WTI Crude Price Forecast: Bulls Target $66.73 After Surprise Inventory Drop

WTI crude oil futures fell below $65 this week as the U.S. Energy Information Administration (EIA) released new projections.

Quick overview

- WTI crude oil futures dropped below $65 following the EIA's revised forecast for increased global oil inventory builds.

- The EIA anticipates supply will outpace demand next year, contributing to bearish sentiment among traders.

- A surprise draw of 370,000 barrels in U.S. crude inventories provided short-term relief for bullish traders.

- Progress in U.S.-China trade talks has created cautious optimism, helping WTI stabilize around $65.

WTI crude oil futures fell below $65 this week as the U.S. Energy Information Administration (EIA) released new projections. In its June Short-Term Energy Outlook, the agency increased its forecast for global oil inventory builds to 0.8 million barrels per day (bpd) in 2025, up from 0.4 million bpd in last month’s report.

The revised forecast is due to slower demand growth and higher global production, with the EIA expecting supply to outpace consumption next year. This supply-demand imbalance has bearish sentiment among traders, despite near-term support holding for now.

But not all was bad. The American Petroleum Institute (API) reported a surprise 370,000 barrel draw in U.S. crude inventories last week, beating expectations for a 700,000 barrel build. This was a short-term relief for bulls looking for signs of tightening.

Trade Optimism Boosts Oil Rebound

Adding to the cautious optimism is progress in U.S.-China trade talks. Officials said both sides have reached a preliminary agreement to revive their Geneva consensus—a move that should boost global demand sentiment and ease concerns around slowing energy consumption.

This geopolitical backdrop helped WTI stabilize around $65, creating a launchpad for technical traders to get long. The rebound coincides with broader risk-on flows across commodities and equities.

What’s supporting the bounce:

- API 0.37M barrel draw

- U.S.-China trade deal progress

- Near-term oil demand outlook improving

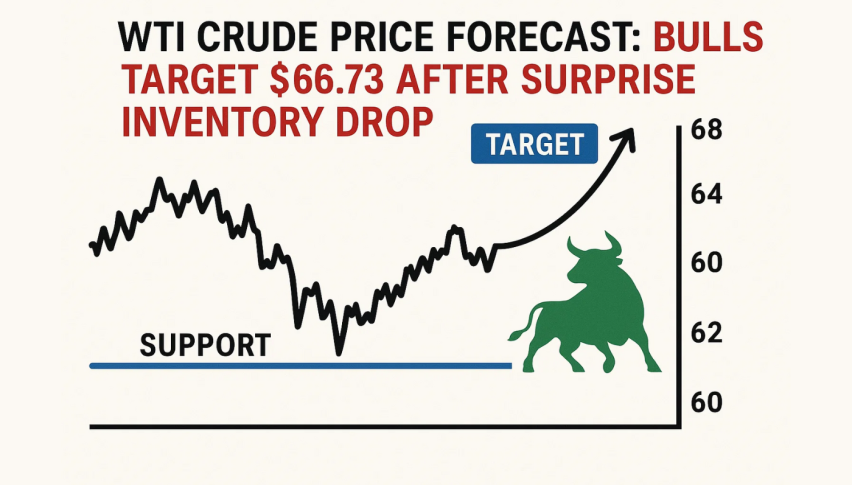

WTI (USOIL) Technical Setup: Bulls Eye $66.73

WTI (USOIL) is in a bullish ascending channel, bounced sharply off trendline support and the 50-EMA near $64.49. The chart printed a bullish engulfing candle above $64.55—reaffirming support and hinting at more upside.

The MACD is below the zero line but converging, a bullish crossover is building. Traders are watching $65.62; a breakout here could go to $66.20, and if momentum continues, $66.73 is the next target.

Trade Setup:

- Entry: Above $65.62

- Stop-loss: Below $64.49 (EMA + trendline)

- Targets: $66.20 short-term, $66.73 extended

- Risk: Moderate. MACD and volume watch.

Summary

The EIA’s supply surplus is a long-term bearish for oil prices but near-term is looking good. As traders digest inventory and trade news, it’s up to bulls to get above $65.62—and hold.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account