JSE Top 40 Nears 95K as Rand Gains and Traders Eye Key Breakout Levels

SA equities are on a roll, with the JSE Top 40 extending its gains as the rand strengthens and investor sentiment improves.

Quick overview

- SA equities are gaining momentum, with the JSE Top 40 benefiting from a stronger rand and improved investor sentiment.

- The rand has risen 0.4% against the dollar, supported by a stable dollar and expectations of US rate cuts.

- Upcoming local data releases could confirm the positive market sentiment or lead to a slowdown.

- Technical indicators suggest the JSE Top 40 is testing key resistance levels, with strong buying momentum but a need for cautious risk management.

SA equities are on a roll, with the JSE Top 40 extending its gains as the rand strengthens and investor sentiment improves. Buying interest is returning as the rand holds firm against the dollar, with expectations of US rate cuts and domestic stability.

By 06:25 GMT the rand was at 17.5450/USD, up 0.4% after Tuesday’s 1% gain. TreasuryONE’s Wichard Cilliers says “sudden rand weakness seems unlikely” unless there’s a domestic shock, given the softer dollar backdrop. The dollar was steady against other major currencies, supporting risk-on.

Key points:

- Rand up 0.4% after 1% gain on Tuesday

- Dollar flat against majors

- Softer US outlook supports emerging markets

Data in Focus as Bonds Hold Steady

Now we wait for the local data to see if the rally is sustainable. The South African Chamber of Commerce and Industry (SACCI) releases its business confidence index at 09:30 GMT, followed by retail sales at 11:00 GMT. These numbers could either confirm the positive sentiment or slow down the market.

In bonds, the 2035 benchmark was up 1.5 basis points to 9.65%. Stable bonds and a stronger rand is a good backdrop for equity inflows. Analysts say strong business sentiment could add to the JSE’s upside.

Investor takeaways:

- Strong business sentiment could extend the JSE’s run

- Rand strength supports more equity flows

- Bonds steady is a good base for risk assets

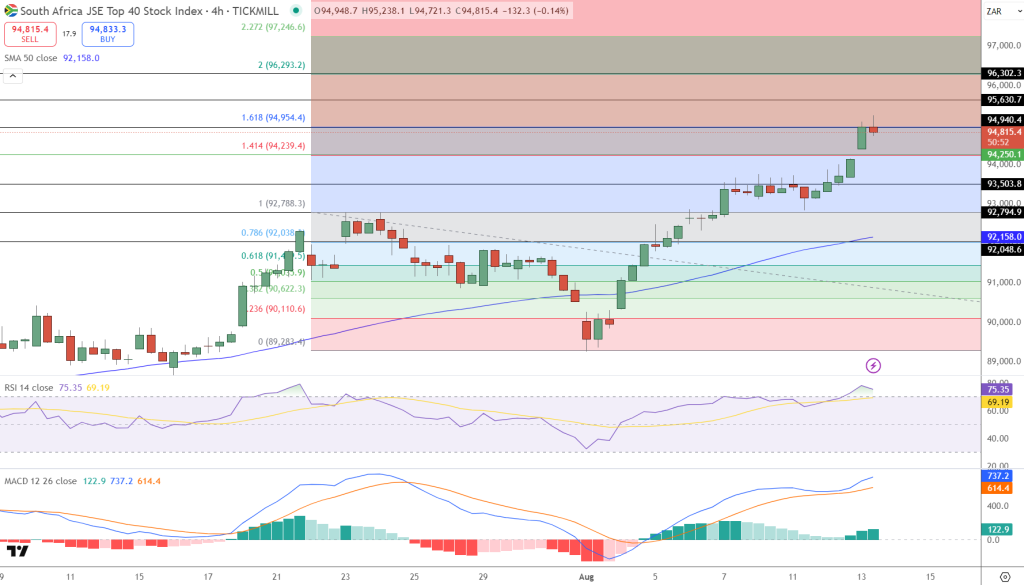

JSE Top 40 Technicals Point to Breakout Above 94,960

From a technical perspective the JSE Top 40 has broken above the 0.786 Fibonacci at 92,038 and the 1.414 extension at 94,239 and is now testing the 1.618 level at 94,954. This zone could be resistance.Momentum is still strong with RSI at 75.67, overbought but no bearish divergence yet.

MACD is expanding and price is above the 50-period SMA at 92,158. Candlestick patterns show strong buying but a longer upper wick on the latest candle suggests some profit taking.

Trade ideas:

- Aggressive: Buy above 94,960 to 95,630 and 97,246; stop below 94,250

- Conservative: Wait for pullback to 94,240-94,000 zone and look for bullish reversal patterns to enter

Trend is with the buyers but overbought momentum means disciplined risk management is key to avoid getting caught in a sharp reversal.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account