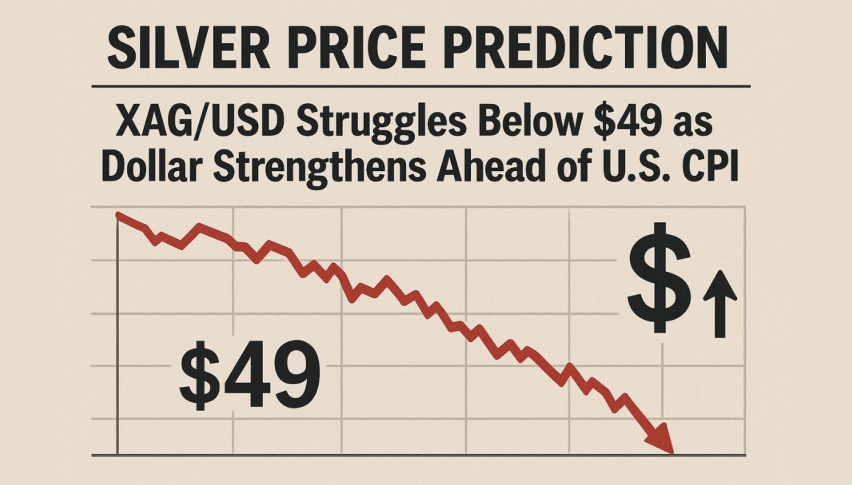

Silver Price Forecast: XAG Eyes $38.74 Breakout as Rate Cut Bets and Tariff Tensions Mount

Silver is pushing higher in early August, heading towards $38.74 as geopolitical risk and monetary policy uncertainty boosts demand...

Quick overview

- Silver prices are rising towards $38.74 due to increased demand for defensive assets amid geopolitical risks and monetary policy uncertainty.

- The recent 25% tariff imposed by the US on India could escalate trade tensions, further enhancing silver's appeal as a safe-haven asset.

- Analysts suggest that a potential Fed rate cut could support silver's performance, as historically it tends to do well during easing cycles.

- Technical indicators show a bullish trend for silver, with key resistance at $38.30 and potential targets of $38.74 and $40 if upward momentum continues.

Silver is pushing higher in early August, heading towards $38.74 as geopolitical risk and monetary policy uncertainty boosts demand for defensive assets. This comes as trade tensions escalate, after US President Donald Trump imposed a 25% tariff on India, citing New Delhi’s continued purchase of Russian oil. The tariff could raise duties on some goods to 50% and is one of the most aggressive trade actions against a major US partner in recent years.

This adds to silver’s appeal as a hedge as global supply chain and currency volatility intensifies. Analysts warn the tariff standoff could widen into a broader diplomatic rift, making the case for safe-haven plays like silver and gold stronger.

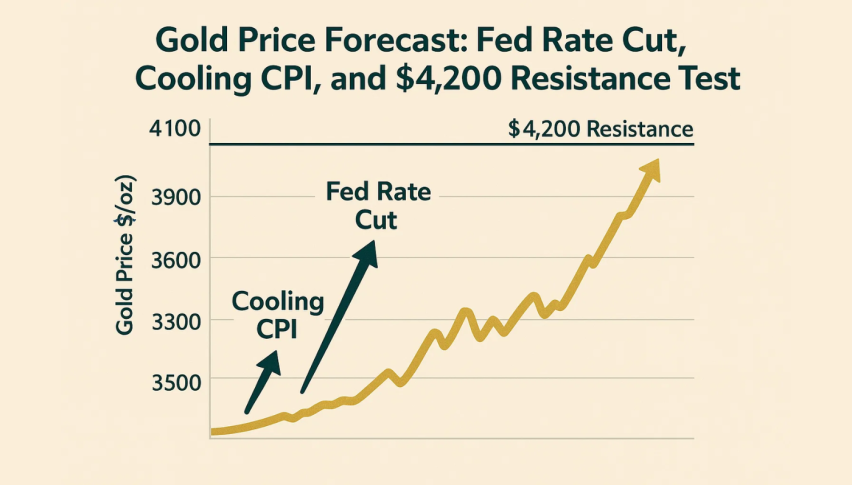

Meanwhile, US macro is softening too. After weaker than expected jobs data, traders are now pricing in a 95% chance of a 25bp Fed rate cut in September according to the CME FedWatch Tool. Minneapolis Fed President Neel Kashkari poured fuel on the fire by saying the Fed may need to act soon to prevent further economic cooling.

Historically, silver tends to outperform during easing cycles as lower yields reduce the opportunity cost of holding non-yielding assets.

Silver (XAG/USD) Technicals Suggest Breakout

Silver (XAG/USD) is forming a clean ascending channel, now at $38.01 after rebounding from $36.24 on August 1. The pattern, defined by higher lows and a rising trendline, is bullish.

Above the 50-period moving average on the 2-hour chart ($37.42) and the RSI is 64.92 – not yet overbought. No bearish divergence supports the case for more upside.

A 2-hour close above $38.30 would be the next leg up, targeting $38.74 – the high of the July consolidation range. Beyond that $39.18 and if macro winds persist, $40 is back in play.

Key levels to watch:

- Support: $37.70 and $37.42 (SMA)* Resistance: $38.30 (breakout), $38.74, $39.18

Silver’s Risk-Reward Improving

For traders and investors in a volatile summer, silver is getting harder to ignore. It’s at the intersection of geopolitical risk, dovish central banks and technically bullish structure – a rare combination that often precedes big moves.

$38.30 is the level to watch, especially with volume confirmation. If it breaks, silver could not only retest the July highs but the $40 level in the weeks to come.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account