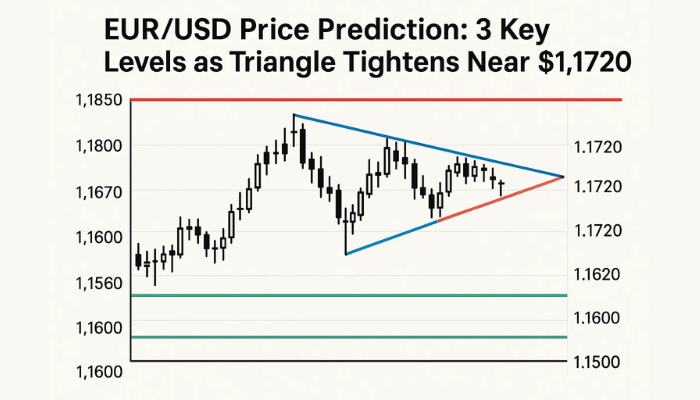

EUR/USD Price Prediction: 3 Key Levels as Triangle Tightens Near $1.1720

The euro is under pressure as investors wait for fallout from US trade measures. As of Tuesday, EUR/USD is stuck around $1.1718...

Quick overview

- The euro is under pressure as investors await the impact of US trade measures, with EUR/USD stuck around $1.1718.

- Despite positive eurozone data, including a German trade surplus, the euro remains weak due to global policy risks and a strong US dollar.

- Technical indicators show a bearish bias for EUR/USD, with critical support at 1.1687 and resistance at 1.1765.

- Traders are advised to be cautious as the market anticipates potential breakouts or breakdowns in the coming days.

The euro is under pressure as investors wait for fallout from US trade measures. As of Tuesday, EUR/USD is stuck around $1.1718 and can’t get above recent lows. Treasury Secretary Scott Bessent said the rollout of President Trump’s new tariff package might be delayed until August 1 but the uncertainty is enough to spook markets.

Investors are going defensive as the US threatens 10% tariffs on BRICS nations. The UK, Vietnam and China have finalised trade deals with Washington, the EU and India are still up in the air. The cautious tone is causing a rotation into the US dollar and further weakening the euro despite positive eurozone data.

- German trade surplus beat expectations at €18.4B

- French trade deficit steady at €7.7B

- Bundesbank President Nagel speaks at 4:00 PM CET

Eurozone Data Fails to Lift Sentiment

Despite 1.2% German industrial production bounce and neutral French trade, EUR/USD is still struggling. The euro can’t get a boost from local data as the market is more focused on global policy risks and Fed tightening.

US data is strong. Last week’s nonfarm payrolls showed 147,000 new private jobs in June, well above expectations. Unemployment rate dropped to 4.1%, beating 4.3% forecasts. Traders are quickly cutting July Fed rate cut bets – sending the US dollar higher and further weighing on EUR/USD.

- July rate cut odds below 5% (from 20%)

- September rate cut odds 68% (from 95%)

- FOMC minutes Wednesday could shift market sentiment

EUR/USD Technical: Bearish Bias

The technicals are as cautious as the fundamentals. EUR/USD is trapped in a symmetrical triangle on the 2-hour chart. The pair is testing trendline support at 1.1687 while upside moves are failing at 1.1765 which is now the 50-SMA and resistance.RSI is at 41.60 and there’s no bullish divergence. Unless the pair breaks above 1.1765, the outlook is for a retest of deeper levels.

Levels to Watch:

- Resistance: 1.1765 → 1.1808 → 1.1846 → 1.1891

- Support: 1.1687 → 1.1641 → 1.1590

Trade:

- Bearish: Below 1.1685 on volume

- Bullish: Above 1.1765 on close

- Stop: 1.1725 (triangle midpoint)

- Target: 50-80 pips, breakout dependent

With macro risk building and EUR/USD range bound, traders should be nimble. The next 24-36 hours will bring the breakout – or breakdown – that sets direction into mid-July.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account