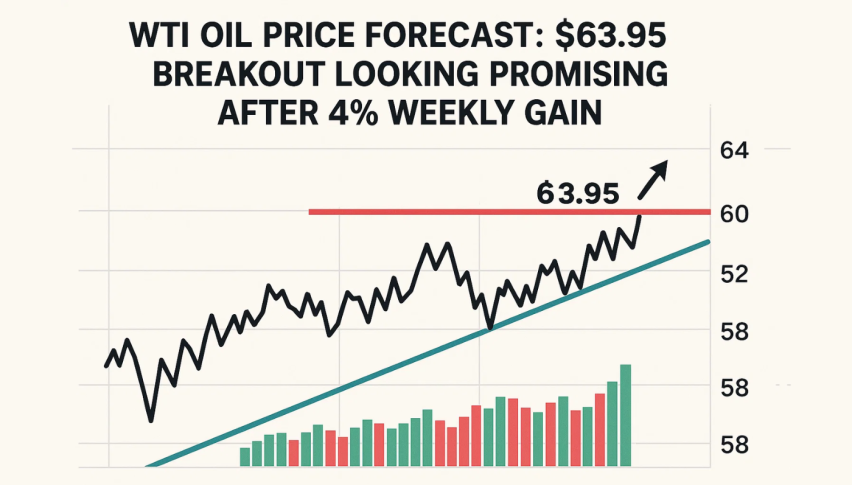

Both benchmarks were expected to settle higher for the week following two weeks of declines. WTI has risen 4% while Brent surged by 2.1% this week

According to China’s official news agency Xinhua, Washington requested that Xi and Trump hold trade talks. The call ended with a “very positive conclusion,” according to Trump, who also stated that the US was “in good shape with China and the trade deal.”

According to Industry Minister Melanie Joly, Canada also continued trade negotiations with the United States, with Prime Minister Mark Carney maintaining direct communication with Trump. News regarding tariff discussions and data showing how trade uncertainty and the impact of US levies affect the global economy caused the oil market to continue fluctuating.

BMI, a Fitch affiliate, noted that the potential for an Israeli strike on Iranian infrastructure and tighter US sanctions in Venezuela to limit crude exports pose upside risks to the hydrocarbon.

Saudi Arabia, the world’s largest exporter, reduced its July crude prices for Asia to levels seen in the past two months.

This price cut was less than expected following OPEC+’s agreement to increase output by 411,000 barrels per day in July.

The Saudi kingdom had been advocating for a more significant increase in output as part of a broader strategy to regain market share and penalize over-producers within OPEC+.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account