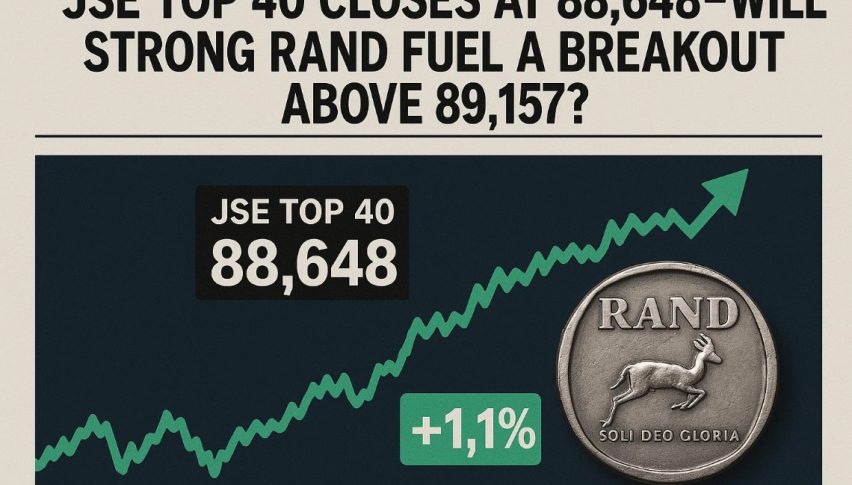

JSE Top 40 Closes at 88,648—Will Strong Rand Fuel a Breakout Above 89,157?

JSE Top 40 closed at 88,648 Friday. With fuel prices dropping and the rand firming, all eyes turn to the 89,157 resistance.

Quick overview

- The JSE Top 40 Index closed at 88,647.7, down 0.07% after a strong rally earlier in the week, but investor confidence remains intact due to improving macroeconomic conditions.

- The South African rand strengthened to R17.7650/$, supported by rising foreign reserves and a weaker U.S. dollar, alongside optimism about the country's fiscal roadmap.

- Projected fuel price cuts in July are expected to provide relief for consumers and businesses, potentially easing inflation and boosting household spending.

- The JSE Top 40 is at a technical crossroads, with the potential for a breakout above 89,157 or a pullback if it falls below 88,050.

The JSE Top 40 Index (SA40) ended Friday’s session at 88,647.7, slipping just 0.07% after a strong early-week rally. The slight dip does little to shake investor confidence, as South Africa’s macroeconomic backdrop continues to improve.

The South African rand strengthened to R17.7650/$, marking its highest level since December 2024. The move followed a South African Reserve Bank report showing net foreign reserves climbed to $64.804 billion in May, up from $64.318 billion in April.

Key factors supporting the rand’s advance:

-

A weaker U.S. dollar driven by global rate uncertainty

-

Market optimism around South Africa’s fiscal roadmap

-

Rising demand for emerging market assets amid risk-on sentiment

Though South Africa’s 2035 government bond yields rose modestly by 2 basis points to 10.07%, analysts noted that broader sentiment remains constructive. The reduced political risk tied to the Government of National Unity (GNU) and forthcoming national budget vote is also helping reduce the country’s risk premium.

Fuel Price Cuts Offer Mid-Year Relief

Fresh estimates from the Central Energy Fund (CEF) point to substantial fuel price reductions in July—welcome news for consumers and businesses alike. With global oil prices stable and the rand-dollar exchange rate holding firm, relief at the pump seems likely.

Projected July fuel price cuts:

-

Petrol 93: ↓ 30 cents/litre

-

Petrol 95: ↓ 28 cents/litre

-

Diesel 0.05%: ↓ 47 cents/litre

-

Diesel 0.005%: ↓ 45 cents/litre

-

Paraffin: ↓ 57 cents/litre

Lower fuel costs could help ease inflation and bolster household spending, improving conditions for retailers and logistics-heavy sectors listed on the JSE Top 40.

SA40 Holds Trend—Breakout or Pullback Next?

Technically, the JSE Top 40 Index continues to trend inside a bullish ascending channel, with Friday’s close holding just above channel support at 88,518. The 50-period EMA, sitting at 87,379.7, has provided consistent dynamic support throughout the uptrend.

However, momentum is showing early signs of fatigue. The MACD histogram is flattening, and a bearish crossover appears near, suggesting a potential cooling in the short term.

Key technical levels

-

Resistance: 89,157 (breakout level), 89,583, and 90,019

-

Support: 88,518 (trendline), 88,050, then 87,622

Outlook for Next Week:

-

If bulls push the index above 89,157 with volume, a rally toward the psychological 90,000 is in play.

-

A break below 88,050 would challenge the current structure and could trigger a retest of 87,168 support.

Conclusion

The JSE Top 40 is at a technical crossroads. Improved macro indicators—such as a firming rand, political clarity, and easing fuel prices—support further upside. But short-term momentum needs to align with the broader optimism.

For now, the path of least resistance favors continued consolidation with a bullish bias heading into next week.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account