Crypto Investment Funds Defy Market Turbulence with $1.24 Billion Weekly Inflows

The latest CoinShares analysis shows that digital asset investment products maintained their amazing run of investor trust, recording $1.24B

Quick overview

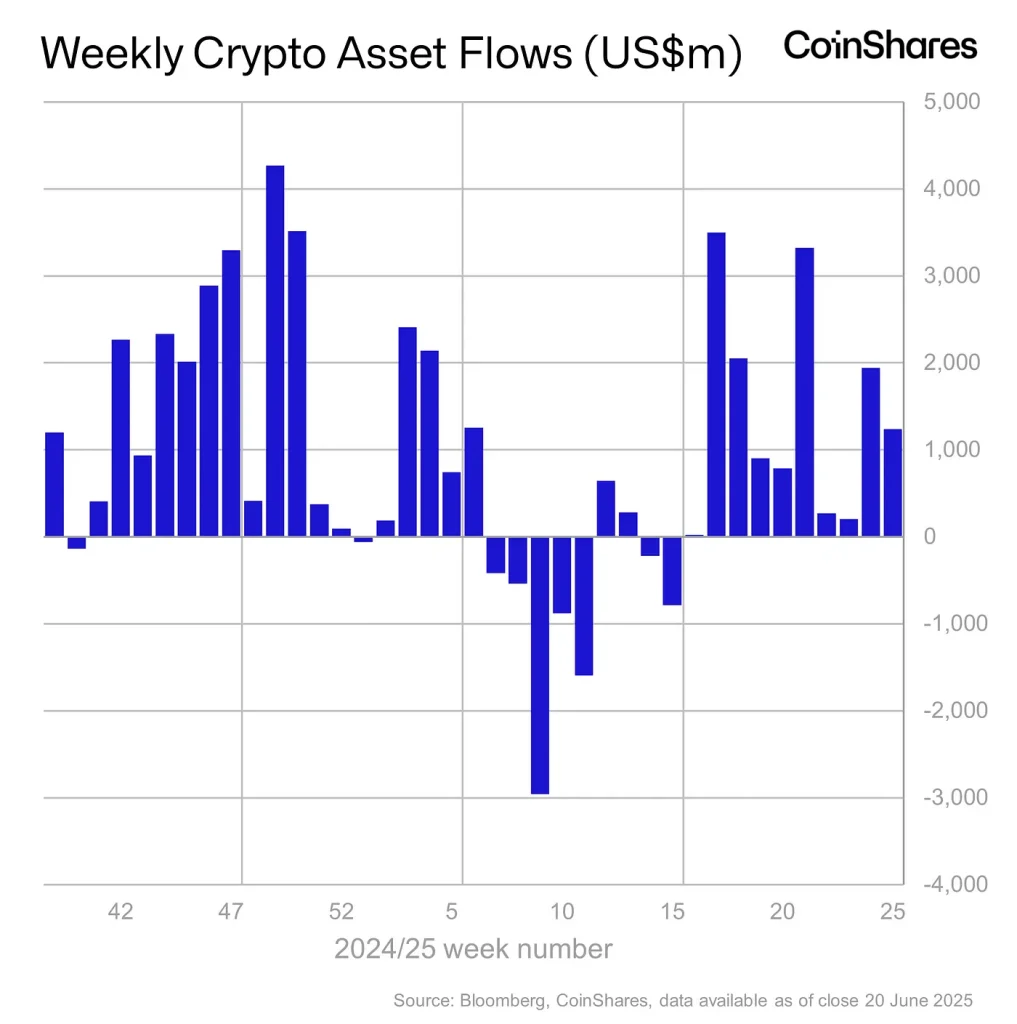

- Digital asset investment products saw $1.24 billion in inflows for the week ending June 20, marking the eighth consecutive week of positive inflows.

- Bitcoin ETPs attracted $1.1 billion despite a price drop, indicating sophisticated investors are capitalizing on market weakness.

- Ethereum also maintained strong momentum with $124 million in inflows, reflecting ongoing institutional confidence in its long-term prospects.

- The U.S. led regional inflows with $1.25 billion, while geopolitical factors influenced trading patterns and market sentiment.

The latest CoinShares analysis shows that digital asset investment products maintained their amazing run of investor trust, recording $1.24 billion in inflows for the week ending June 20, despite clear price drops across most major cryptocurrencies.

With this eighth straight week of positive inflows for crypto exchange-traded products (ETPs), year-to- date inflows are heading to a historic high of $15.1 billion. Even if market volatility still tests the industry, the consistent momentum shows amazing resilience in institutional and retail investor interest for cryptocurrencies exposure.

Bitcoin Leads Despite Price Pressure

Given Bitcoin’s price drop from roughly $108,800 to $103,000 over the same period, Bitcoin ETPs caught the lion’s share of inflows—$1.1 billion for the second consecutive week, a very remarkable outcome. This inverse association between price movement and investment flows points to sophisticated investors grabbing on market weakness to build positions.

“This sentiment was further supported by minor outflows from short-Bitcoin products, which totalled $1.4 million,” said James Butterfill, head of research at CoinShares, noting that institutional investors’ gloomy attitude is fading.

Ethereum Maintains Strong Momentum

With $124 million in inflows, Ethereum maintained its remarkable run and marked ninth straight week of positive flows. Representing the longest continuous inflow period since mid-2021, the cumulative inflows throughout this period have come to $2.2 billion. This performance highlights ongoing institutional faith in Ethereum’s long-term future in face of current market challenges.

Regional Dynamics and Market Sentiment

With $1.25 billion, the United States led regional inflows; Canada and Germany respectively made contributions of $20.9 million and $10.9 million. Notable outflows from Hong Kong ($32.6 million) and Switzerland ($7.7 million) however somewhat countered this, implying some geographical difference in investor mood.

Reflecting the balance between fresh inflows and market price changes, total assets under management in crypto ETPs modestly rose from the previous week’s $175.9 billion to $176.3 billion.

Geopolitical Factors Influence Trading Patterns

The trading activity for the week revealed interesting trends; strong momentum early in the week slowing off greatly in the later half. CoinShares notes how geopolitical events still affect crypto market dynamics and relates this cooling to the US Juneteenth holiday and growing rumors of possible US engagement in the Iran conflict.

Reflecting this uncertainty, the Crypto Fear & Greed Index abruptly changed to “Fear” on Sunday following maintenance of “Greed” levels over the previous month, then recovered to “Neutral” by Monday.

Altcoin Interest Remains Selective

Beyond the leading cryptocurrencies, Solana drew $2.78 million in inflows and XRP secured $2.69 million clearly showing selective altcoin interest. Though small in comparison to Bitcoin and Ethereum, these numbers show that crypto investors nonetheless follow diverse methods.

Looking Forward

For the scene of cryptocurrency investments, the ten-week inflow streak of over $15 billion year-to- date marks a major turning point. The fact that these inflows have endured through several market corrections and geopolitical uncertainty points to a maturing market in which institutional investors see brief price dips as accumulation possibilities rather than causes to leave positions.

The gap between short-term price volatility and long-term investment flows as the crypto market develops may indicate a basic change in how institutional money views digital assets, giving strategic orientation top priority over tactical trading around daily price swings.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account