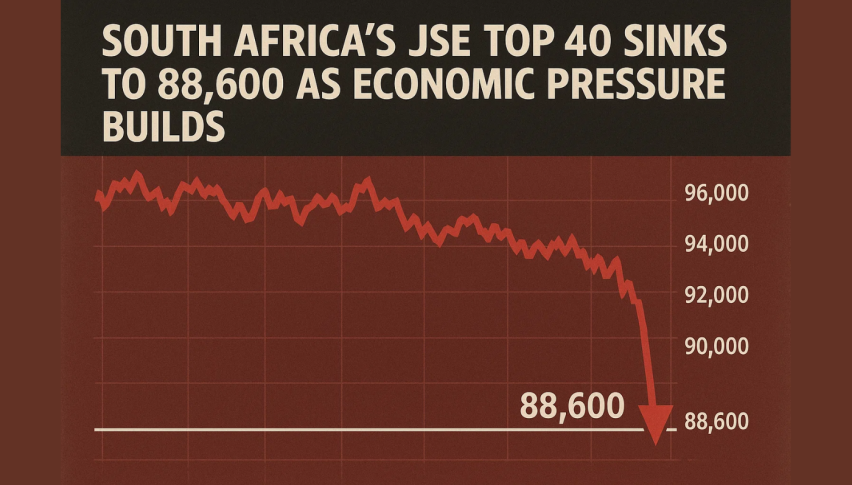

South Africa’s JSE Top 40 Sinks to 88,600 as Economic Pressure Builds

The JSE Top 40 Index fell to 88,600 ZAR on Friday, down from a recent high of 89,331 ZAR. The decline comes as geopolitical tensions...

Quick overview

- The JSE Top 40 Index fell to 88,600 ZAR amid rising geopolitical tensions and a global flight to safety.

- South Africa's economy is stagnating with a GDP growth of only 0.1% in Q1 2025 and unemployment rising to 32.9%.

- Comparatively, South Africa's economic growth lags behind countries like Singapore, highlighting significant policy gaps.

- The JSE Top 40 Index technical analysis indicates weak momentum, with a critical support level at 88,554 ZAR.

The JSE Top 40 Index fell to 88,600 ZAR on Friday, down from a recent high of 89,331 ZAR. The decline comes as geopolitical tensions rise after Israeli airstrikes in the Middle East and investors flock to safety globally. The rand had been strong in recent weeks after the budget impasse was resolved and inflation expectations came down, but the outlook has deteriorated sharply. Oil prices have risen again and that’s putting pressure on South African equities.

South Africa’s 2035 government bond yield jumped 16.5 basis points to 10.25%. There was no major domestic data on Friday but next week’s inflation and retail sales numbers may influence the market.

Growth Stagnates, Joblessness Rises

The South African economy is still underperforming. GDP grew 0.1% in Q1 2025, not enough to match population growth, so effectively stagnant. Unemployment rose to 32.9% and broader labour underutilisation to 43.1%. These numbers are structural issues.

- B-BBEE policies are socially important but controversial among investors.

- The informal sector employs millions but relies on a failing formal economy.

- MIP fintech data suggests real economic activity may be understated.

These challenges erode private sector confidence and limit job creation, so South Africa is lagging its emerging market peers.

Comparisons Show Policy Gaps

South Africa’s stagnation is stark compared to countries like Singapore, whose GDP grew from $300 billion in 2013 to $500 billion in 2024. South Africa’s economy has only grown to $403 billion over the same period.

- Singapore’s growth is due to policy flexibility and pro-business reforms.

- South Africa’s labour laws and regulatory uncertainty discourage investment.

- Capital is flowing to markets with a clear growth story.

Without bold structural reforms, South Africa will underperform further.

JSE Top 40 Technical Analysis: Support Holds

The JSE Top 40 Index is at the 50-day EMA of 88,676 ZAR and the ascending trendline from June 4. Momentum is fading and the MACD is bearish. A break of 88,554 could see 88,050 and 87,612.8 next. To get back to bullish the index needs to close above 89,331. Until then the technicals are weak against the macro and geopolitical backdrop.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account